Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Discounting Tax Cuts Several Decades Hence

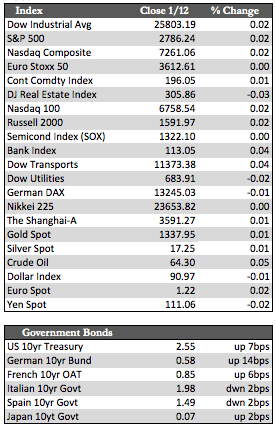

Worldwide, stock markets have added about $18.6 trillion worth of market cap since the 2016 presidential election. Much of that is in US stocks, which comprise as much as $9 trillion or about half of that total. In the same period, the S&P 500 is up about 30.22%, the Dow 40.75%, and the NASDAQ composite index 39.81%. This was primarily in response to Trump’s goldilocks-style policies. The only one we can put a stamp on so far is the tax cut, which, according to experts, was supposed to be accretive to corporate earnings to the tune of about 30.0%, max, so it would seem that the S&P 500 may be the closest to the mark in terms of a return commensurate with perceived benefits. But when you dig a little deeper, the average corporate rate years past has been about 24.0%, not the max rate of 35.0% stated – repeatedly – by the media. This means that, at the new corporate rate of 21%, the actual top line benefit is more like 12.5% (the percentage difference between 24% and 21%). I bring this up simply because the tax cut, for all intents and purposes, has most likely been discounted by more than double that amount by the markets. Yet stocks continue to move higher with each passing day, as they did this week, with most of the major indexes tacking on an additional 1% to 2%. I believe we can safely say that, on top of other malfunctioning aspects of this market, we are effectively in a mania and/or bubble, and that it will end when it ends – to state a truism.

On a more granular level, JP Morgan reported earnings today (along with Blackrock), and there was nothing earth shattering or out of the ordinary to comment on. However, I was curious to hear just what the company thought of the tax cut as it pertained to its bottom line. As I understand it, the company sees its tax rate dropping from 31% last year to 21% this year, which would save the bank about $3.5 billion in tax bills, and effectively give an immediate boost of about 14% or perhaps as much as 16% (after reinvesting the profit) to its after-tax earnings in 2018. What most folks don’t know or don’t wish to recognize is that JP Morgan’s stock has risen by approximately 65% since the election, which translates to something just north of $145 billion in market cap (I am guesstimating on share-buyback adjustments). This would imply that the market has overshot the valuation of the company by about 306%. Expressed differently, the stock should be trading around $84 (it started at 70 on November 8, 2016), not $112.67 as it is today.

On a more granular level, JP Morgan reported earnings today (along with Blackrock), and there was nothing earth shattering or out of the ordinary to comment on. However, I was curious to hear just what the company thought of the tax cut as it pertained to its bottom line. As I understand it, the company sees its tax rate dropping from 31% last year to 21% this year, which would save the bank about $3.5 billion in tax bills, and effectively give an immediate boost of about 14% or perhaps as much as 16% (after reinvesting the profit) to its after-tax earnings in 2018. What most folks don’t know or don’t wish to recognize is that JP Morgan’s stock has risen by approximately 65% since the election, which translates to something just north of $145 billion in market cap (I am guesstimating on share-buyback adjustments). This would imply that the market has overshot the valuation of the company by about 306%. Expressed differently, the stock should be trading around $84 (it started at 70 on November 8, 2016), not $112.67 as it is today.

To sum it all up, JP Morgan is not the only stock with a relative pricing problem as it pertains to the expected benefits of Trump’s policies, but until the market is provided a trigger that causes recalibration of markets to normalized levels, we may continue to see this mania proliferate through midyear – on lack of sellers, etc. Rest assured, the correction will be fierce when it comes, which may be why the metals continue to soar, perhaps as a hedge to stocks, or more aptly to a brewing crisis in fixed income. Gold is set to test the 1,350-level next week. Coincidentally, this is where gold traded before Trump was elected. At some point (given the aforementioned trigger), stocks will likely begin a similar reversion (i.e., to Dow 20,000).

Best Regards,

David Burgess

VP Investment Management

MWM LLC