Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

The Media That Cried, “Trade Deal”

The media’s overuse of that titular phrase propelled stocks to their sixth week of interim highs. In the backdrop there’s the specter of a more dovish Fed, and, of course, an averted government shutdown. Rewarding the markets at this elevated level for things that amount to little is rather nonsensical at best, but it is what it is.

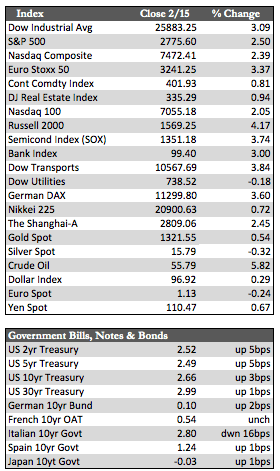

China’s reported net trade position for the month of January doubled from the year before, from 123.0 billion to 271.2 billion yuan, and rests at aggregate levels not too far from normal – this while Trump’s tariffs were in effect. As far as tariffs are concerned, at a minimum Trump is asking for a 7.0% reduction on US exports to China, which would amount to about $7.0 billion annually (or 7.0% of about $100.0 billion in US exports in 2018). At best it’s a drop in the bucket for a $20.6 trillion US economy, so I will reiterate what I said last week. The rally in my opinion is in nosebleed territory, and operating on borrowed time. In any case, stocks held to gains of about 2.0% to 3.0%, led by a few industrial shares that have lagged over the course of the last year.

China’s reported net trade position for the month of January doubled from the year before, from 123.0 billion to 271.2 billion yuan, and rests at aggregate levels not too far from normal – this while Trump’s tariffs were in effect. As far as tariffs are concerned, at a minimum Trump is asking for a 7.0% reduction on US exports to China, which would amount to about $7.0 billion annually (or 7.0% of about $100.0 billion in US exports in 2018). At best it’s a drop in the bucket for a $20.6 trillion US economy, so I will reiterate what I said last week. The rally in my opinion is in nosebleed territory, and operating on borrowed time. In any case, stocks held to gains of about 2.0% to 3.0%, led by a few industrial shares that have lagged over the course of the last year.

Away from stocks, Treasuries remained firm across the curve, losing only a little ground amid the ramp job in stocks. The dollar also gained, I believe in sympathy with stocks, though by week’s end the dollar fell under some pressure. A topping-out process may now be underway for the bullish arguments, and subsequently the markets (stocks). Dollar strength did nothing to undermine certain commodities, as the “oversold” oil market added about 4.9%, while the metals were mixed. Gold added 0.55% to silver’s 0.32% loss. Aside from this, the economic data once again was rather useless – skewed by the government shutdown of late December/early January. US Retail Sales for December surprised with a rather large 1.2% decline, but, as expected, markets shrugged that off. Drops of 0.5% in import prices and 0.6% in industrial production for the month of January were also ignored.

Next week we’ll hopefully get some finalization of the China trade deal, which I assume will be a “sell-the-news” proposition for stocks. The FOMC minutes will be released on Wednesday; February manufacturing surveys on Thursday. Given how the metals performed into the close on Friday, it’s reasonable to assume that the economic downshift, Fed dovishness, and dollar weakness scenario is ready to play out to the next level – with $1,350 for gold within sight unless the China trade deal is delayed.

Best Regards,

David Burgess

VP Investment Management

MWM LLC