Podcast: Play in new window

Gold bounced back from a short-term decline following April’s highs. Platinum pushed up to its highest level in a year, while palladium gained 9%. With shifts in global monetary sentiment, bitcoin shot up to a new high. Let’s take a look at where prices stand as of Wednesday, May 21:

The price of gold is up about 4%, from our recording last week at $3,318. So we’re seeing a bit of a rebound in the price of gold.

The price of silver is also up 4% at around $33.56. Over the past month, it has been up and down about 3%, but it is still looking pretty healthy.

Platinum is up a whopping 10.5% over the last week at around $1072. It was last May that we saw the price rise up this high.

Palladium is also up, rising 9% on the week, at around $1,037.

Moving over to the paper markets…

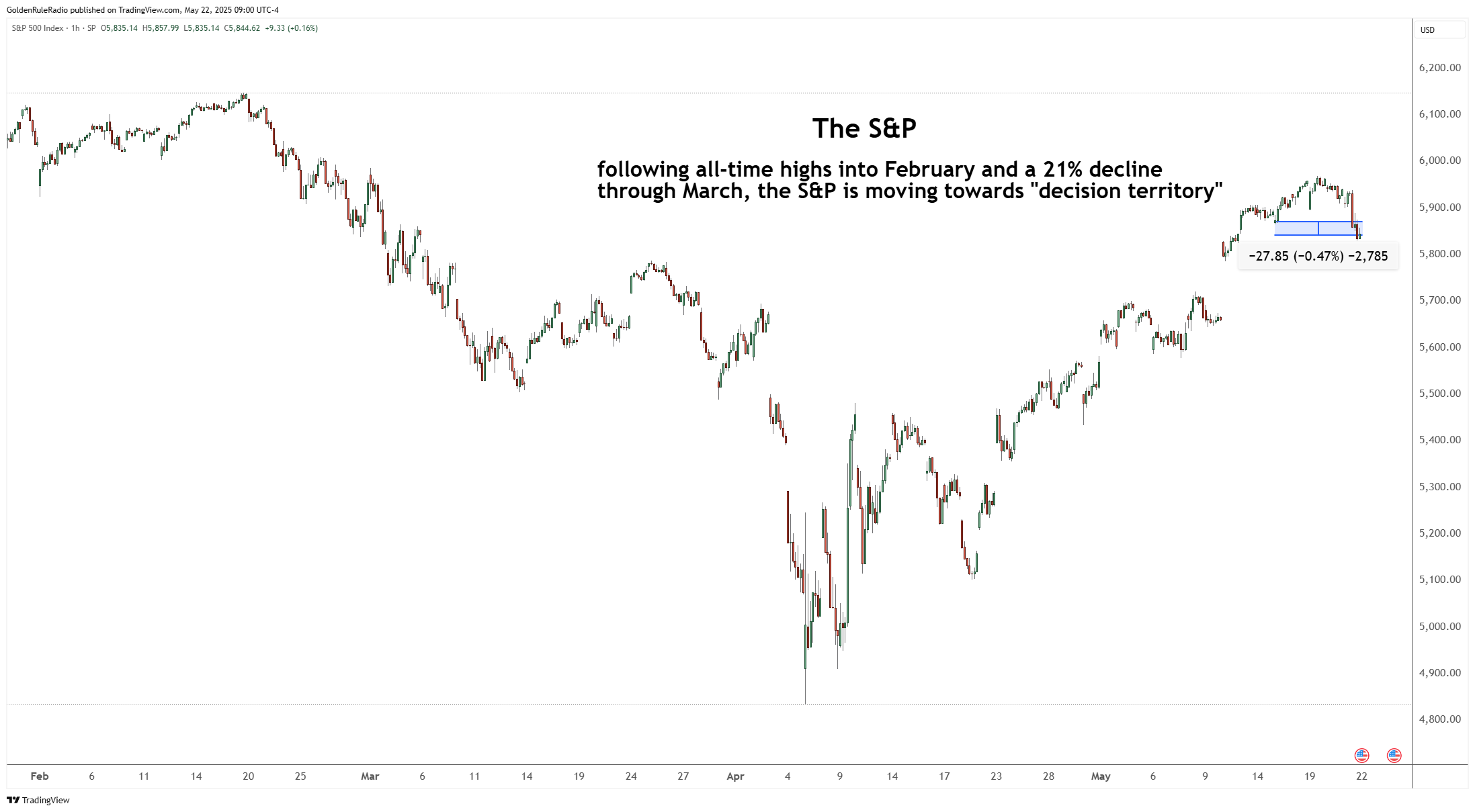

The S&P 500 is down about 0.5% from a week earlier, sitting at 5,842.

The dollar index is down 1.3% on the week, currently sitting at 99.65. There was a nice small run on the dollar, but it’s now pushed back below 100.

Bitcoin reached an all time high of $108,000. This goes back to the restructuring of the global monetary system — and ultimately, it really reeks of negative news.

Precious metals such as silver and copper continue their slow climb supported by industrial demand, while gold sees short-term weakness. Thanks for listening.

Gold’s Healthy Technical Pattern

From the technical analysis side, the gold price hit that 3 8 2 fibonacci level as we talked about a week or so ago. We’ve had this really nice little short-term pullback in the gold price, which it has thus far bounced.

In the short term, gold is sitting within a nicely compact, declining channel, working its way down.

Gold will likely stop around $3,350 and then turn back down. However, if gold breaks above that number, it’s reasonable that it would reach $3,500 or somewhere within $50 of that level. Now it could test that and turn back down.

If we don’t see any type of breakout movement in gold here, probably within the next week, it’s likely we could see gold continue to slide down. And that fits in line with what we typically see in the middle of the year — that is, our summer slump across the board in markets. After a $1,500 rise in gold, we might see a $500 decline.

Seasonal and Fundamental Factors

The American buyer has not come back into the gold market. The rise in the price of gold is being driven by central banks and Eastern buyers. But we are moving seasonally out of our strong spring market into more of a summer slumber market. So it’s likely that we probably will see a further rally based on the continuing tumultuous US debt.

Bonds Sink on Downgrade

Moody’s downgraded the AAA credit rating of the US on May 16. It’s the last major rating agency to downgrade the US, signaling the country’s mounting debt burden has shifted from a theoretical risk to a constraint on the power and leadership of the economic leader. Without reform, the US debt is projected to reach 156% of the U.S. GDP by the year 2055.

Consequently, this has weakened the bond market. Demand for US 20-year bonds at Wednesday’s auction was the lowest since February, according to the Treasury Department.

Copper Rally & Ratio Trade Opportunity

There have been some big purchases in copper coming out of the Asian market. Dr. Copper is poised to move higher again, and it will pull silver up with it.

We see this as a ratio opportunity to move from gold into silver, because we’re still flirting with that 100-to-one ratio — a unicorn event. We’ve only seen this a handful of times, and never with premiums being so low that you can actually take advantage of it.

Make Your Move Today

If you’re ready to start investing in precious metals — or want to add ounces to your existing portfolio — the advisors at McAlvany are eager to help. We’re happy to speak with you on a complimentary, no obligation call. Reach us at 800-525-9556.