Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bonds Balk

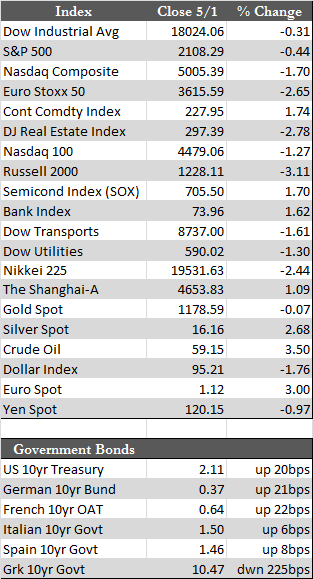

U.S. and overseas markets began to show some signs of exhaustion this week, for no apparent reason. In what was close to being called a rout, European bonds gave up valuable technical ground, aided by the German 10-year Bund, which tacked on nearly 22 basis points to 0.37%. This didn’t impact European stocks initially, but by mid-week the indexes began to sag – except the Greek and Portuguese averages, which finished in the black. All of this, combined with some rather lackluster results from the likes of Apple (on Monday), a few of its suppliers, and LinkedIn (on Thursday), gave U.S. stocks and bonds the jitters for most of the week. Stocks recouped some of their losses on Friday in a rally precipitated by start-of-the-month excitement and front-running the usual Monday rally. Treasuries, however, remained under pressure – as did their foreign counterparts (see the box scores) – through Friday, which could suggest that the selling may extend into next week.

The fact that long-term bonds were hammered this week while most central banks across the globe are in the act of easing definitely raises doubts as to whether banks have markets under control. If rates continue to trek higher, in effect removing the punch bowl from leveraged operators, dreams of a second-half recovery for stock bulls may not come true. And by the by, rising long-term rates are not always a function of an improving economy, as so many have asserted. In this day and age, they are more commonly a function of increased credit risk (e.g., Greece) – gold bears beware.

The fact that long-term bonds were hammered this week while most central banks across the globe are in the act of easing definitely raises doubts as to whether banks have markets under control. If rates continue to trek higher, in effect removing the punch bowl from leveraged operators, dreams of a second-half recovery for stock bulls may not come true. And by the by, rising long-term rates are not always a function of an improving economy, as so many have asserted. In this day and age, they are more commonly a function of increased credit risk (e.g., Greece) – gold bears beware.

But for now, expectations of a second-half recovery rule the roost. This is evidenced by the fact that nobody cared about the less-than-expected 0.2% increase in 1st quarter GDP or the multiple disappointments among the economic releases. Instead, traders and the Fed are at present fixated on the occasional upbeat indicator, as was the case with the plunge in jobless claims to a 15-year low. Gold tumbled on that news. For what it’s worth, I do not believe the dip was justified given the dubious manner in which those numbers can be derived – but it is what it is. The economic data for April to date does not support the notion of a turnaround – at least not one that would offset the losses from the first quarter. Perhaps the gold price, which rebounded nicely off its lows Friday, has already come to that conclusion.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP