Podcast: Play in new window

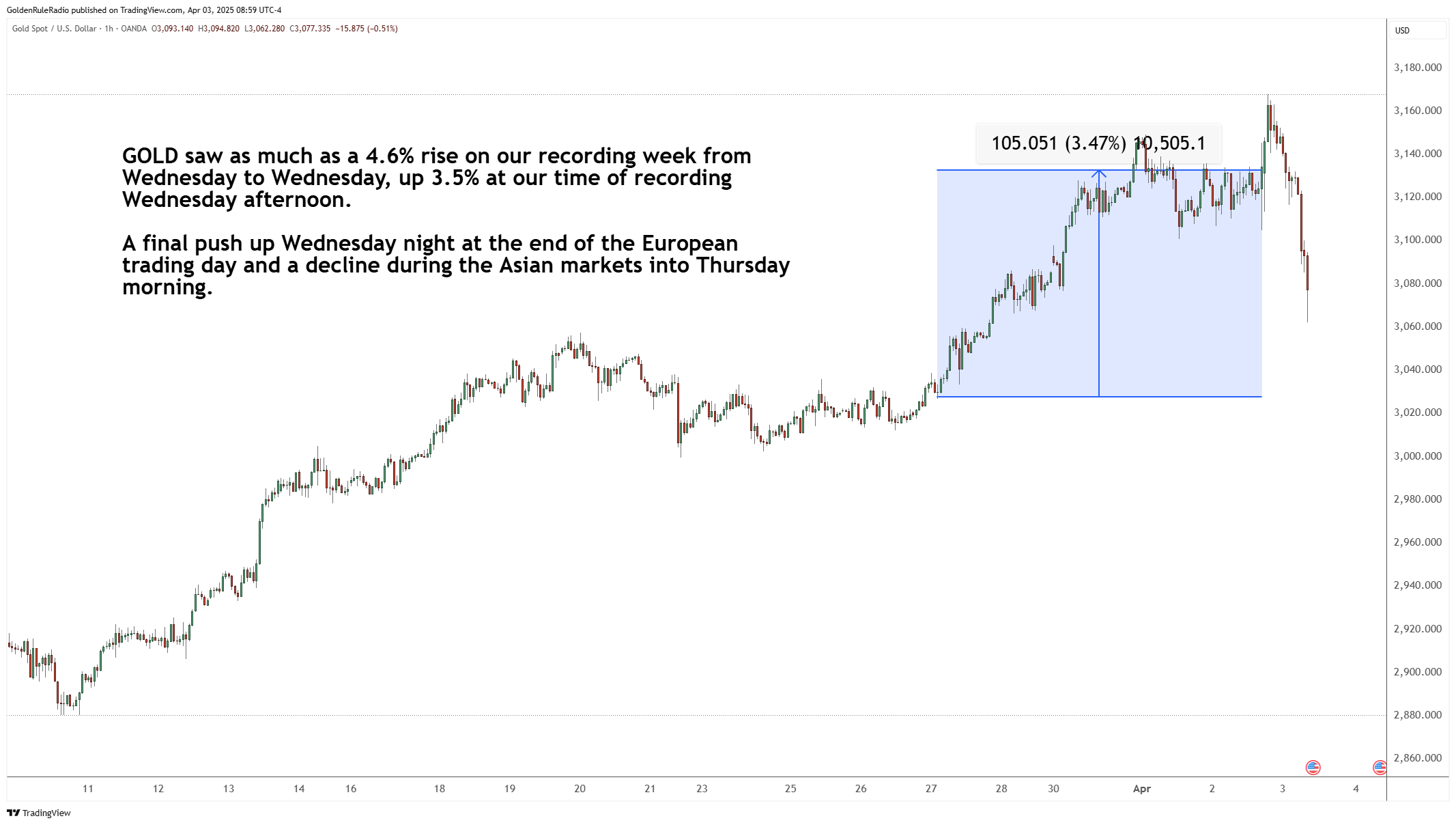

This week we review the strong gains seen in precious metals over the first quarter against the struggling equities market. Gold’s increases follow a strong movement from central banks and hedges to repatriate money to cover weak equities markets.

Let’s take a look at where prices stand as of our recording on April 2:

The price of gold is down 3.5% to $3125 from a week earlier.

The price of silver is up about 0.5% from our recording last week to $33.80.

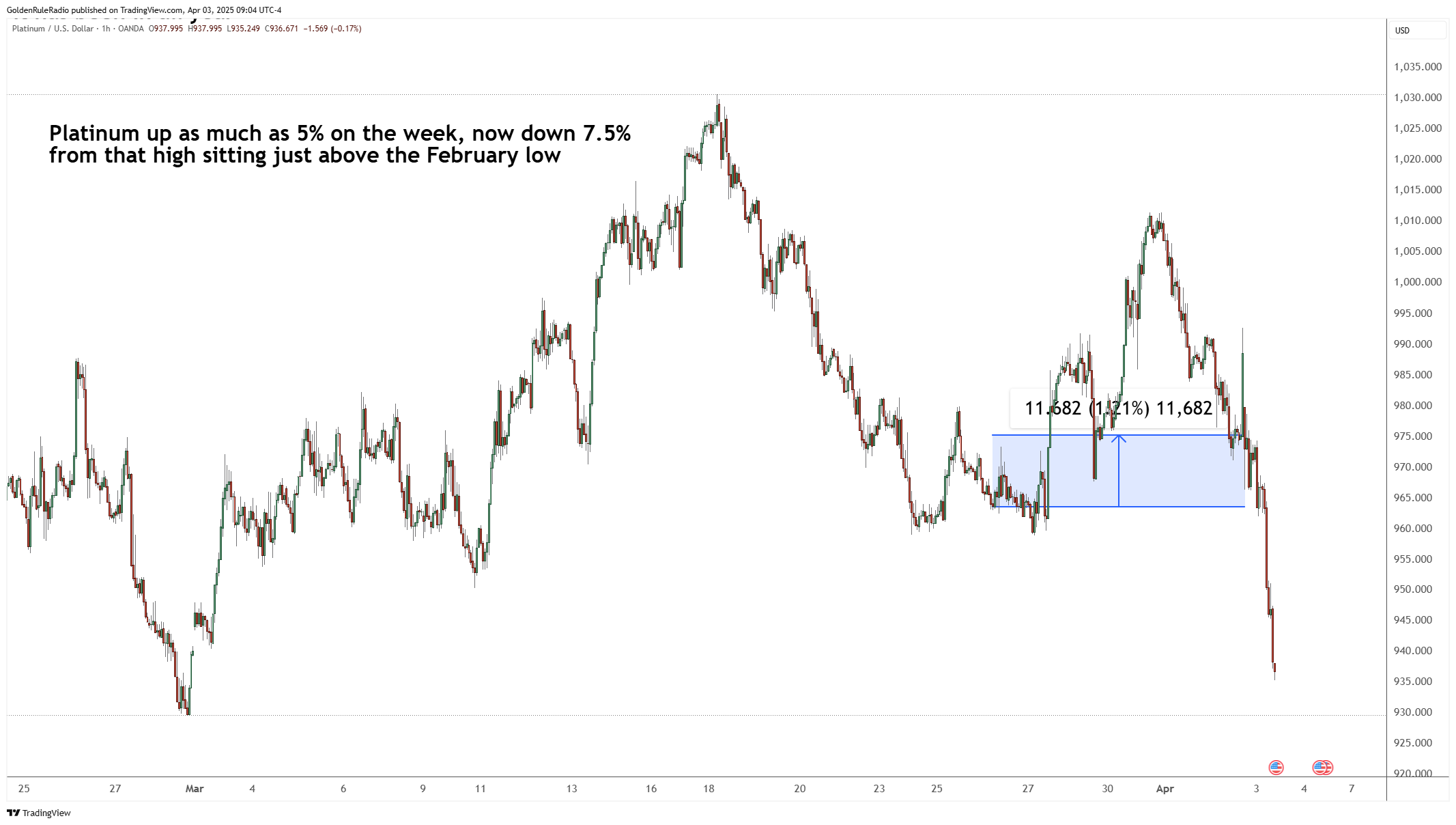

Platinum is up about 1% to $975 an ounce.

Palladium is up 1.5% to $978 per ounce.

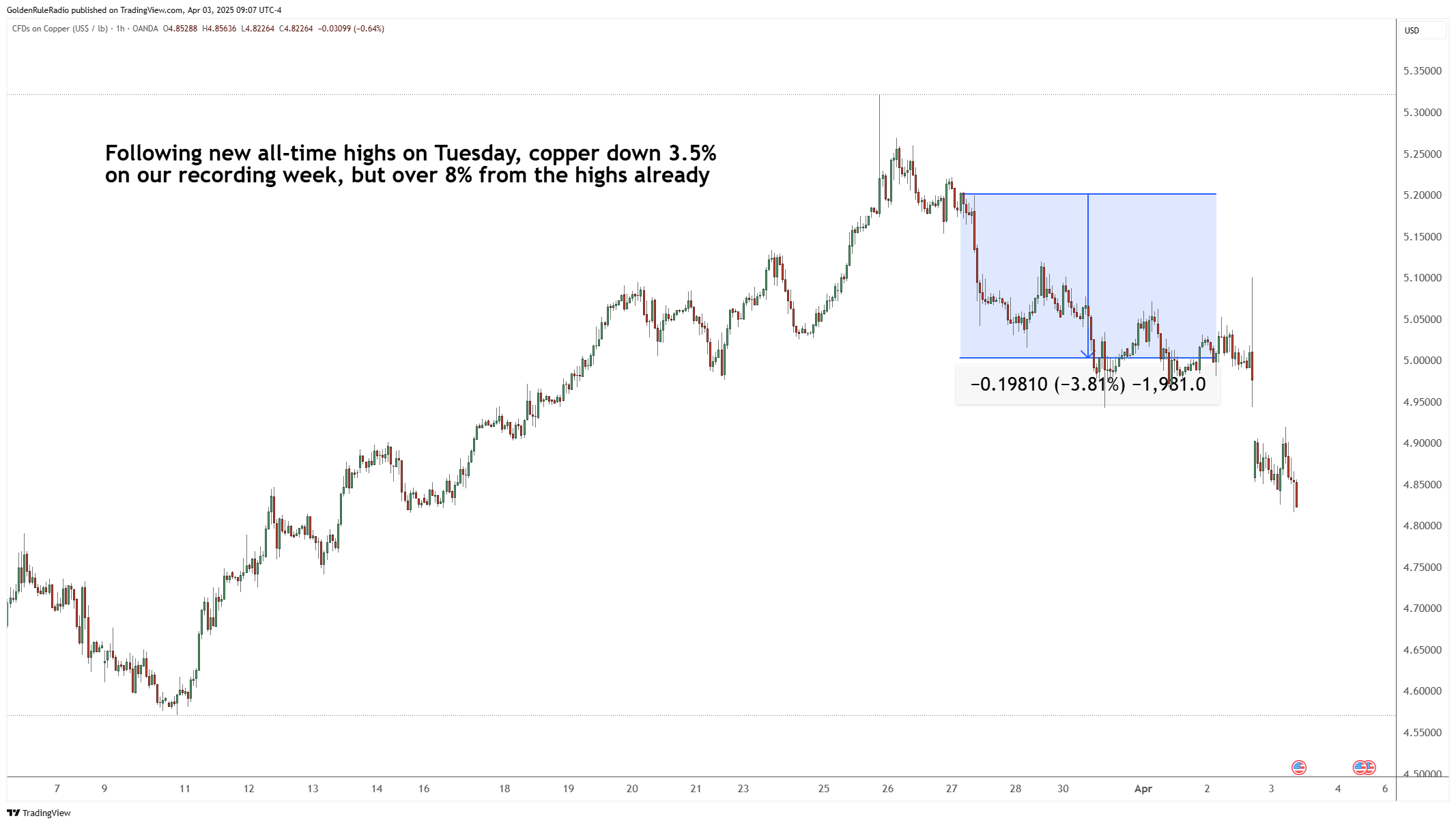

Copper is down about 3.5% to $5.01 this week.

Looking at the equities markets, which are mostly down this week…

The S&P 500 is down about 0.5% at 5670. There was an intraday lowest price in the S&P since September.

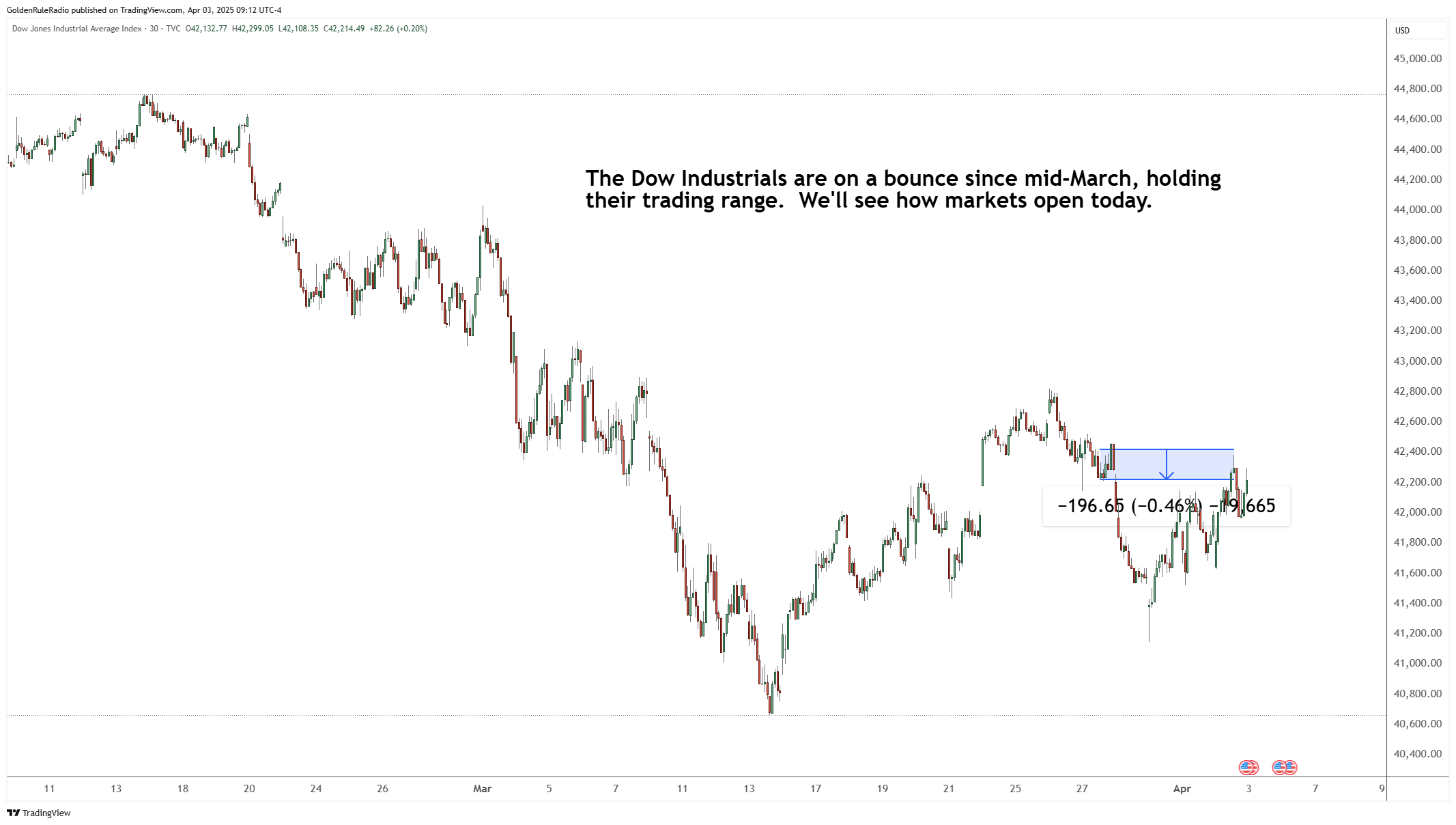

The DJIA is also down about 0.5% to 42,200. It also hit its September lows, but it did that about a week ago.

The Dow Transports rose up just under 1% to around 15,000.

And of course, we did record this before the tariff day announcements happened, so we expect to see even more volatility in the coming days.

Q1 Metals Performance

Precious metals showed outstanding performance in the first quarter of 2025. Gold is up 19% for the quarter, and silver gained 17%. Platinum gained 8%, while palladium increased 5% for the quarter. We would happily take this kind of performance in any quarter.

That’s the great news for precious metals investors — they’re seeing great appreciation of their holdings. However, it also means that consumers are getting squeezed at the grocery store and gas pump.

Silver Opportunity

If gold is looking too pricey these days, you can start building your gold reserve by stacking ounces of silver and eventually making a ratio trade between gold and silver when the time is right.

Now is the perfect time to add more silver ounces to get in before silver has its own run up. Silver is still undervalued, and it has a lot of upside potential. And now, silver is starting to play catch up.

Looking at the silver chart, you can see that silver has been moving up in a stair-step pattern since the end of February. Silver has gone from $28 to $33 per ounce since then. Now, it looks like it will soon reach $35, and that’s where it could meet some resistance.

As long as the gold to silver ratio remains in the 70 – 90 to one range, our clients will likely add more silver ounces to their portfolios. The trick is to just be patient and hold the silver until the ratio swings in favor of gold.

Update Your Metals Strategy

Are you considering adding more silver or gold ounces to your portfolio? How much should you own? The McAlvany advisor team is here to help guide you. With decades of experience in precious metals investing, they are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556

Markets face uncertainty amid geopolitical tensions, inflation concerns, and new tariffs. Thanks for listening.