Podcast: Play in new window

Gold and precious metals saw more volatility over the last week, but overall strong in the beginning of this new year. Let’s take a look at where prices stand as of our recording on February 5:

The price of gold is up 3.6% to $2,862. However, gold did break above $2,900 in the futures market.

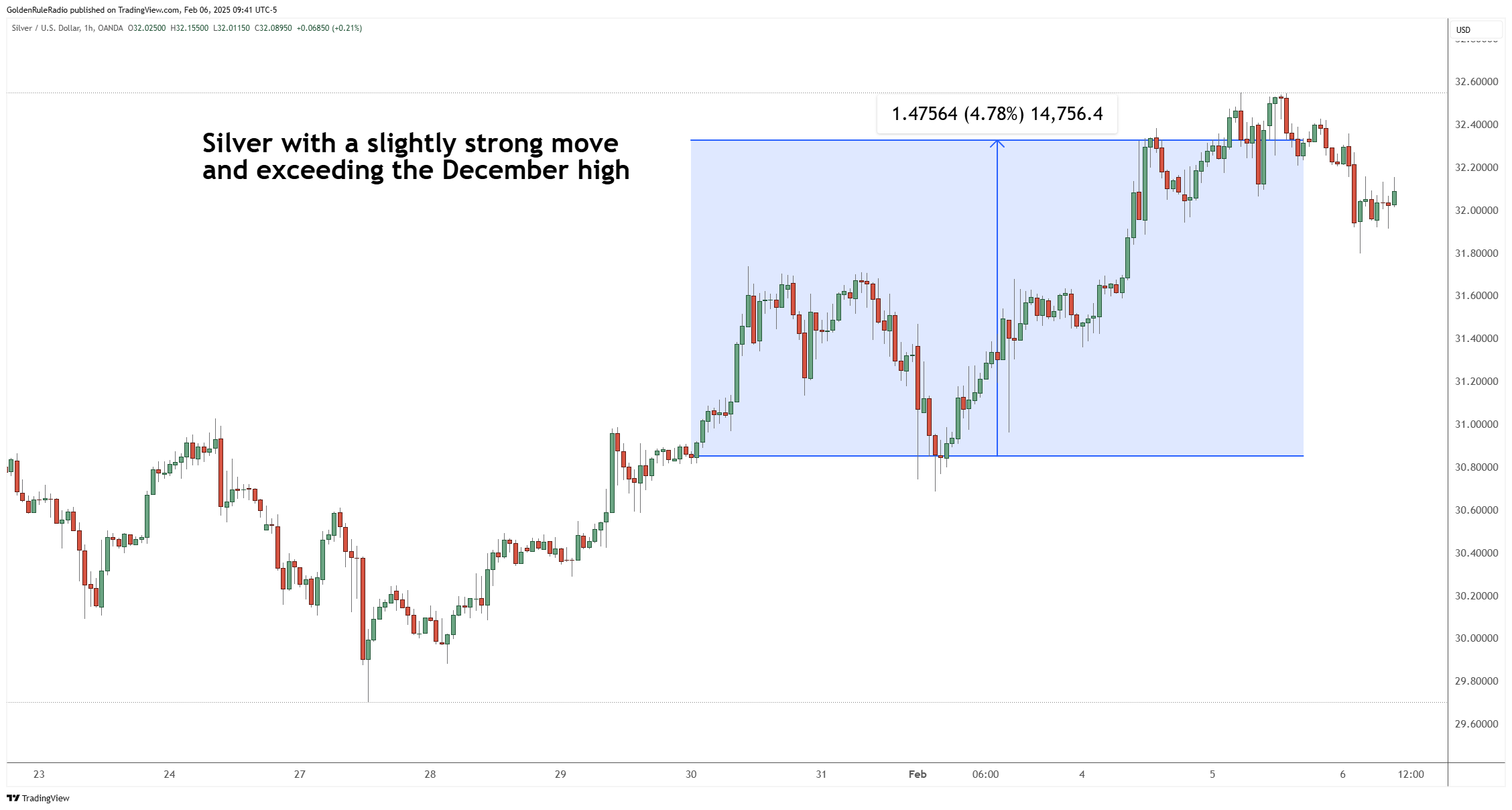

The price of silver rose up 4.8% to $32.32. This has inched the gold to silver ratio down a couple of points to 88 to 1.

Platinum is up about 3% to $1,008, from a week earlier.

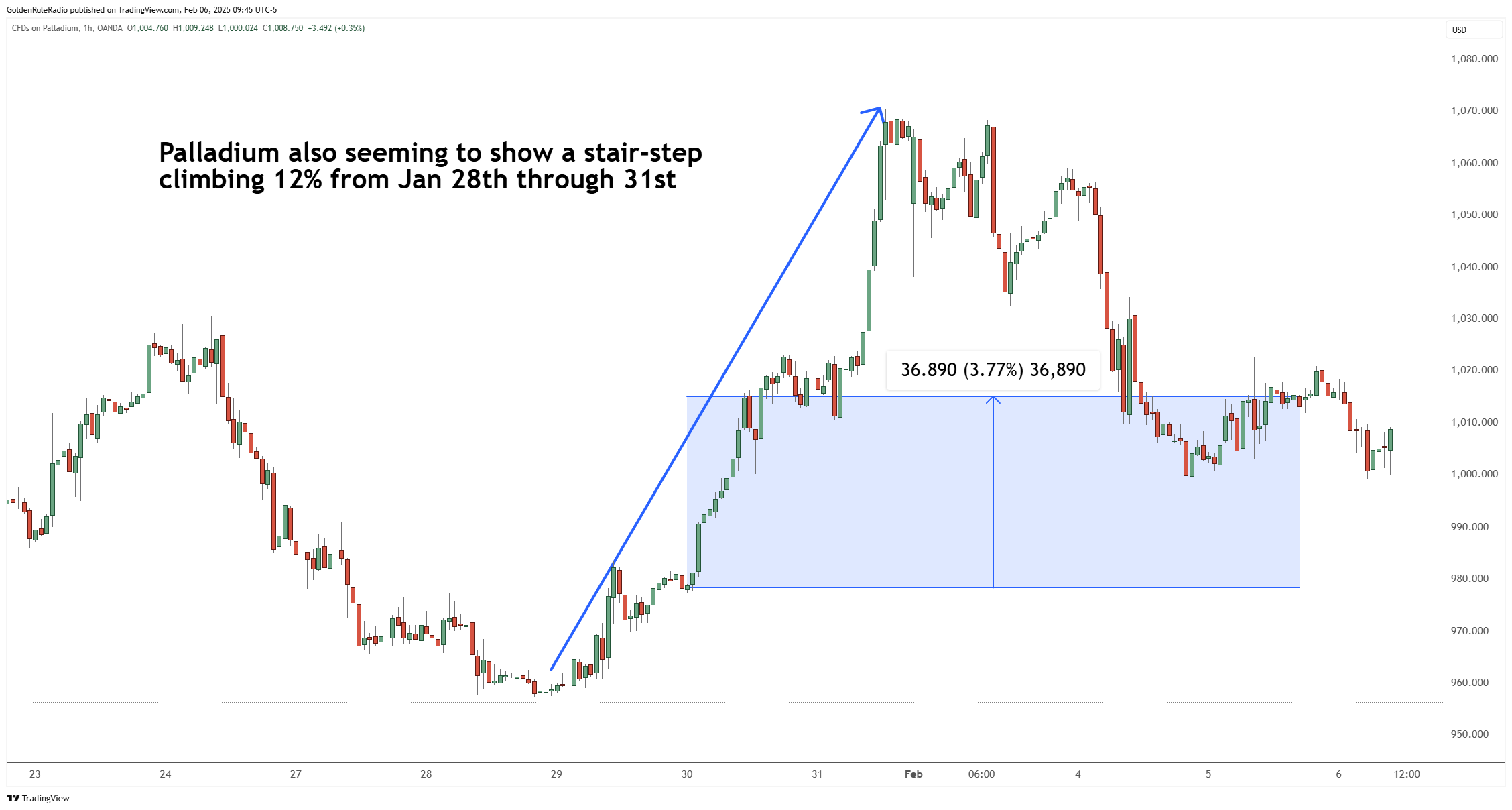

Palladium up about 3.8% to $1,015, rising from a week earlier as of recording.

Looking at the broader markets…

The S&P 500 moved sideways, and was at 6,058 as of recording.

The US dollar index was down about 0.25% to $107.06. But it did reach $110 before making a pretty significant crash back down.

A Strong January for Metals

Looking back at January performance, precious metals across the board showed strength in the first month of the year. Gold closed out the month up 6.5%, while silver outperformed gold with a rise of 8.6%. It gets none of the attention, but that’s because gold’s at all time highs. Platinum rose up 8.1% in January, while palladium led the charge overall, up 10.6% by the end of the month.

As discussed in our January 24th show, the commitment of traders continues to bet long on gold. We believe that gold could reach a new record high of $3,000 before we see a decline.

Bond Market Stabilizes

Despite interest rates shifting down 18%, the bond market looks pretty stable. The short-term one-year and two-year bond yields are down around 20%. But looking at the 10-year bond yield, it has only declined 10%.

So despite the massive interest rate rise through 2022 into 2023, tapering off in 2024 and down a little bit at the end of last year, the bond rates have stabilized.

The bond market is far bigger than the equities market, and it’s encouraging to see money moving into 10 year Treasurys — an indication that big money is happy with the direction the US is going and perhaps even hedging risk in the equity world.

Volatility in Cryptos

Bitcoin still looks relatively healthy, but Ethereum had a 36% drop in a day. And while it took a significant bounce up, it did also have a significant decline over the last couple weeks and months in some of the alternative cryptos. So we’re seeing rampant volatility in certain places right now.

While some investors will continue to beat the drum for this gold alternative, cryptocurrencies still haven’t shown the stability of precious metals. Gold is still the original money — real, tangible, and the true hedge against inflation.

Protect Your Money With Gold

Gold is a powerful safe haven and insurance policy against economic and political uncertainty.

Now is the time to reach out to a trusted McAlvany advisor for precious metals investing advice. They are happy to speak with you about your investment goals and strategy for investing in gold and other precious metals. Reach us at 800-525-9556