Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Turning Point for the Fed?

Early on in the week, shares of Apple and its suppliers continued to weigh heavily on the major indices as doubts about the future growth of iPhone sales continued to circulate. Later in the week, however, two things sparked a bullish revival. The first was Fed speakers Powell and Clarida, who both – surprise, surprise – admitted to some degree of “slowing” in the global economy and hinted that Fed rate hikes would stop somewhere in the vicinity of “neutral” (i.e., near the current rate of inflation). The second was on the subject of trade, where a more cooperative Chinese government generated some optimism that a trade pact would soon be reached. In any case, that one-two punch had stocks back in rally mode from about midweek into the close on Friday – where at last glance stocks had recouped about half their early week losses.

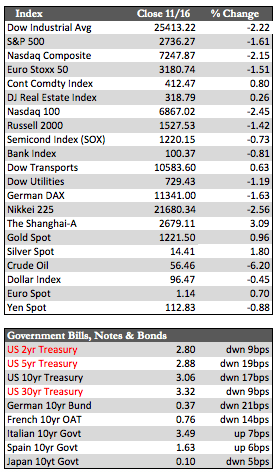

All of that led to some reversals away from equity markets. Treasuries advanced across the curve, which brought the 2-year yield down to about 2.81% and the 10-year to about 3.07%. The dollar fell 0.5% to a still technically bullish level of 96.45, but that decline was enough to ignite a relief rally in the metals and oil – though oil made up for only a small portion of its earlier-week losses related to ongoing oversupply issues. In addition, there were a few economic reports, but they were overshadowed by the aforementioned developments. Of the reports, October Retail Sales and Industrial Production were the most significant. They added about 0.8% and 0.1% respectively, but the gains weren’t enough to push the averages into expansionary territory.

All of that led to some reversals away from equity markets. Treasuries advanced across the curve, which brought the 2-year yield down to about 2.81% and the 10-year to about 3.07%. The dollar fell 0.5% to a still technically bullish level of 96.45, but that decline was enough to ignite a relief rally in the metals and oil – though oil made up for only a small portion of its earlier-week losses related to ongoing oversupply issues. In addition, there were a few economic reports, but they were overshadowed by the aforementioned developments. Of the reports, October Retail Sales and Industrial Production were the most significant. They added about 0.8% and 0.1% respectively, but the gains weren’t enough to push the averages into expansionary territory.

What happens in the short-run, now that economic weakness has become more widely known and recognized, is uncertain. If history is any indication, the market will expect the Fed to become less aggressive on rates and lean in a more dovish direction. If it does so, we can expect stocks and bonds to begin a series of rallies that will endure for an unknown period of time, perhaps through year-end. I expect the whole exercise to backfire fairly quickly, as any speculative trend that takes hold in stocks will likely send 1- to 5-year Treasury rates back into economically restrictive territory. It’s a self-defeating process that may repeat a few times before markets truly correct. In the meantime, and at the very least, a less aggressive Fed will likely take pressure away from the metals, which up until now have been the victim of several economic and financial misinterpretations.

Best Regards,

David Burgess

VP Investment Management

MWM LLC