Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

The Storms Never Happened

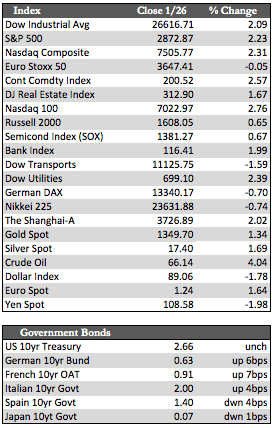

While in Davos, Trump was once again taking credit for the ongoing stock bubble. At the same time, he encouraged folks to “buy American” – which I find grossly contradictory. The escalation in the former makes a contraction in the latter more probable. As I have said here before, when prices rise beyond what is normal, they negate what would otherwise be regarded as economic progress. A prime example occurred this week when Union Pacific announced that the rising cost of fuel (in conjunction with competitive pressures from Burlington) would weigh on after-tax-cut profits. Shares of Union Pacific fell about 5% on the news, and that was the main contributor to the 1.88% loss in the Transports. Elsewhere, stocks were firm. The Dow and S&P 500 added about 2%, aided by what appear to be “solid” fourth-quarter earnings (and the usual end-of-week rally) that have been credited to natural causes rather than natural disasters. Folks apparently spent an astonishing amount to rebuild after the storms/fires, so much so that the US savings rate reached its third lowest level on record in the fourth quarter 2017.

Away from stocks, fixed income was rather weak across the board and across the globe. The German 10-year Bund yield now sits at a two-year high, while many other EGBs are on the verge of doing likewise. Treasury yields were especially weak at the short end (one- to five-year), reverting to levels not seen since 2008. Yields at the long end were unchanged. The dollar fell for a seventh week in a row despite Trump’s comments waffling on this issue. This helped oil add over 4%, and the metals averaged about 1.5% by the close on Friday. As for the economic data, we’ll get a better idea of how the economy is trending as we pass through the first and second quarters of this year. Those stats should start to be released at the end of January/first week of February.

Away from stocks, fixed income was rather weak across the board and across the globe. The German 10-year Bund yield now sits at a two-year high, while many other EGBs are on the verge of doing likewise. Treasury yields were especially weak at the short end (one- to five-year), reverting to levels not seen since 2008. Yields at the long end were unchanged. The dollar fell for a seventh week in a row despite Trump’s comments waffling on this issue. This helped oil add over 4%, and the metals averaged about 1.5% by the close on Friday. As for the economic data, we’ll get a better idea of how the economy is trending as we pass through the first and second quarters of this year. Those stats should start to be released at the end of January/first week of February.

In this environment, I remain optimistic for the metals as a hedge against both stocks and an eventual meltdown in fixed income. Stock prices have risen to meteoric levels using massive amounts of leverage, while underlying corporate profits have stagnated intrinsically since 2014. It’s an extremely bifurcated situation that has crisis written all over it. I am of course getting ahead of myself, since the stock bubble could expand further into March and April. But I do believe the stage has been set for a rather disorderly unwind of said imbalances. Next week we have Trump’s State of the Union address, the bulk of tech earnings (including the FANGs), and Janet Yellen’s last decision on rates before Mr. Jerome Powell takes the chair.

Best Regards,

David Burgess

VP Investment Management

MWM LLC