Here’s the news of the week — and how we see it here at McAlvany Wealth Management:

Final Tax Bill in the Making

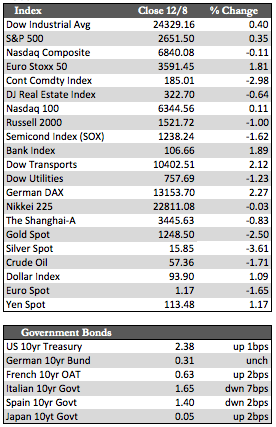

US stock indices finished the week rather quietly with gains of less than a half percent, ex the Dow Transports, which ramped higher by about 2.3%. Once again, tax legislation, or should I say proposed tax legislation, seemed to be the principal driver behind the action. The Senate passed its version of the tax bill last Saturday afternoon. From what I could tell, corporate taxes will be reduced (perhaps permanently, with a few quid pro quos) from 35.0% to 20%, while the middle class will receive a modest cut that can be revised again in eight years. Other than this, I believe stock speculators were modestly encouraged when the House passed a spending bill that extended the government shutdown deadline, and when Lt. Gen. Flynn’s testimony was dismissed or deemed inconsequential to the Russian investigation. Overseas, stocks added as much as 3.0%, depending on the index, after a NAFTA-sized “free trade” agreement was reached between Japan and the European Union.

Underneath the hood, so to speak, the US economy continued to taper off peak post-storm levels. In November, auto sales dipped 4.0% to a 13.38 million annual run rate domestically. The ISM manufacturing index fell to 58.2 from 58.7, and ISM prices paid fell to 65.5 from 68.5. The ISM non-manufacturing (services) index retreated to 57.4 from 60.1, while the NFP report produced 228,000 jobs, down from a revised 244,000 in October. The ADP employment change fared a bit worse, registering 190,000 jobs created versus 235,000 in October. The headlines that followed stated repeatedly that these economic releases “bolstered confidence” in the economy among investors – but I find, based on the progression in the data, that it’s a case of misplaced reasoning to hold that opinion when stocks are more likely strong(er) due to year-end dynamics.

Underneath the hood, so to speak, the US economy continued to taper off peak post-storm levels. In November, auto sales dipped 4.0% to a 13.38 million annual run rate domestically. The ISM manufacturing index fell to 58.2 from 58.7, and ISM prices paid fell to 65.5 from 68.5. The ISM non-manufacturing (services) index retreated to 57.4 from 60.1, while the NFP report produced 228,000 jobs, down from a revised 244,000 in October. The ADP employment change fared a bit worse, registering 190,000 jobs created versus 235,000 in October. The headlines that followed stated repeatedly that these economic releases “bolstered confidence” in the economy among investors – but I find, based on the progression in the data, that it’s a case of misplaced reasoning to hold that opinion when stocks are more likely strong(er) due to year-end dynamics.

Away from stocks, Treasuries traded sideways, while EGBs and Asian debt were fractionally lower (yields higher) in the wake of the free trade agreement. Oil saw some profit taking in the aftermath of the renewed OPEC agreement, while the dollar rallied (mostly against the euro) closer to 94.0. This, along with the economic data (which some found “deflationary”), set the metals off on their heels. Both metals retraced to familiar (support) levels, with gold near 1,250 and silver just below 16. Again, I wouldn’t pay much attention to these setbacks as we close out the year. Traders have already begun to diversify back into more conservative areas in preparation for what “might be” in the way of a contraction next year. I wouldn’t be surprised to see the metals perk up in the last few weeks of December. Next week we’ll hear from the BOE, ECB, and the Fed on rates. Of course, the Fed is expected to raise rates, so I imagine the market will pay more attention to their forward guidance.

Best Regards,

David Burgess

VP Investment Management

MWM LLC