Podcast: Play in new window

This week gold rose up slightly, while silver took a small dip. Palladium and platinum are neck and neck. Meanwhile, the dollar index made a slight recovery despite a quiet Fed announcement. Let’s take a look at where prices stand as of Wednesday, May 7:

The price of gold is up about 2.5%, sitting at $3,367 as of this recording. Intraweek, gold was up as high as $3,440.

The price of silver is down about 2.3% over the last week at $32.27.

Platinum is up about 1% at $965 from a week earlier.

Palladium is up 3% on the week, even with platinum at $965.

Moving over to the paper markets…

And the S&P 500 is flat from a week earlier, sitting at 5,630.

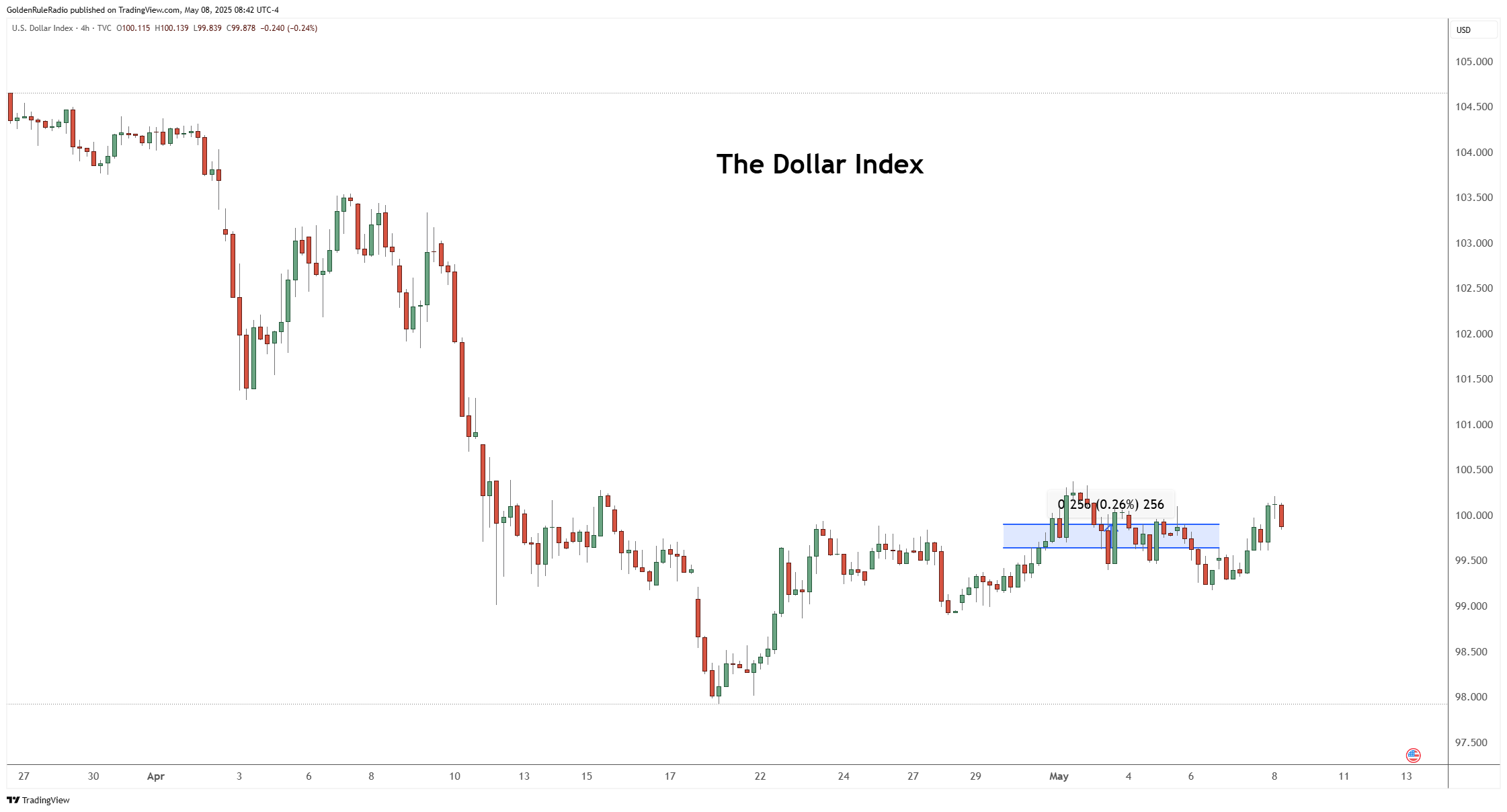

The dollar index is up 0.25% on the week, currently sitting just below 100 at 99.50.

Supply chain disruptions, declining trade activity, and mounting U.S. debt fuel the rising demand for tangible assets.

Fed’s “Wait and See” Stance

While the Fed didn’t announce any dramatic policy changes at its latest meeting, its posture of “wait and see” is itself influencing markets. The Fed is caught between conflicting data: rising risks of unemployment and inflation, complicated by new tariffs and global trade disruptions.

The looming elephant in the room is the U.S. debt refinancing. With trillions in Treasury debt set to be refinanced at higher interest rates, the fiscal outlook is concerning. Higher rates on a massive debt load puts further pressure on the Fed’s policy options.

And while the S&P 500 remains buoyant, much of the market’s strength is concentrated in a handful of mega-cap stocks, with underlying sectors like transportation showing signs of weakness.

The Dollar Index Watch

After peaking at over 110 in January, the US dollar index dropped sharply-down 12–13% in just a couple of months, bottoming at 98 in April.

While there’s been a slight rebound, this kind of volatility in the world’s largest financial asset is significant. The dollar is valued against other major currencies, so its decline reflects not just domestic issues, but global shifts in confidence and capital flows.

Despite concerns about a dollar “crash,” the dollar will likely remain relatively stable compared to other currencies, simply because all fiat currencies are facing similar pressures. However, the rapid decline and ongoing volatility are warning signs of underlying stress in the system.

This makes gold’s role as a store of value even more relevant, especially as the dollar’s purchasing power erodes.

Gold in Demand Worldwide

Central banks are boosting their gold reserves, moving from under 10% of reserves in precious metals to 20–25% and still climbing. This trend signals a loss of faith in the global financial system by its very stewards, making gold a hedge not just for individuals, but for entire nations.

People buy gold for different reasons — including building a legacy, wealth preservation, or as insurance against systemic risk.

Gold is resilient. It never goes to zero, unlike fiat currencies which can lose value through inflation or policy missteps. Gold is not just about return on investment, but the security of the investment itself. In uncertain times, that “return of your investment” becomes paramount.

Get in Touch for Expert Guidance

Now is the perfect time to evaluate your precious metals strategy. The McAlvany Precious Metals advisors have decades of experience investing in gold and other precious metals, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.