Here’s our weekly recap of the precious metals markets for June 6. As of this recording, here is where precious metals stand:

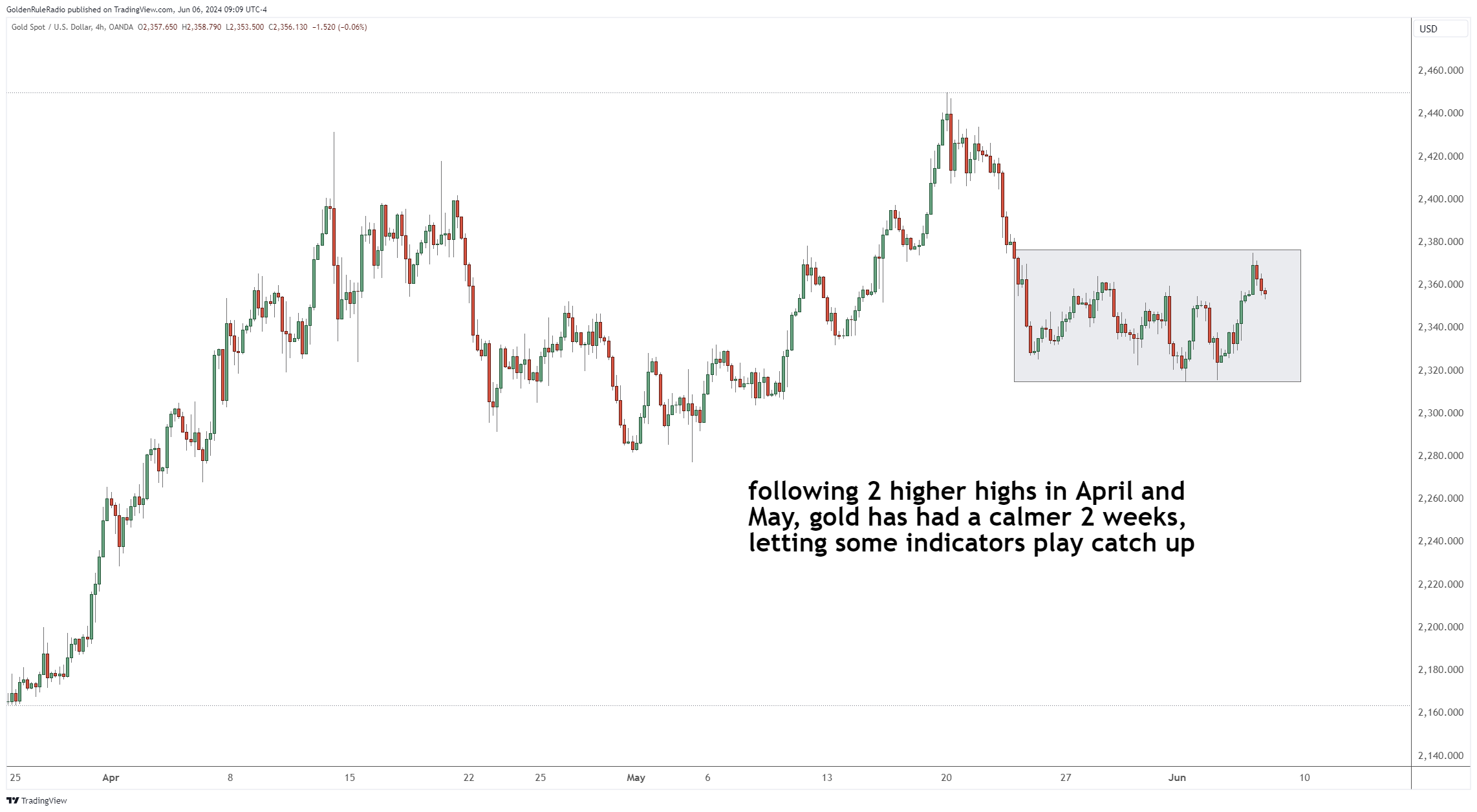

The price of gold is flat at $2,350. Gold has been in a trading range between about $2,320 and $2,360. This is after gold peaked at $2,450.

The price of silver had declined to just above $30 per ounce. Within the past week, it rose up all the way to $32.50 and dipped down under $30.

These pullbacks present a couple of different opportunities to purchase precious metals:

Ratio Trade in Silver

The gold-to-silver ratio has widened, and silver is hovering around $30. Now is a good time to buy more silver and hold it. When the gold-to-silver ratio narrows again, you can then sell your silver ounces and use the proceeds to buy gold — effectively increasing your number of ounces of gold down the road.

Dollar Cost Averaging into Gold

With the recent pullback in gold, now is a good time to dollar-cost average your gold purchases. You can use our Vaulted app to purchase smaller amounts of gold and get in while the price is lower.

Listen to the full episode to learn about all your investment opportunities.

Finding Your Entry Point

What is your best strategy for buying gold, silver or other precious metals? Depending on your personal situation and goals, you may want to build your precious metals portfolio with a number of different options — from collectible coins to bars.

McAlvany Precious Metals advisors can help you find your perfect strategy. Give us a call for a no cost, no obligation consultation.