Podcast: Play in new window

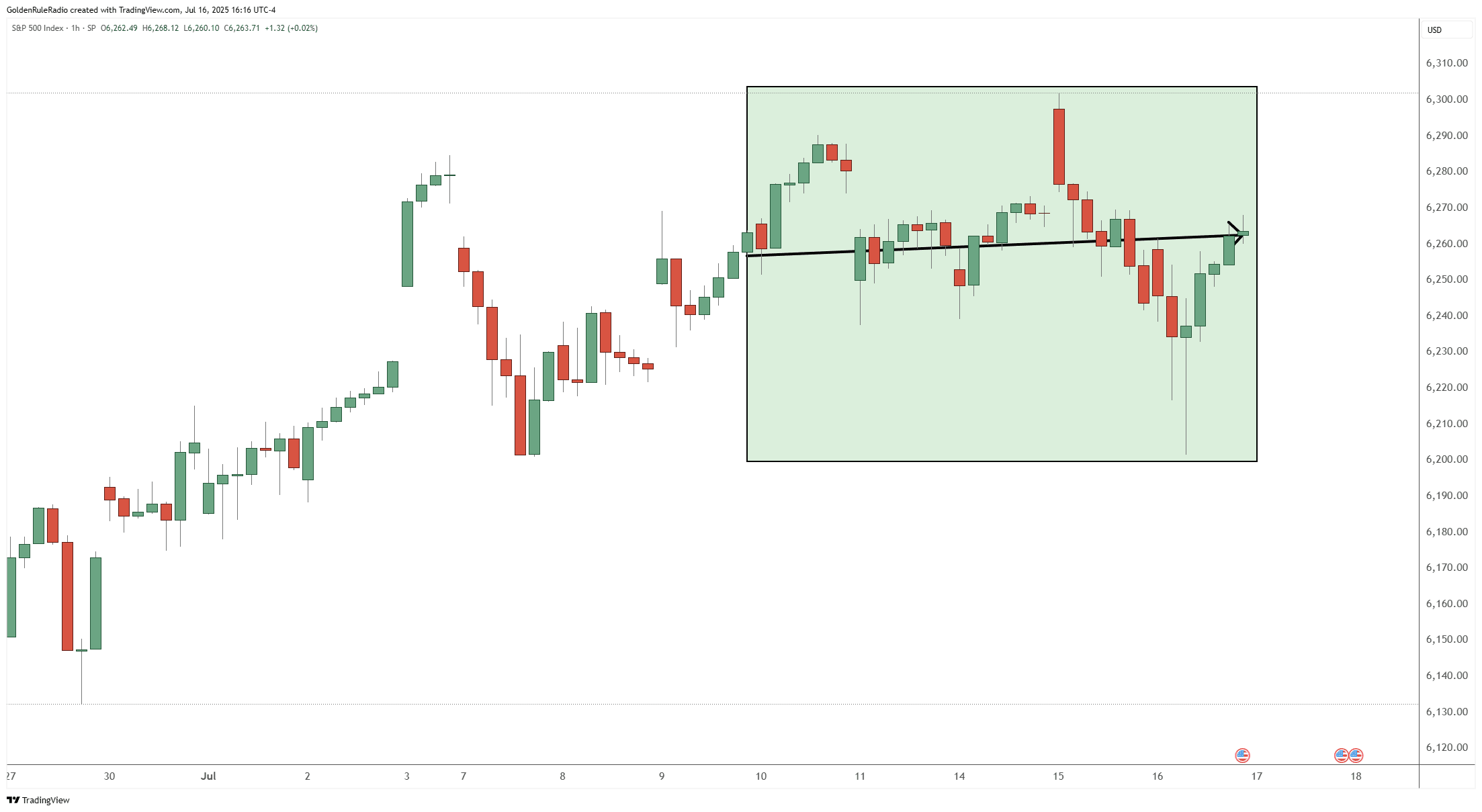

While the S&P 500 showed little activity this week, precious metals sparked significant excitement among investors. Let’s take a look at where precious metals stand as of Wednesday, July 16:

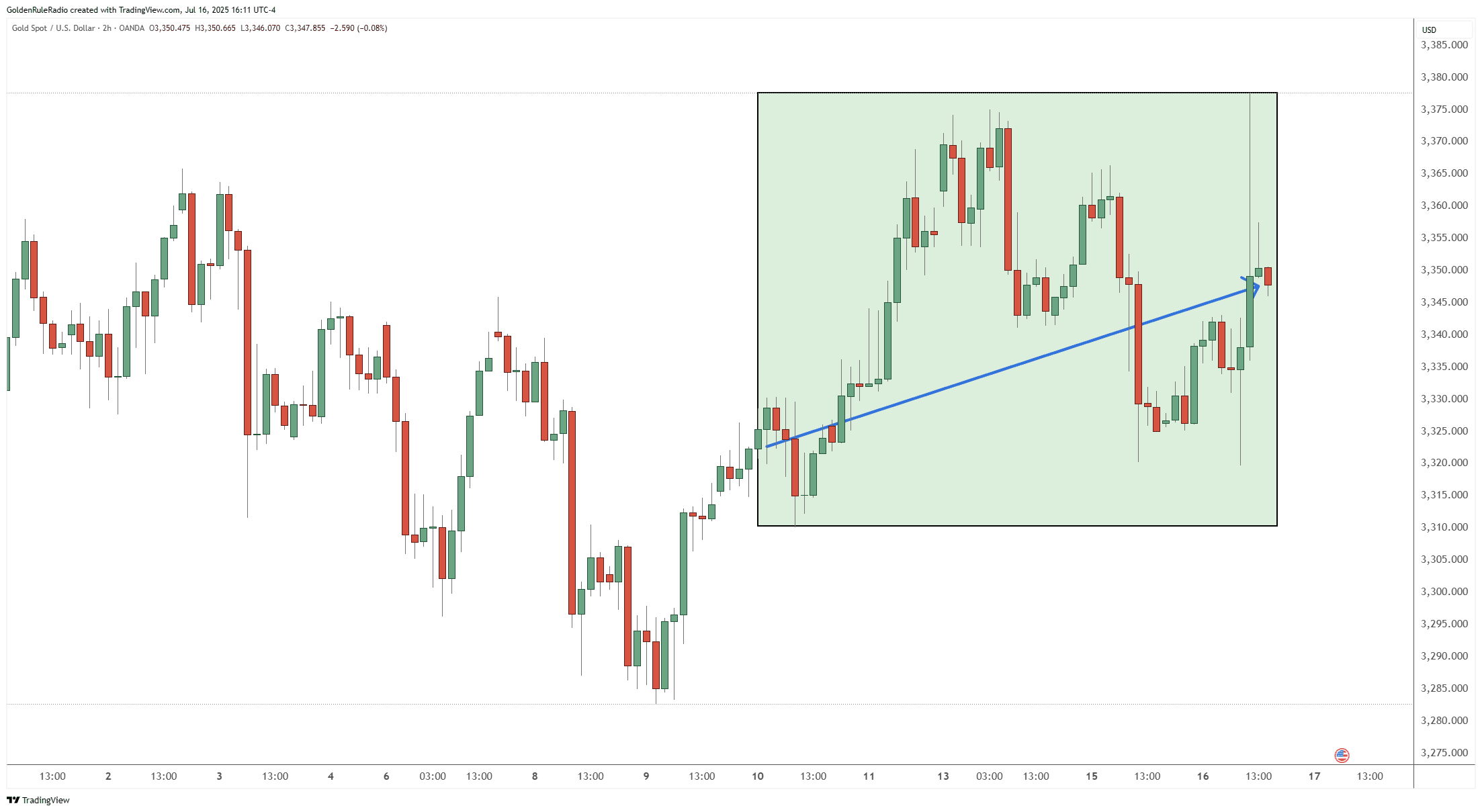

Gold edged up 0.75% to near $3,350 per ounce. The real story, however, was the volatility: we saw $60 swings in gold’s price in a single day.

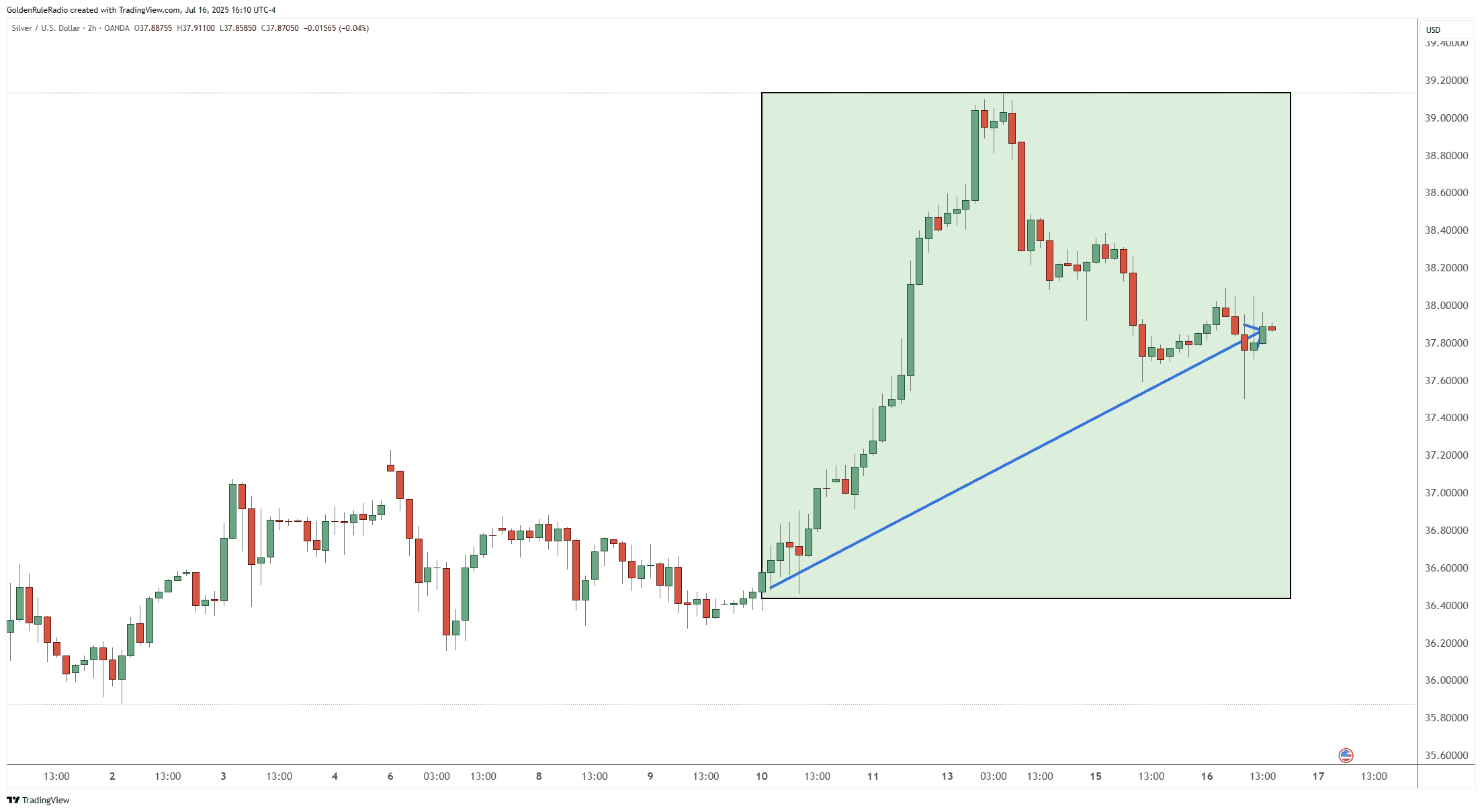

The price of silver surged approximately 3.5% for the week. Silver had a brief break above $39 before a slight pullback. That’s an impressive 30% run since mid-April.

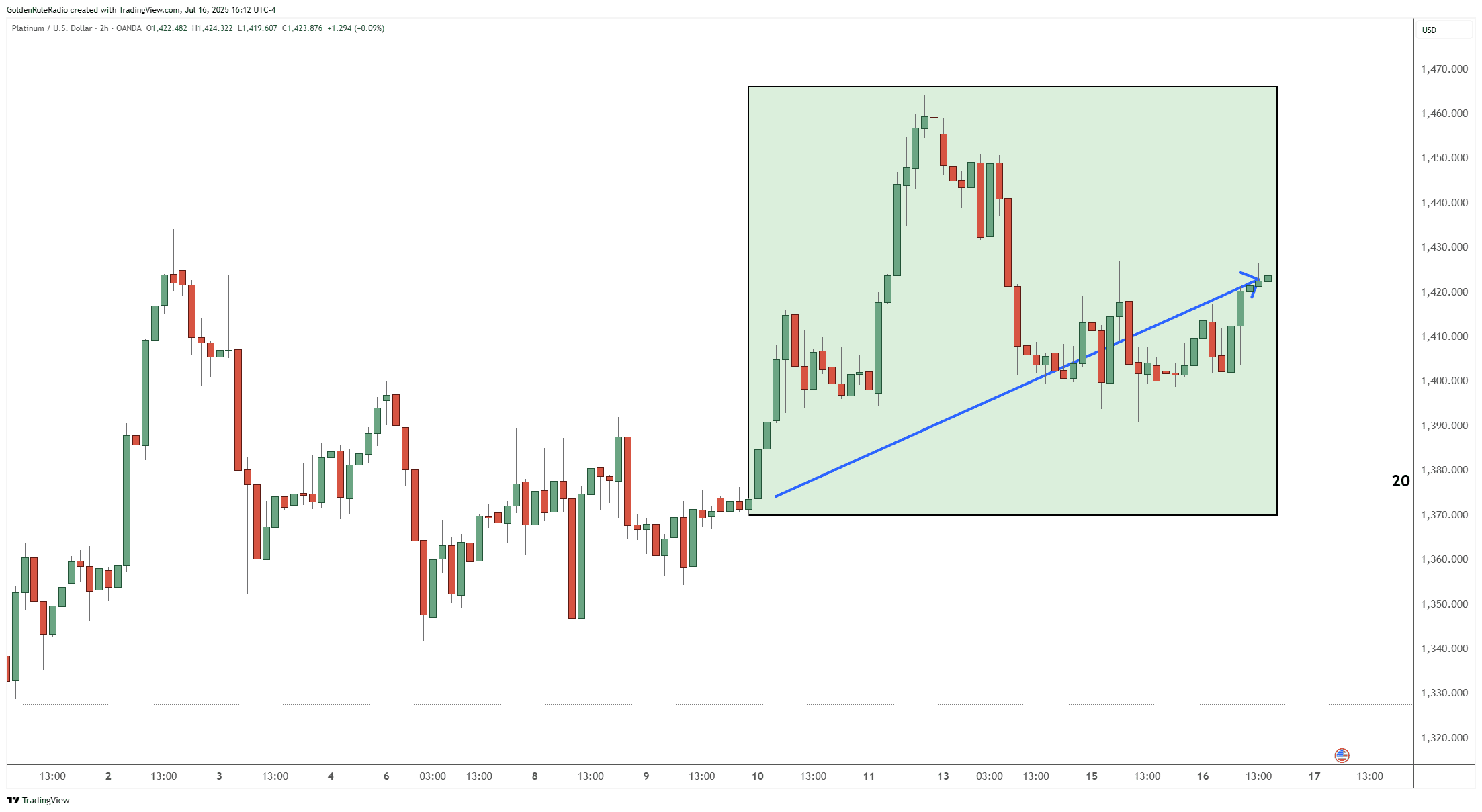

Platinum advanced by 3.5% to $1,425, but the charts suggest this rally may be winding down.

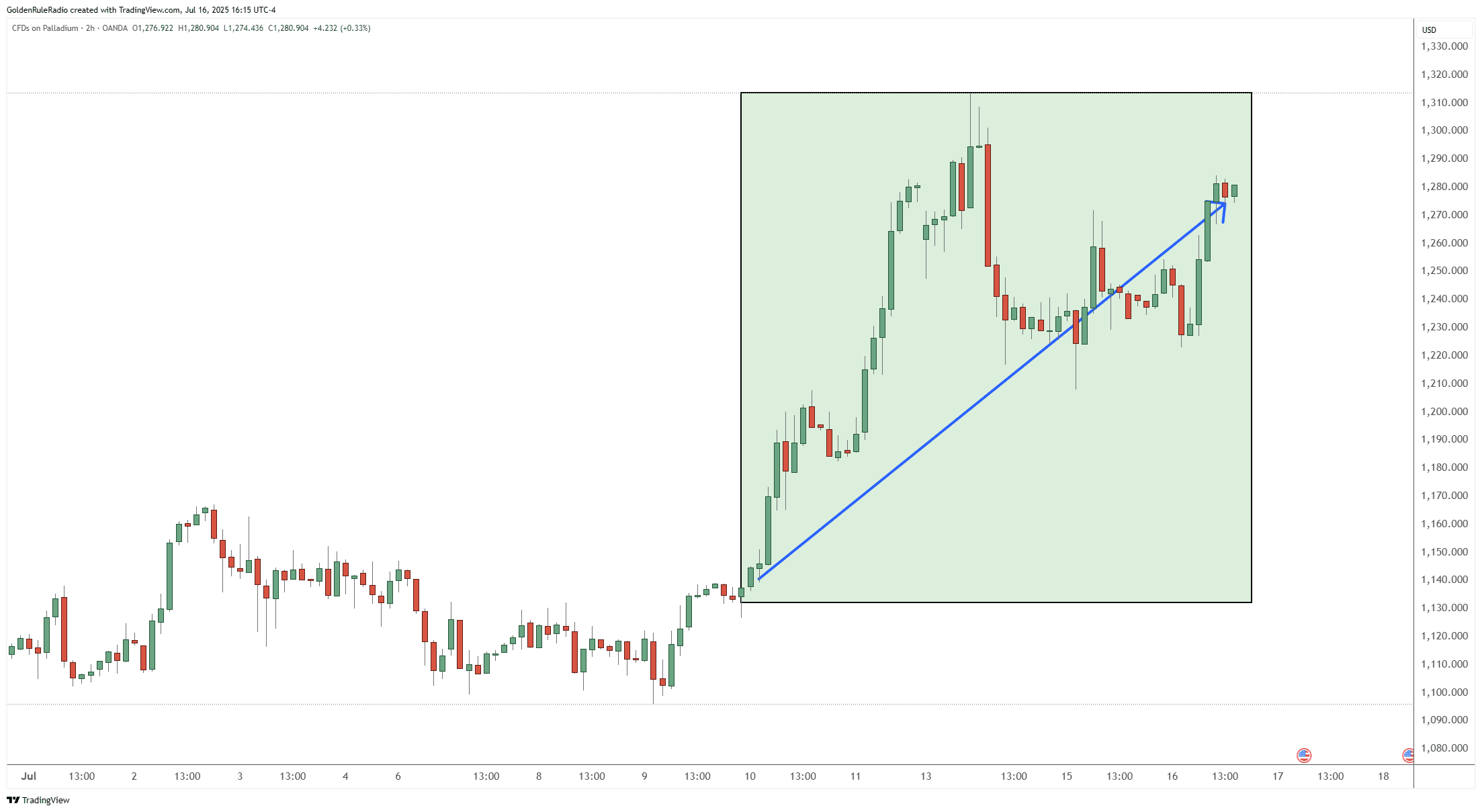

Palladium stole the spotlight with a 12.5% jump to $1,280. It is narrowing its gap with platinum—a notable move, considering palladium’s higher valuation over the past decade.

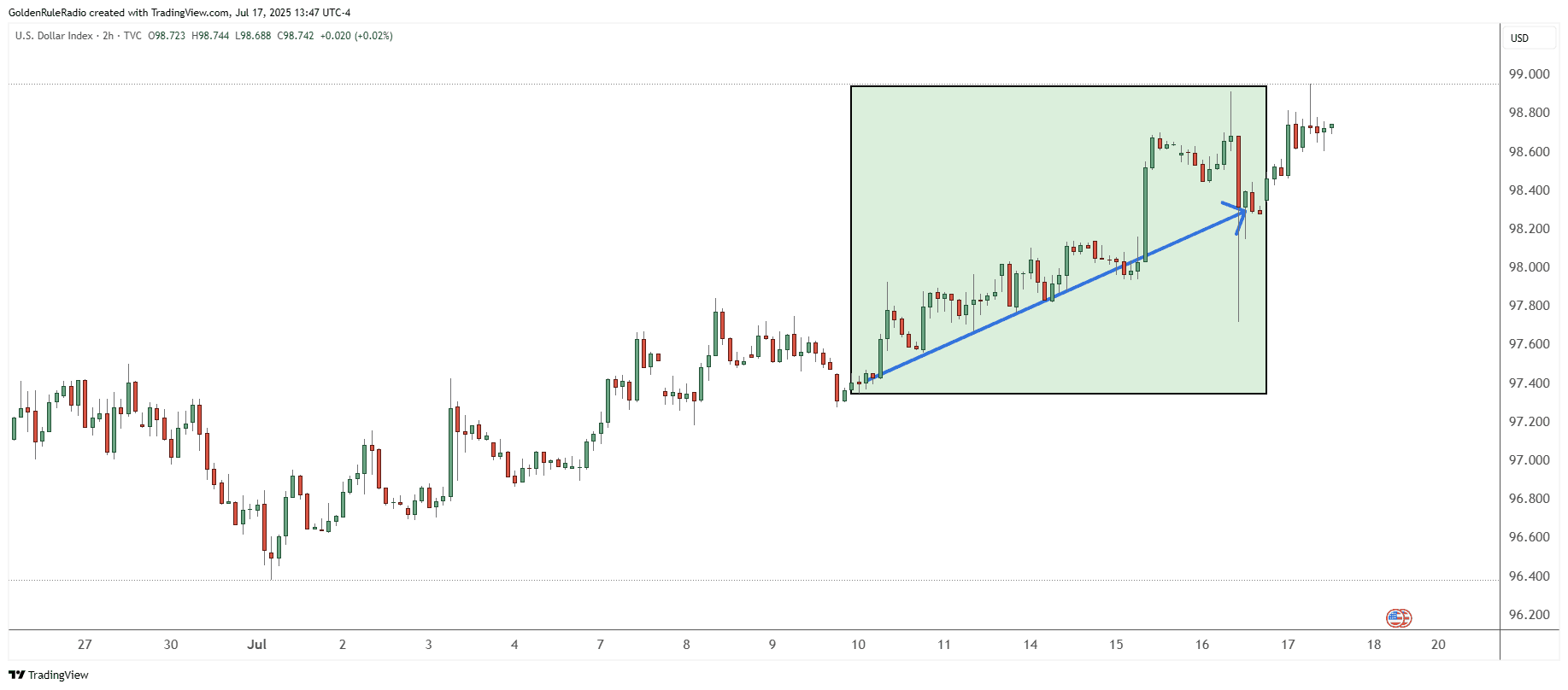

The dollar index climbed about 1% this week to 98.30, with heightened fluctuations, underscoring the market’s reactive mood amid headline and rumor-driven trading.

The S&P 500 was dead even week-over-week, coming in at 6,260.

Geopolitical and Macro Rumors

This week’s volatility wasn’t just about numbers. Headlines hit hard, especially a swirling rumor that the White House intended to fire Federal Reserve Chair Jerome Powell. Even though this proved unfounded, the rumor triggered sharp moves in both the dollar and gold. It’s a clear reminder of how sensitive the metals and currency markets remain to political developments, especially during uncertain times.

Geopolitically, we’re watching an intriguing shift: Russia, along with India, has begun adding silver to central bank reserves—a rarity, since central banks have traditionally focused on gold. As both are BRICS nations, this move could create a new foundation for silver prices. It puts pressure on major Wall Street banks that hold large short positions in the metal. When silver breaks key resistance levels, such as $35, $38, and $39, it sets the stage for potential bullish momentum.

Long-term Dollar Strength and Bullish Patterns

Despite media narratives suggesting ongoing dollar weakness, the long-term charts show the U.S. dollar remains in a multi-decade uptrend. Yet, and importantly for investors, gold and silver have also notched strong gains over the past 20 to 30 years, often rising in parallel with a strong dollar. Understanding these shifts requires careful attention to timeframes; while short-term corrections can be unsettling, the broader trajectory remains robust for precious metals.

From a technical standpoint, silver displays classic bullish patterns. In particular, we’re monitoring a “cup and handle” formation—a setup that, if confirmed by a break above $50, could signal much higher prices ahead.

We also see evidence of tightening in physical silver supply: the annualized interest rate to borrow silver has surged above 6% (up from close to zero not long ago). This points to developing scarcity, although retail investors haven’t yet felt the full effects in the coin and bar market.

Ratio Trading: Opportunities Amid Shifting Relationships

We continue to track evolving relationships among the “white metals.” Platinum and palladium, for instance, have now reached price parity after years of palladium far outpacing platinum. This realignment creates unique ratio trading opportunities—a strategy we use to increase gold or platinum ounces in a portfolio by swapping metals when the ratios swing to historical extremes.

At McAlvany Precious Metals, our trusted advisors have helped clients execute ratio trades in their precious metals IRAs and storage accounts, sometimes quadrupling their holdings over a decade just by patiently waiting for the right moments. These trades are best suited for patient investors, as tangible assets like gold and silver never go to zero, and incrementally improving one’s position over time is a proven wealth-building approach.

Get in Touch

What should your next move be in your precious metals portfolio? Your trusted McAlvany advisor can help you determine the best strategy for doubling your ounces. Get in touch and get a complimentary consultation at 800-525-9556.