Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

You Shouldn’t Call It “Protectionism” Until…

The trade deficit disappears and the dollar is no longer a target of foreign manipulation – at least that’s my take on the matter. Trump summed up the effects of these dynamics quite nicely before signing the steel and aluminum tariff into law on Thursday; “From Bush 1 to present, our country has lost more than 55,000 factories, 6,000,000 manufacturing jobs, and accumulated trade deficits of more than 12 trillion dollars.”

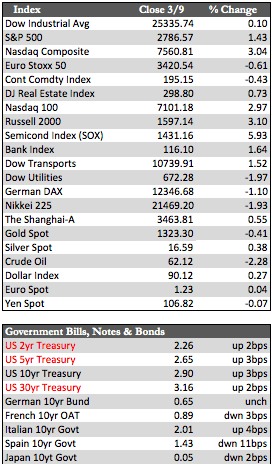

Now, I don’t particularly care for tariffs because they raise the cost of doing business. But one has to start somewhere along the path of reversing a trend that’s gutted the country. Hopefully the current flap will lead to a broader discussion over the dollar and its effects on trade, but I may be asking too much too soon. In any case, the market didn’t take its own complaints about the tariffs very seriously, as the markets were back in rally mode late in the week. Depending on the index, stocks both here and abroad added between one and three percent by the close on Friday.

Now, I don’t particularly care for tariffs because they raise the cost of doing business. But one has to start somewhere along the path of reversing a trend that’s gutted the country. Hopefully the current flap will lead to a broader discussion over the dollar and its effects on trade, but I may be asking too much too soon. In any case, the market didn’t take its own complaints about the tariffs very seriously, as the markets were back in rally mode late in the week. Depending on the index, stocks both here and abroad added between one and three percent by the close on Friday.

The real reason why stocks rallied is something of a mystery. Perhaps there was a lot of short covering related to the tariff deal and/or the unexpected jump in the jobs report today. Or it could have been a breach in technical barriers that ruled the day. Suffice it to say that bulls have found every excuse possible to explain away risk and extend the post-election party in stocks. The main risk in this case, as I have said here before, is the positive correlation between the cost of leverage for speculators and that of the stock market. Incidentally, the 2-year Treasury yield hit an intra-day all-time high of 2.27% this week. In a sustainable bull market, that rate would be moving in the opposite direction. In any case, the action outside of stocks wasn’t much to speak of. Commodities, the dollar, and the metals were all essentially rangebound on the charts.

Early next week, the Treasury will hold auctions for 3- and 10-year notes, along with 30-year bonds. This will be the first of four auctions (for the long end) scheduled through mid-year. We’ll also hear more about retail sales and inflation from the vantage point of the CPI, PPI, and import prices. Though the inflation gauges are highly manipulated via hedonic adjustments, it will be increasingly more difficult to fudge these numbers as the rates move uncontrollably higher. The bulls, as usual, are trained to equate any uptick in inflation as a healthy by-product of economic growth – so it will be interesting to see if inflation in February stayed firm against major industries that have already begun to soften, such as housing and autos.

Best Regards,

David Burgess

VP Investment Management

MWM LLC