Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Another Central Bank in Retreat?

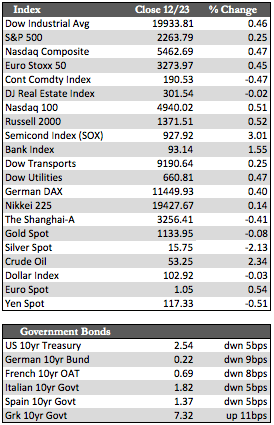

On Monday Janet Yellen told students at the University of Baltimore that they were “entering the strongest job market in nearly a decade.” Economic gains, she claimed, had finally raised living standards after years of a slow recovery. Stocks believed her whether the students did or not, but even combined with the post-election tailwind her lofty rhetoric was not enough to push the Dow above the 20,000 mark. Stocks were held to small gains by the close on Friday, as traders seemed to be eager to lock in profits ahead of the low-volume trade that is the holiday norm. We may see stocks drift a little higher as funds square their positions into year-end. For the most part, though, I think it’s reasonable to say that we’ve seen most of what this rally has to offer. The increase in long-term rates is having a significantly negative impact in such areas as autos, homes, and retail as we transition into 2017.

Away from stocks, fixed income markets stabilized (though in the case of bonds I use this term loosely). So did the dollar and the metals, though silver lost a little over 2% on the week – perhaps in response to tightening biases at the Fed or, more likely, the Trump Administration’s 10% import tax proposal (which also hurt retail and Chinese stocks). Large cap mining shares posted gains of 1.67% in a sign that the bottom in the metals may have been reached. That said, I’d like to see gold hold near or above $1,100 in tandem with a resurgence of dovish speculation before going long on that idea.

Away from stocks, fixed income markets stabilized (though in the case of bonds I use this term loosely). So did the dollar and the metals, though silver lost a little over 2% on the week – perhaps in response to tightening biases at the Fed or, more likely, the Trump Administration’s 10% import tax proposal (which also hurt retail and Chinese stocks). Large cap mining shares posted gains of 1.67% in a sign that the bottom in the metals may have been reached. That said, I’d like to see gold hold near or above $1,100 in tandem with a resurgence of dovish speculation before going long on that idea.

On the separate but familiar topic of central bank policy reversals, the Swedish central bank on Wednesday said that the effectiveness of its easing program has reached the “end of the line.” Other central banks (such as the ECB and the BoJ) made similar indications. It’s hard to overestimate the importance of this development. You can read the details on Bloomberg, and I would strongly encourage you to do so. When the economy controllers effectively concede that their primary control tool no longer works, wiser heads pay attention. It’s a development crucial to the markets, and why one needs to be positioned defensively – regardless of new Trump policies or populist advances. It suggests the nullification of trillions worth of stimulus, as well as the central bank “backstop” or “put” used in the past to insulate the markets from a full-blown deleveraging crisis.

That is some heavy news with which to lead into such a meaningful holiday weekend. Given that we celebrate the coming of the Supreme Truth Teller, however, who Himself insured that the bad news was understood before the good news could be meaningfully conveyed, I’m not sure I could do otherwise at such a critical time as this. So my follow-up to the somber reflections above is simply this: May His peace be yours, and may you enjoy a very meaningful and merry Christmas and a happy New Year.

Best Regards,

David Burgess

VP Investment Management

MWM LLC

P.S. We will not be issuing a recap next week, so please look for these communiqués to resume in January.