Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Dead-Cat Bounce for Stocks?

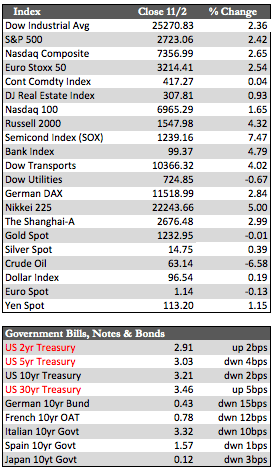

I am a little short on time today, so here’s the skinny for the week. Stocks rallied and added anywhere between 2% and 4%, depending on the index. Internet stocks led for most of the rally, but at the peak of the frenzy just about everything was catching a bid, ex some players in the oil and gas industry thanks to a rapid increase in OPEC’s production. What prompted the ramp job in stocks, at least at the start of things, was a widespread belief that stocks had “bottomed” and that Trump was ready to reach a trade deal with the Chinese. Neither is really true at this juncture, but, nonetheless, headlines ruled.

By mid-week, the bullish mood shifted into high gear when the October ISM manufacturing data and its components were released. The overall index fell over 2 points to 57.7 from 59.8, employment fell to 56.8 from 58.8, and new orders fell to 57.4 from 61.8. However, I believe the real kicker was the prices paid component, which rose over 4 points to 71.6 (from 66.9). In simpler terms – inflation is up and the economy is down. This helped stocks continue their ascent based on the now spreading notion that the Fed would be, at the very least, “less aggressive” in raising rates, while the inflation data propelled the metals back into technically bullish territory.

By mid-week, the bullish mood shifted into high gear when the October ISM manufacturing data and its components were released. The overall index fell over 2 points to 57.7 from 59.8, employment fell to 56.8 from 58.8, and new orders fell to 57.4 from 61.8. However, I believe the real kicker was the prices paid component, which rose over 4 points to 71.6 (from 66.9). In simpler terms – inflation is up and the economy is down. This helped stocks continue their ascent based on the now spreading notion that the Fed would be, at the very least, “less aggressive” in raising rates, while the inflation data propelled the metals back into technically bullish territory.

As these things were happening, I think it’s important to point out that the bond market kept dancing to its own tune. The 30-year Treasury rate hit a new interim high of 3.46%, while 2-, 5-, and 10-year rates were seen closing in on similar records. Again, said in simpler terms, rates are up and economic activity is down. All of this brings us to the FOMC meeting scheduled for next week, where the big question mark will be whether or not there will be any change in policy in the same week as the elections. I won’t be holding my breath, but, suffice it to say, it will be far more difficult for the Fed to hold to its hawkish ways on the basis of a red-hot economy at its next meeting in December.

Surprisingly, the US dollar also set an interim high of about 97.20 after what appeared to be a series of event-driven short squeezes. The dollar has spiked higher, not on its own merits but on the relative weakness of others (specifically the euro and the yen), whose respective economies look a bit worse than the US – if only for the moment. Next week, there’s going to be a fair amount of economic and corporate data in the mix, but we’ll see if any of it matters as the aforementioned elections and Fed news may take precedence.

Best Regards,

David Burgess

VP Investment Management

MWM LLC