Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bad News Was Actually Bad News – Almost

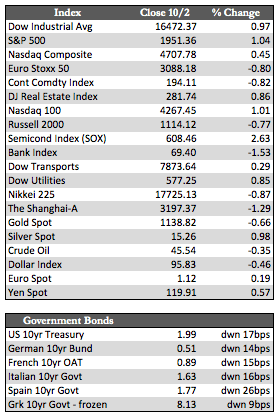

A series of Fed speaking engagements, quarter-end performance gaming, and surprisingly weak U.S. employment numbers gave the monetary doves and stock bulls a respite from recent bearish sentiment. Though Fed officials said nothing about monetary policy, their presence at the podium and the bad news proved just the right ingredients for the “melt up” rally in stocks into the close Friday. Dow stocks erased an earlier 259-point decline (after non-farm payrolls registered 142,000) to finish an impressive 200 points in the black by day’s end. The upside volume Friday was still a bit below average, which suggests that the rally may fade, as it did after the dovish hype preceding the last FOMC meeting on Sept 17th. For the moment, though, it seems as if stocks may have a tailwind that could last – well, at least through Monday.

But as we head into October, stock bulls will be faced with an earnings season (starting with Alcoa at the close next Thursday) that is sure to fall short of expectations. As we said in an earlier recap, street estimates have been calling for a sharp 16% rebound in Q3 earnings for all S&P 500 companies. However, as reality has settled in, the street began this past week to slash those estimates to fall in line with more realistic expectations of a 5.0% decline in earnings and a 3.4% decline in revenues. As long as the Fed and other central banks drag their heels on money printing – as even the BoJ is expected to do next week – negative adjustments to stock prices are probable.

But as we head into October, stock bulls will be faced with an earnings season (starting with Alcoa at the close next Thursday) that is sure to fall short of expectations. As we said in an earlier recap, street estimates have been calling for a sharp 16% rebound in Q3 earnings for all S&P 500 companies. However, as reality has settled in, the street began this past week to slash those estimates to fall in line with more realistic expectations of a 5.0% decline in earnings and a 3.4% decline in revenues. As long as the Fed and other central banks drag their heels on money printing – as even the BoJ is expected to do next week – negative adjustments to stock prices are probable.

Away from stocks, Treasuries rallied as traders pushed back the likelihood of a Fed rate hike into March 2016, the dollar fell, and both the metals and the miners gained steadily into the close Friday. I don’t necessarily have a precise road map for the metals from here, but I suspect that with the shock that the August and September jobs reports gave the market, the bloom may now officially be off the economy’s rose. If so, we should begin to see traders hedge and/or unwind their extensive US dollar positions – which should provide some marginal benefit to the metals.

Next week we’ll hear from another lineup of Fed speakers, ending with Evans at 1:30 on Friday, along with a host of central bankers that will speak on monetary policy – including notables from the BoE, the ECB, and the BoJ. It could be a volatile week, depending on what is said. But this will be the last we will hear from the banks until the bulk of earnings season has passed.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP