Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Different Kind of Invisible Hand?

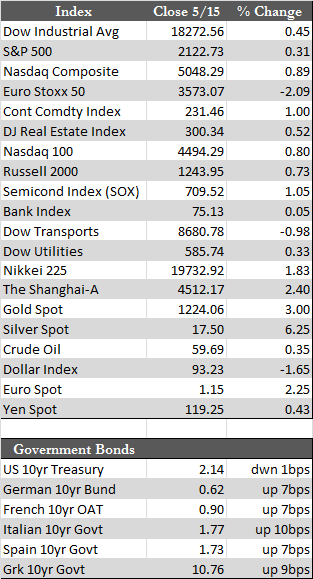

Earlier in the week bond markets worldwide were in the process of extending their losses, which held equity bulls in check until overnight trading on Wednesday. Debt markets in Europe then initiated a small bounce (in which the German 10-year improved by two basis points). That in turn ignited an outsized rally in U.S. equities on Thursday. As to the reason bonds decided to turn, it’s not exactly clear; there was no fundamental event that preceded the move. The media claimed that “value” investors were buying hand over fist because both stocks and bonds had reached bargain levels. That’s absurd given that we are still at relative market highs, so the move was more likely precipitated by central bank intervention meant to arrest the broad-based and near-panic selling that was underway Tuesday morning. That’s speculation on my part, but it’s the only explanation that fits, and it helps explain why the bullish tone persisted without deviation into the close on Friday. Net of these events, German debt still posted a loss for the week, U.S. stocks managed a small gain (except for the transports), while the dollar fell and the precious metals rallied as gold breached its 200-day moving average (see the scores).

As for the economic data, there has been nothing to write home about, or at least nothing to support the notion of a second-half recovery. Weaker data prompted China’s central bank to cut its key lending and deposit rates – again. The People’s Bank of China has cut rates three times over the last six months, to no avail economically thus far. Eurozone first-quarter GDP saw an uptick of 0.4%. That was completely ignored by traders, as the gain was largely attributed to the 11.4% decline in the euro over the same period. Parenthetically, Draghi has been defending, in what seems a daily routine these days, the supposed veracity of ECB QE policies. Here at home, retail sales and industrial production disappointed in April. Sales were flat against 0.2% expected, while production fell 0.3%.

As for the economic data, there has been nothing to write home about, or at least nothing to support the notion of a second-half recovery. Weaker data prompted China’s central bank to cut its key lending and deposit rates – again. The People’s Bank of China has cut rates three times over the last six months, to no avail economically thus far. Eurozone first-quarter GDP saw an uptick of 0.4%. That was completely ignored by traders, as the gain was largely attributed to the 11.4% decline in the euro over the same period. Parenthetically, Draghi has been defending, in what seems a daily routine these days, the supposed veracity of ECB QE policies. Here at home, retail sales and industrial production disappointed in April. Sales were flat against 0.2% expected, while production fell 0.3%.

In any case, I believe we witnessed a bit of irony this week as central banks may have attempted to rescue themselves from their own actions – at the top of a cycle, no less. They are slowly realizing that money printing is having little or no positive effect on economic activity – quite the opposite as they attempt to manipulate long term rates lower. Simply put, the banks are trapped. In such an environment, QE is likely to produce more counterproductive results (inducing higher rates rather than lower). This is a dynamic that could resume again as early as next week as the ECB continues to pour €60.0 billion per month into markets. The metals have reacted consistently with this situation; they coincidentally also spiked higher mid-morning on Tuesday. When tallied year-to-date, gold is up 3.3%, silver 11.45%, and the miners approximately 12.0%.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP