Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Is There a Doctor In the House?

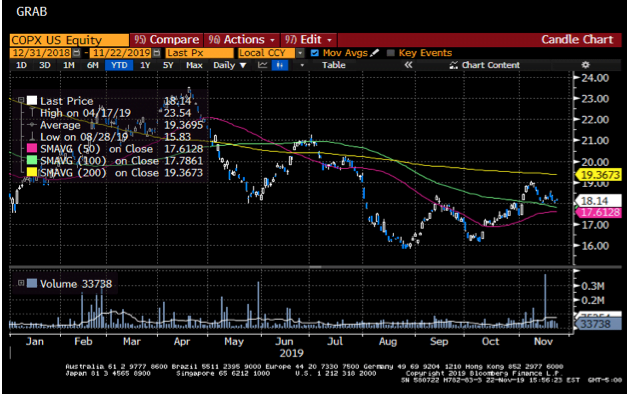

Copper is often referred to as “Doctor Copper” because it is looked to as a barometer of the health and direction of the global economy. The moniker also applies because copper is an industrial metal with very diversified applications in everything from electric vehicles to smart phones, as well as power generation and distribution and many other uses. The conventional wisdom is that when copper prices decline, demand is waning and alarm bells are going off, signaling a significant economic contraction. If this is to be believed, the chart below would suggest that the global economy is somewhat challenged, with copper about 10 percent off of its highs made in April.

The performance of the stocks has been decidedly worse, off just shy of 20 percent since April.

This is in the face of declining supply at mines globally due to disruptions in Africa, sharp declines in Indonesian production, and strikes in many key copper-producing countries such as Chile. What’s more, the International Copper Supply Group (ICSG) indicates that in 2019, while we saw a deficit of copper to the tune of 220,000 tons, global inventories are continuing to build. They are small in the context of the overall global picture, but, by all accounts, we are seeing a slowdown in incremental copper demand.

We can certainly make the case that, in the absence of a trade deal with China, global copper demand will continue to wane and any supply imbalances will become more acute into 2020. However, this week we saw a few data points that lead us to be incrementally more constructive on copper. First, we saw cancelled warrants of 23,000 tonnes in LME warehouses. Warrant cancellations mean that the tons of material covered by a warrant is no longer available and therefore has been absorbed by the market. In addition, we are seeing a drop in 2020 contracts (lowest level since 2011) for treatment and refining charges for copper concentrates paid by mining companies to smelters. Because of this, it is likely that smelters in China will be forced to cut production as mining companies are unable to keep up with demand from Chinese smelters. This actually is suggestive that supply from the minesite is tightening. Further, despite the fact that the Chinese economy has clearly lost steam as evidenced by slowing industrial production, the government and central bank are providing stimulus by reducing the minimum capital requirements for infrastructure projects and allowing local governments to use funds from special bond issuances – which would directly tie to copper demand.

The wild card of a China trade deal aside (admittedly tough to do), the factors above taken together suggest to us that copper supply/demand characteristics are far more complex than its perceived status as an economic bellwether, and we are careful to not read much into one for confirmation of the other. It is true that slowing global demand for copper may be suggestive of an economic slowdown or contraction. However, other factors can play into pricing. For example, supply disruptions can often have a significant positive impact on pricing. We only need to stand back and observe performance of copper versus the broad market over a long time period to really understand the correlation between the two, or rather lack thereof. Copper is down 32 percent since the end of 2011, while the S&P 500 is up 147.3 percent, so those looking to copper for signs of a selloff in the markets could perhaps wait a long time.

In short, there is no clear sign that declining copper prices are indicative of a recession, and the dynamics for each are clearly independent of one another. We think copper prices, if anything, are much more of a tell on the odds of a China trade deal, given the relative importance of manufacturing in that economy.

We thank you for your continued support and appreciate your interest.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC