Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

1,000-Point Swings – the New Norm?

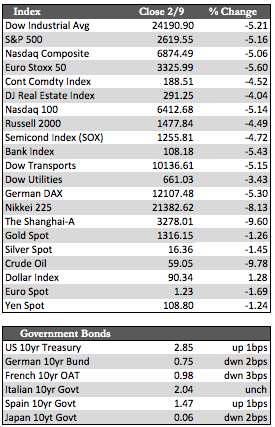

After an incredibly volatile week in which the indices gyrated in and around the moving averages, stocks “bounced” off of their three-month lows Friday. The bounce followed the Senate’s passage of a bill that plans to spend $300 billion over the next two years, but was not enough to insulate the indices from loss. The Dow, S&P, and NASDAQ 100 all finished well into the red by the close of the week, with returns of -5.21%, -5.16% and -5.14% respectively – led by the energy, financial, and healthcare sectors. The carnage seemed to have worsened Wednesday, when an attempted rally failed to hold above the Dow’s 50-day moving average.

Setting the stage for these dynamics has been the relational paradox of interest rates rising in lockstep (especially at the short end) with either gains in the stock market or what’s perceived as economic growth. Higher rates must at some point have the opposite effect on markets and the economy. I believe the market has just received a rude wake-up call in the form of this revelation (accompanied by massive amounts of denial), with several more such calls to come in the near future.

Setting the stage for these dynamics has been the relational paradox of interest rates rising in lockstep (especially at the short end) with either gains in the stock market or what’s perceived as economic growth. Higher rates must at some point have the opposite effect on markets and the economy. I believe the market has just received a rude wake-up call in the form of this revelation (accompanied by massive amounts of denial), with several more such calls to come in the near future.

The economic data was lost in the background noise of the wild market action, but I’m still on the lookout for a downshift that should logically follow the post-storm rebuild. So far there hasn’t been much to see, aside from auto sales in January. They declined by 4.5% from December, and 8.6% from the peak last November. Most other indicators are sentiment driven, so it’s understandable that with the stock market where it was in January, these indicators have remained fairly strong. Apart from these, Treasuries were weaker at the long end, which may be a reflection of some carry trade unwinds. Oil fell about 9.8% in sympathy with stocks and in response to the rising tide of inventories, while commodities in general lost about 2.8%. Gold shed 1.3% to silver’s 1.44% in reaction to an ongoing rally in the dollar from the mid-88 level to just over 90. I believe this to be an overreaction, in light of the fact that gold traded over 50 points higher (around 1,350 in 2016) when the dollar was around 95.

Next week, we’ll hear more about Trump’s budget plan (for as much as $2 trillion over 10 years) after the House reviews, retail sales, and the CPI for January. We’ll also see if the Dow can hold its position above its 100-day moving average, or if the 200-day of 20,679.5 will be the one that matters. I suspect that, if the latter turns out to be the case, interest rates may be causing greater harm behind the scenes than we have all been led to believe.

Best Regards,

David Burgess

VP Investment Management

MWM LLC