Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Tempest in a Teapot or Hurricane in a Hemisphere?

Dow Jones Industrial Average for the week:

Monday: up 1,293.93

Tuesday: down 785.91

Wednesday: up 1,173.45

Thursday: down 969.58

Friday: down 256.23

Opening level: 25,409.36

Closing level: 25,866.27

Net change: up 179 basis points

The above illustration of day-to-day volatility doesn’t even capture the tremendous intraday volatility. All of those gyrations for 1.79 percent in performance for the Dow. Is this kind of behavior in any way indicative of a normal, rational market? Of course it isn’t. But I think the net change for the week is important perspective to maintain within the tremendous volatility.

To us, it is reflective of a highly emotional, highly fearful, and highly uncertain economic and political environment. We think the above helps to put the environment in context for the longer-term investor. Hedge fund traders and the media love volatility and crisis, as it can often help short-term trading profits and viewership. For us, stepping back from the cacophony helps us formulate a strategy for structuring long-term portfolios.

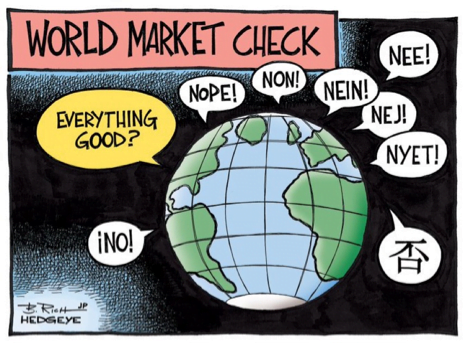

The one thing we know about Coronavirus (COV-19) is that the outcome in terms of its ultimate spread and its impact on the global economy remains highly uncertain. We know that the old, exceedingly overused saw “the market hates uncertainty” is applicable here. However, performance is somewhat bifurcated. We have seen panic and liquidation in various parts of the equity market, particularly in energy after no OPEC+ deal was reached and high yield in that area showed signs of stress. Other areas, particularly those more correlated to bonds, remain relatively unscathed.

To us, it is a fabulous time to have a tremendous amount of dry powder and start to think about taking advantage of opportunities in high quality companies with good balance sheets that the market may present. We see a lot of fear, coupled with valuations that are getting incrementally more attractive, and some areas where there are signs that we are approaching cycle lows. We are exceptionally mindful and respectful of credit conditions as we approach this part of the business cycle, and recognize that the COV-19 shock may bring about a deepening of a correction. Then again, it may prove to be a blip on the radar. No one can predict this with any level of certainty, and we encourage readers watching financial news networks to beware anyone that possesses enough hubris to believe they can.

The traditional money management community abhors holding elevated cash levels, but in a market downturn like this they will often see redemptions, and therefore have no ability to put cash to work when the relationship between price and value becomes more favorable. Effectively, they are momentum investors. Market environments like this are often differentiators, and we have our pencils sharpened. We can’t tell you exactly when, but this too shall pass.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC