Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Test of the August Lows

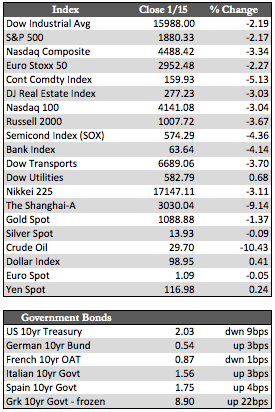

It may not be worth reprising the week’s volatility in stocks on a play-by-play basis. That would likely just confuse matters. But the important take-away is that even after dovish talk by several Fed speakers and a few interventions from the PBoC in its markets, stocks still headed south with purpose – ultimately settling around the lows set in August. Of course it was from these earlier levels that the market began a fairly sizeable rally. I suppose the question now facing speculators is whether stocks will bounce off these levels as they did before or continue to unwind from here. Given the damage that levered operators must be suffering in this decline (especially in energy) and a weak start to fourth-quarter earnings, I am doubtful that any meaningful rally will occur until we see some sort of capitulation. In the meantime, the bullish crowd’s complacency amazes me after a more than 2,000-point drop in the Dow. Margin debt among unfazed retail investors remains close to an all-time high of $472 billion, and “buy on the dips” now appears to be the common refrain.

In short, investors seem more worried about missing out on a rally than being in the middle of a full-blown crisis. After all, the reasoning must go, the Fed’s ability to rescue the markets is eternal and absolute. But that will change, as we have mentioned here many times before. The Fed’s ability to positively affect the markets evaporated when significant foreign creditor support disappeared in the middle of 2013. The markets have essentially been running on fumes since then – fumes and a great deal of corporate debt. In any case, when the gravity of the situation finally becomes apparent, defensive assets such as the metals will see much stronger upside. First, though, I believe that real fear will need to enter into the equation for stocks – which I believe we will see in the weeks if not days ahead.

In short, investors seem more worried about missing out on a rally than being in the middle of a full-blown crisis. After all, the reasoning must go, the Fed’s ability to rescue the markets is eternal and absolute. But that will change, as we have mentioned here many times before. The Fed’s ability to positively affect the markets evaporated when significant foreign creditor support disappeared in the middle of 2013. The markets have essentially been running on fumes since then – fumes and a great deal of corporate debt. In any case, when the gravity of the situation finally becomes apparent, defensive assets such as the metals will see much stronger upside. First, though, I believe that real fear will need to enter into the equation for stocks – which I believe we will see in the weeks if not days ahead.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP