Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Apple Worm Hole

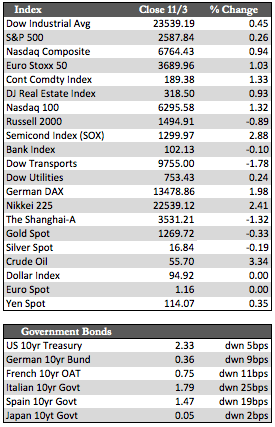

Stocks continued their speculative feeding fest this week as most of the major averages touched on new highs (ex the transports and small caps) on slightly above-average volume. Even in that light, it feels like stocks have begun to struggle. Perhaps that’s because prices have gone so far as to discount all possible bullish arguments or perhaps it’s because the bullish arguments have begun to lose their luster – or perhaps both.

Meanwhile, Powell was appointed the new Fed Chairman, the Fed kept rates unchanged and gave an upgrade (in language only) to the economy, the House released a preliminary tax proposal, and Apple reported “blockbuster” earnings. As I’ve said elsewhere, the market expected all these developments and may now be more interested in whether the reality behind the headlines is enough to support record equity valuations.

Powell will follow Janet Yellen’s lead and continue the Fed’s current course of “gradual” rate increases. The Fed changed its outlook on the economy by replacing the word “moderate” with “solid,” but failed to upgrade inflation forecasts commensurately. The House released a new tax reform plan that supposedly gives relief to the middle class, but aside from a favorable tax bracket shift and a boost in standard/child deductions, Congress did its best to negate any benefit by recouping lost revenues with adjustments to itemized deductions (e.g., medical, property, and business expenses; state and local taxes). And last, but not least, Apple flew high after reporting a record quarter, but failed to inform investors that there’s a record $4.8 billion (up from $1.13 billion a year ago) in unsold product sitting on the shelves, despite the usual hype about the crowds waiting outside Apple stores.

Powell will follow Janet Yellen’s lead and continue the Fed’s current course of “gradual” rate increases. The Fed changed its outlook on the economy by replacing the word “moderate” with “solid,” but failed to upgrade inflation forecasts commensurately. The House released a new tax reform plan that supposedly gives relief to the middle class, but aside from a favorable tax bracket shift and a boost in standard/child deductions, Congress did its best to negate any benefit by recouping lost revenues with adjustments to itemized deductions (e.g., medical, property, and business expenses; state and local taxes). And last, but not least, Apple flew high after reporting a record quarter, but failed to inform investors that there’s a record $4.8 billion (up from $1.13 billion a year ago) in unsold product sitting on the shelves, despite the usual hype about the crowds waiting outside Apple stores.

Away from stocks, Treasuries were much firmer – for no apparent reason other than that both the ECB and the Fed said nothing Hawkish in their latest communiqués. Oil jumped above 55.0 while the metals held ground in the presence of a stronger US dollar. The dollar started the year at 102.17 and fell as low as 91.0 by mid-September. We are now comfortably above 94.0 and could go as high as 97.0 before this rally concludes. However, if the market concerns itself with what have become rather obvious holes in the bullish case, it’s possible the metals will find support regardless of more technical dollar strength. $1,260 will mark the next battleground for gold, and I remain somewhat optimistic that gold will finish the year well.

Best Regards,

David Burgess

VP Investment Management

MWM LLC