Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

One More Record for the Books

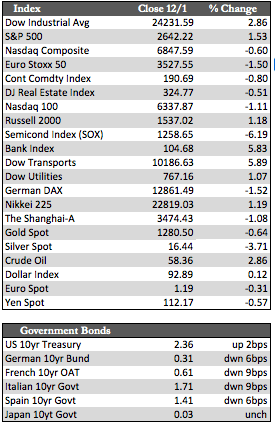

Like magnetic attraction, traders seemed unavoidably drawn to the Dow 24,000 mark this week –for no reason that I could see other than “because they could.” I realize there were the usual contributors, such as the tax bill and perhaps the revised GDP figures (+3.3%, 3Q), but for all intents and purposes these things have been well known for some time now. That hasn’t stopped Wall Street from treating each news headline as an opportunity to juice the markets with full-blown hype as the year-end closes in. And of course I don’t think it matters much to the stock gamers that the tax bill is shaping up to be more like a tax reorganization/shuffle rather than an actual tax “cut,” but again, here we are. The only things that seemed to keep the speculation in check this week were Bullard’s bearish warning about a possible inversion of the yield curve (circa 2018), North Korean missile threats, and former National Security Advisor Lt. Gen. Michael Flynn’s turning state’s evidence against Trump on Russia.

Away from stocks, fixed income markets were stronger (especially EGBs), oil retraced to recent highs as OPEC decided to maintain production cuts into 2018, and the dollar was marginally weaker. This didn’t seem to help the metals, as gold lost 0.64% to silver’s 3.68% after the dust settled on North Korean threats. As for the economic data, it continues to show signs of fading from peak “post-storm” levels (i.e., October New Homes Sales, +6.2%) in the last few months of the year. For November, the Dallas Fed Manufacturing Activity fell to 19.4 from 27.6, the Chicago Purchasing Managers fell to 63.9 from 66.2, and the ISM Manufacturing index fell to 58.2 from 58.7. Also, the ISM Prices Paid component fell to a less robust but still healthy 65.5 versus 68.5. The decade-old average for prices paid sits at around 61.9.

Away from stocks, fixed income markets were stronger (especially EGBs), oil retraced to recent highs as OPEC decided to maintain production cuts into 2018, and the dollar was marginally weaker. This didn’t seem to help the metals, as gold lost 0.64% to silver’s 3.68% after the dust settled on North Korean threats. As for the economic data, it continues to show signs of fading from peak “post-storm” levels (i.e., October New Homes Sales, +6.2%) in the last few months of the year. For November, the Dallas Fed Manufacturing Activity fell to 19.4 from 27.6, the Chicago Purchasing Managers fell to 63.9 from 66.2, and the ISM Manufacturing index fell to 58.2 from 58.7. Also, the ISM Prices Paid component fell to a less robust but still healthy 65.5 versus 68.5. The decade-old average for prices paid sits at around 61.9.

Next week we’ll get a look at the November jobs report, more from the Senate on taxes, and an update regarding the impact of Flynn’s testimony on the Mueller investigation. I don’t have much to say about the stock market and its trajectory from here to year-end, as Wall Street is obviously hooked on its artificial successes at present. But I will say that, in addition to the FANGs getting roughed up (nearly $60 billion in market cap this week), overseas markets did not move on the “Trump trade” as they have for most of 2017. In fact, most stocks abroad have been in retreat since mid-October. In any case, it’s just another data point I believe worth mentioning in the ongoing analysis of how US stocks may behave over the short-run.

Best Regards,

David Burgess

VP Investment Management

MWM LLC