Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Surprise Brexit Roils the Markets

Well, this week’s market action certainly wasn’t dull. When the “Brexit” news hit the tape in overnight markets Thursday, stocks began to tumble as it became clear that the “leaves” had gained the upper hand. What surprised me was that, despite all the fear mongering about Britain’s future, Swiss and U.K. indices finished the week in the black – unlike the rest of the world, which fell severely. So if we can treat the market as a voting machine (which it is), this Brexit deal received thumbs up from investors all over the world – notwithstanding media and EU noises to the contrary. Personally, I believe Britain will be better off making its own rules, including those pertaining to immigration. Its departure may also inspire the EU to finally make some unpopular but necessary changes (both social and economic) if it intends to keep other countries from following suit.

Keep in mind, though, that, whatever changes might take place, there’s not much the EU, the US, or any other country can do to escape the consequences of more than two decades of irresponsible central bank decision-making. I say this because the history books may blame Britain for whatever bad happens from here, which would be unfortunate. Britain may have been the trigger for the market action we saw today, but it’s certainly not the underlying cause.

Keep in mind, though, that, whatever changes might take place, there’s not much the EU, the US, or any other country can do to escape the consequences of more than two decades of irresponsible central bank decision-making. I say this because the history books may blame Britain for whatever bad happens from here, which would be unfortunate. Britain may have been the trigger for the market action we saw today, but it’s certainly not the underlying cause.

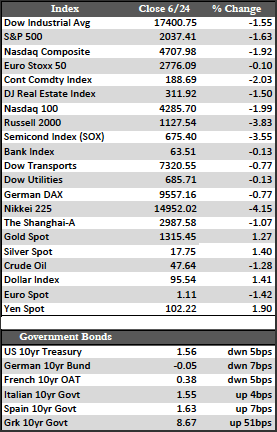

Away from stocks, fixed income of the high-quality governmental type was seen racing higher, with yields plummeting. The US 10-year touched down at a record 1.4% intraday today, while the German 10-year closed at a record negative .049%. The dollar rose against most other paper except the yen, but that didn’t hold the metals back. They erased pre-Brexit losses to finish the week with gains of 1.2% for gold and 1.4% for silver. Gold ended the week around $1,315, which is right on top of its intraday high set on June 16th. I would have liked to see it close above that high to gain a little more momentum, but perhaps it will do so next week as we hear more from corporate America.

Understandably, earnings news took a backseat to the events surrounding Brexit this week. However, given the fact that the market didn’t treat companies that reported or pre-announced this week very nicely, I would imagine that bad news might actually be treated as bad news this quarter. Homebuilder Lennar and car retailer CarMax both won at beat the number in late first quarter reporting only to see their shares fall by more than 4%. Adobe Inc., which has been one of the great success stories in cloud computing, saw its shares discounted by nearly 5% on a sales forecast miss for Q2. This was all pre-Brexit market activity, which makes me believe there is a good chance for more of the same as the second quarter unfolds.

Best Regards,

David Burgess

VP Investment Management

MWM LLC