Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Watching an Opportunity Form in Commodities

The overall performance of commodities has been very interesting to watch in the context of the COVID-19 crisis, as well as over the last decade – particularly as we consider how it has performed relative to other asset prices. It is worth noting that, despite extraordinary Fed balance sheet expansion over the last decade, commodities have broadly underperformed other assets. This is also despite the fact that many commodities trade below, and in many cases significantly below, their marginal cost of production. Even as we think about commodity performance relative to robust global growth prior to COVID-19, it has been a portfolio drag within a broad asset allocation model. One has to wonder why this might be the case.

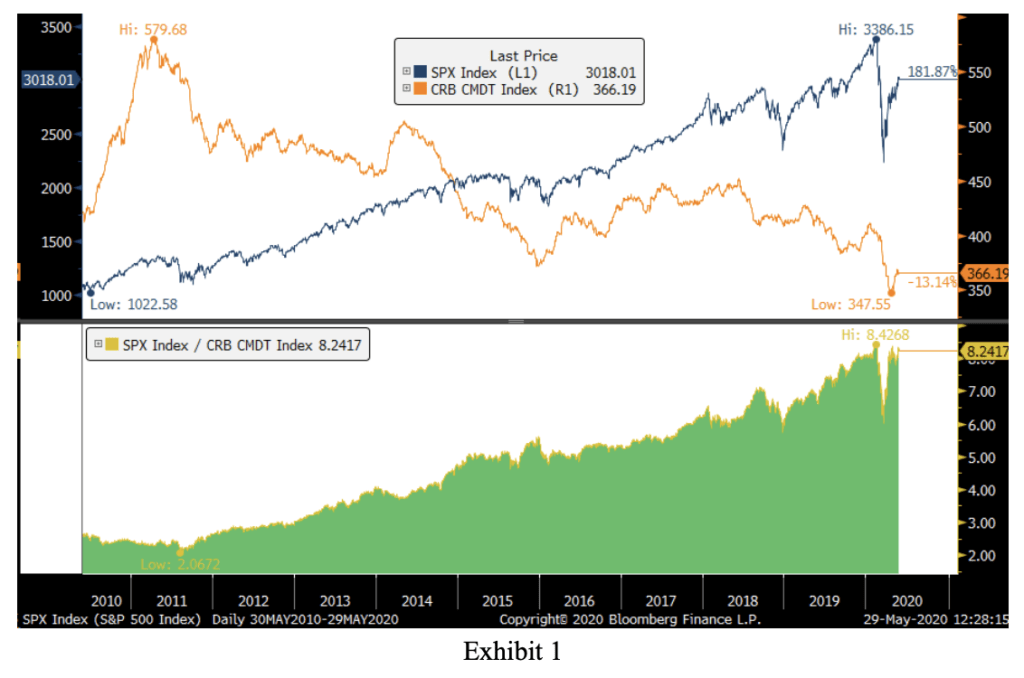

Exhibit 1 is a chart of the S&P 500 versus the CRB All-Commodities Index over the last decade, and it is clear that there is a significant disconnect between paper asset values and commodities. The bottom half of this chart is a snapshot of the relative value between the stock market and commodities – you can see that stocks are relatively as expensive as they have ever been versus commodities.

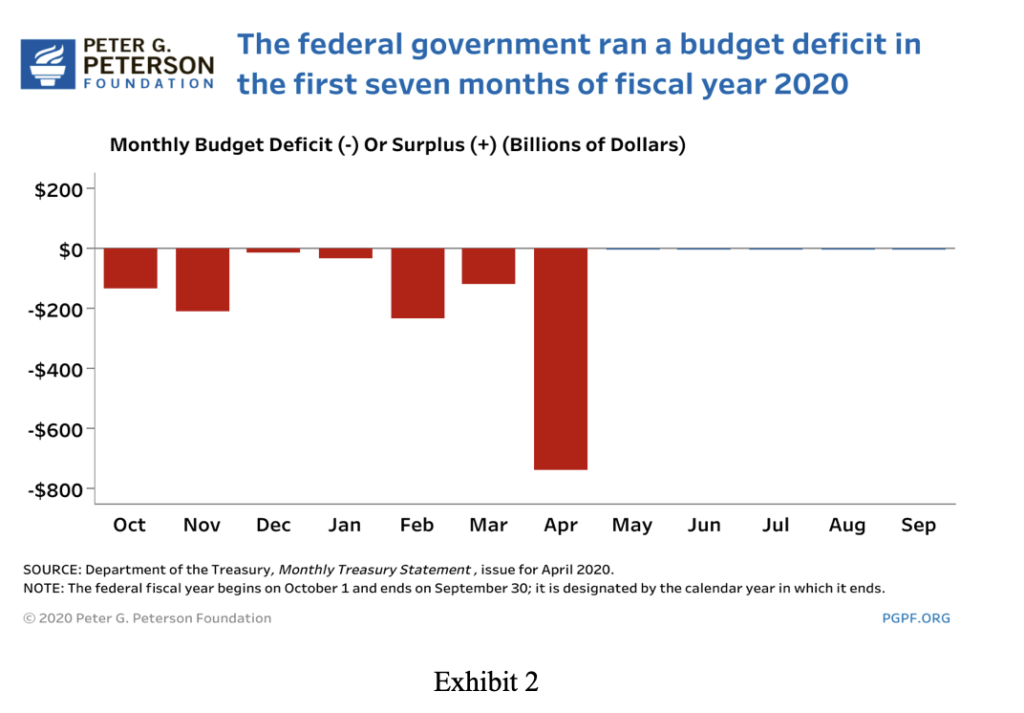

Since the end of February, the Fed has expanded its balance sheet by $2.9 trillion dollars, or by about 70 percent, and has provided all sorts of relief in the form of monetary policy including loans to securities firms, asset purchases, near-zero interest policy, among many other programs. In addition, there has been an aggressive fiscal policy response through the CARES act, the Paycheck Protection Program to the tune of another $2 trillion plus dollars. Of course, backstops do not come without a price, and that price comes as ballooning budget deficits, as we see in Exhibit 2. According to the Congressional Budget Office, the budget deficit may reach 17 percent of GDP in 2020 and debt-to-GDP may reach 108 percent by the end of 2021. The federal government is issuing bonds at rates that we have not seen since World War II. There are two financing options. The first, of course, is to raise revenue by increasing taxes. However, with one in four American workers having filed for unemployment, it is difficult to see a scenario where tax revenues can rise from current levels.

The other, more politically palatable but insidious, way to deal with this is monetization of the debt. However, with that comes the consequence of declining purchasing power and a declining currency as the supply of dollars rises. It is surely a tax, and a regressive one at that. This perhaps isn’t a readily visible cost, but it is a real one as it quietly erodes incomes and savings. CPI data aside, Milton Friedman once said, “inflation is always and everywhere a monetary phenomenon,” and if the value of the dollar is falling, the price of “stuff” relative to dollars is rising. Right now there is no apparent inflation problem, as liquidity is being absorbed by all sorts of troubled assets. Nonetheless, we also see signs of excess liquidity vis-à-vis a stock market making new highs every single day despite challenged and continually deteriorating fundamentals. As the economy normalizes, this unprecedented injection of liquidity will reflate commodity prices. The post-2008 spike in commodity prices is somewhat analogous to the situation today.

You can see from Exhibit 1 that commodity prices are as cheap relative to paper assets as they have been in a decade. When you couple this with the longer-term fundamentals for the US dollar, as well as many commodities being below the marginal cost of production, it is worth making sure our pencils are sharp, knowing that dislocations and aberrations can persist. Commodities can be very cyclical and being early can cause drawdowns that are difficult to recover from. We observe and wait patiently with our shopping lists at the ready.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC