Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Banks Do What They Do Best – Regardless Of The Risks

These past few weeks the markets have had quite of bit of news to digest, so I’m going to get right to it. Last Friday, we had the September non-farm payroll report come in at 156,000, which was just short of the expected 172,000. The revisions to August showed an increase of about 16,000 jobs to 167,000.

The OPEC production cuts we saw a few weeks ago weren’t really cuts per se, they were really reductions to the increases (to record levels) seen this year. On that news, oil still rallied 11% to just over $50/bbl.

The FOMC minutes and several Fed speakers (including Janet Yellen today) gave no clues to speculators as to the near-term future of interest rates.

Alcoa’s shares fell 16% on both a sales and profit miss for its 3rd quarter, while CSX (railroad), JP Morgan, Wells Fargo, and Citigroup all managed to win at “beat the number.” Even so, shares of each essentially moved sideways as this quarter’s double digit loan growth is expected to recede into year-end.

Last but not least, US retail sales rebounded from a mild drop in August to add 0.6% in September. Gains were driven by large-ticket items such as cars, trucks, and furniture.

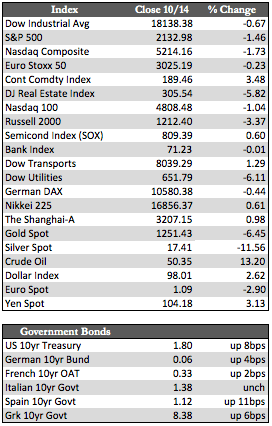

Stocks were still mixed, with overseas markets up about a percent and US markets down about the same. Fixed income, however, was decisively lower (or yields higher – yet again) on a global basis, and has in many cases (i.e., the U.S.) broken into bearish territory. Though sovereign debt in China and South Africa were seen moving higher, the economic weakness has been more pronounced (Chinese exports fell 5.6% in September, and African manufacturing -0.1% and gold production -8.2% in August).

Away from stocks and bonds, the US Dollar was quite firm, thanks to Fed rate hike speculation and Brexit concerns weighing in on the British pound. Dollar strength also had the effect of furthering the consolidation in the metals, as gold lost 0.44% to silver’s 0.72% – though gold has displayed some near-term support just below $1,250.

Next week there will be more to talk about on the topic of earnings. Analysts at Goldman Sachs have already ratcheted down their third-quarter estimates by about 2%, and I suspect their reduction applies mainly to less interest rate-sensitive areas (such as the tech sector). For just how the market intends to react to these lowered expectations, if in fact they are true, I guess we will just have to wait and see. But with long-term rates rising, the Fed neither lowering rates nor printing, and QE not working so well overseas – pressure is building. For that reason, I would not rule out an October dislocation in stocks. It is, in my opinion, already long overdue.

Best Regards,

David Burgess

VP Investment Management

MWM LLC