Podcast: Play in new window

This week gold and silver took a small decline. Gold is still up 5% over April, holding strong in the long-term trend. Let’s take a look at where prices stand as of Wednesday, April 30:

The price of gold is down about 1.2%, sitting at $3,290 as of this recording. But it is up 5% on the month.

The price of silver is down about 2.3% over the last week, but it is still well over 30 bucks at $32.27. Silver went down about 3% in the month of April.

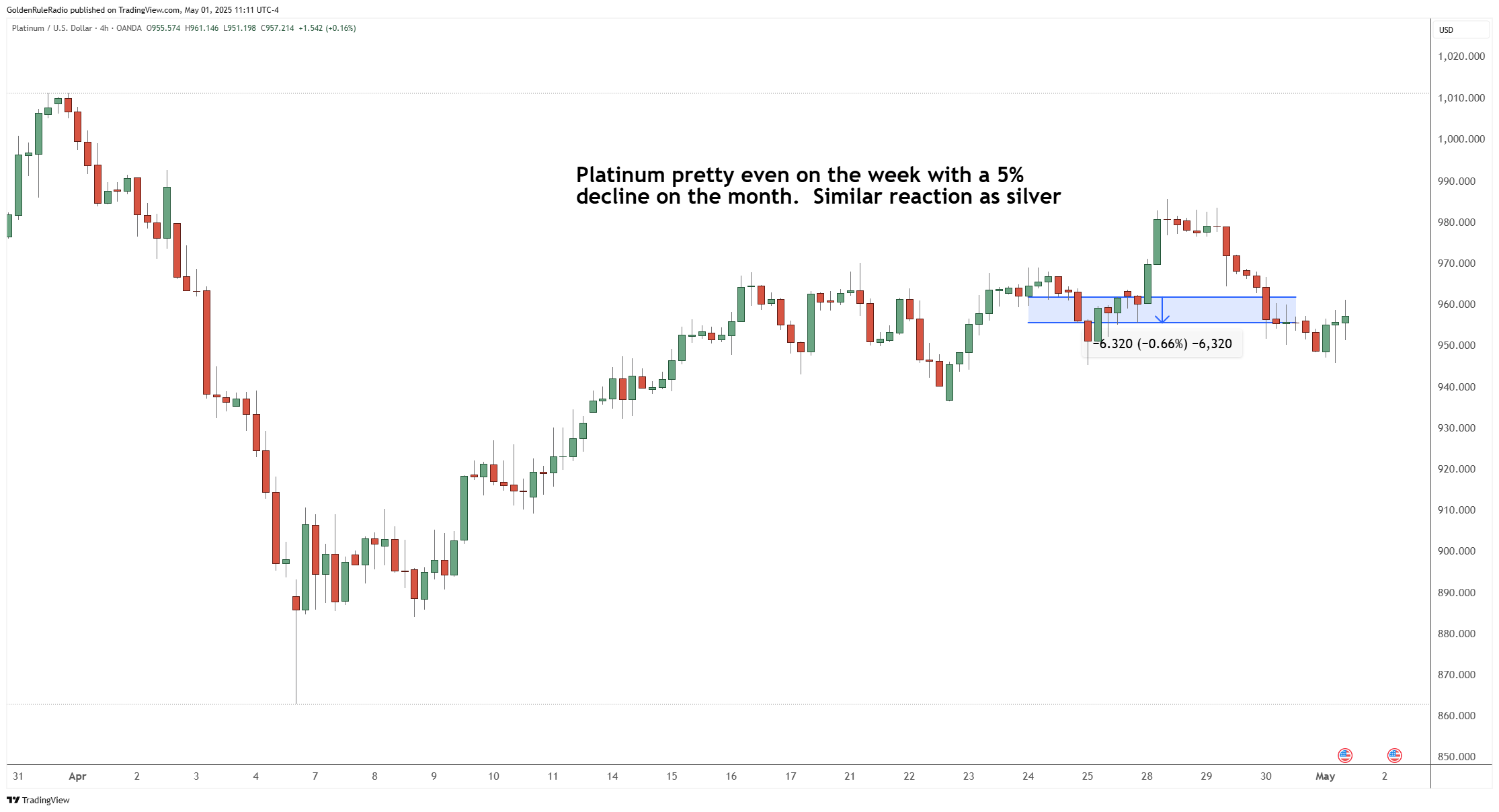

Platinum is down about 0.5% at $955 from a week earlier.

Palladium is dead even on the week, still at $935, and it’s about $20 below platinum.

Moving over to the paper markets…

And the S&P 500 is up 3.5% this week to 5,570, and it is actually pretty even on the month.

The dollar index is dead even on the week, currently sitting just below 100 at 99.50. The dollar index saw a decrease of 4.5% over the month of April.

Sentiment Declines

Consumer sentiment has dropped 8% month over month. It is currently at 52, which is down 32% year over year, primarily driven by worry over rising prices and tariff volatility. The airline industry is declaring a recession as share prices of major airlines are down 44% and fewer people are booking pleasure flights.

Job Openings Declines

The US job openings report jolted the markets this week. According to the report, there were 7.192 million job openings, but 7.5 million job openings were expected. This showed a tightening of the labor market, with 7.6 million job openings reported the month before. But most of this could be sentiment driven, due to inflationary concerns. There has been no official declaration of a recession.

Borrowing Estimate Drops

According to the US Department of the Treasury, the current estimate of privately-held net market borrowing for the second quarter dropped significantly. Excluding the lower-than-assumed beginning of the quarterly cash balance, the current quarterly balance is $53 billion less than announced in February. This is the first sign of reality of a decrease in expectations of debt spending, deficit spending. The belt tightening has begun.

All eyes remain on gold and its continued high demand.

Plan Your Metals Strategy

How many ounces of gold and other precious metals should you add to your portfolio? The McAlvany advisor team is here to help guide you. With decades of experience in precious metals investing, they are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556