Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Low Quality, High Rewards

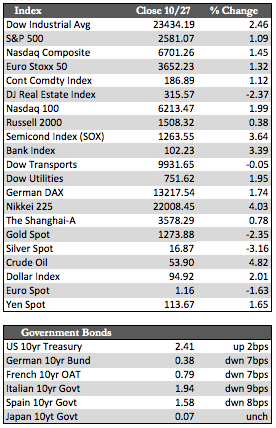

After a bit of a roller-coaster ride in terms of volatility, stocks both here and overseas were broadly higher. They were led by the NASDAQ, which added about 1.65% and attained a new record.

Tech earnings have started to roll in, key among them this week were Microsoft, Google, and Amazon. All three won at beat-the-number, so to speak, on revenues and earnings. Amazon in particular saw its sales growth accelerate (ex Whole Foods) by about $10 billion quarter-over-quarter, which is a little over $4 billion more in growth than normal. I couldn’t help but wonder if their results had anything to do with the post-storm rebuild effort. When one looks at their receivables and inventories, one does get that impression. They grew by approximately $4 billion and $3 billion respectively this quarter, leading one to the conclusion that a majority of “sales” were tallied even though the cash for the transactions hadn’t yet been collected. The same type of sales recognition went on at Boeing, 3M, Google, and Microsoft, where credit was extended on the layaway plan or massive builds of inventory were recorded as sales to meet numbers. A case could be made for Caterpillar, however, where it seems growth was real and accounting gimmickry unnecessary.

Away from stocks, the ECB said it would begin tapering as soon as January. Previous estimates had it tapering down to €20 billion per month through September of next year. However, after bond markets (including Treasuries) started to collapse on that news, the ECB backtracked and pledged €30 billion a month instead. It also provided the usual open-ended remark that it would extend QE beyond the nine-month period “if necessary.” That turned bond market losses into gains by the end of the week, and had a positive effect on both the dollar and the metals – though the PMs still finished lower, with gold off 0.51% to silver’s 0.96%. Oil finished over 5% higher on optimism that OPEC would extend its supply restraints.

Away from stocks, the ECB said it would begin tapering as soon as January. Previous estimates had it tapering down to €20 billion per month through September of next year. However, after bond markets (including Treasuries) started to collapse on that news, the ECB backtracked and pledged €30 billion a month instead. It also provided the usual open-ended remark that it would extend QE beyond the nine-month period “if necessary.” That turned bond market losses into gains by the end of the week, and had a positive effect on both the dollar and the metals – though the PMs still finished lower, with gold off 0.51% to silver’s 0.96%. Oil finished over 5% higher on optimism that OPEC would extend its supply restraints.

Next week, we’ll have the next FOMC meeting, a post-hurricane jobs report, and a possible appointment of the next Fed Chair. Federal Reserve Governor Jerome Powell is most likely to be the next Chairman, and in terms of policy, he is expected to maintain the status quo. If that proves to be the case, we’ll get to see if the stock market can extend its lunacy a bit further.

Best Regards,

David Burgess

VP Investment Management

MWM LLC