Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Broken Window Economics

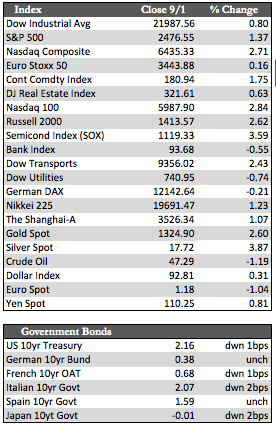

Stocks were higher this week, both here and abroad, with most of the major indices sporting gains of about a percent. They were led by the tech-heavy NASDAQ, which tacked on a little more than 2.5%. A decisively more bearish trend is in effect overseas, but the week’s gains were enough to push US indices to within striking distance of peak levels for the Dow and S&P, and set a new record high for the NASDAQ. The best explanation seems to be that stock bulls, or short sellers in this case, simply wanted to clear their hedges and/or bearish positions ahead of what may be a marginal uptick in economic data as Houston rebuilds after the effects of Hurricane Harvey. Of course, anyone familiar with what’s commonly referred to as the “Broken Window Fallacy” will understand that the net effect of such disastrous events is negative because the cost of repairs is a hindrance to real progress. In any case, damages now total an estimated $30 billion in Houston. Trump, having put in $1 million of his personal funds, has also requested $5.95 billion in initial aid from Congress. What’s of concern is that the government doesn’t have the money, and may have to wrap it into the debt-ceiling vote later this month.

Economic releases were, for the most part, ignored – again. Still, I believe that any negative information may have fueled the bullish flames in stocks, prompting expectations of a more dovish Fed somewhere down the pike. The jobs numbers were perhaps the most important factor in that regard, as non-farm payrolls registered a rather unimpressive 156,000 for the month of August. The unemployment rate also saw an uptick of 0.1 to 4.4, while the labor participation rate remained steady at 62.9. Among the other top-tier economic data, pending home sales and construction spending slipped 0.8% and 0.6%, respectively, for the month of July. Aside from this, we saw a healthy but expected uptick in PMI/ISM manufacturing opinion polls (think Harvey), and second-quarter GDP growth of 0.3% to 3.0%. Inflation data (PCE and ISM Prices Paid) once again showed benign results for July and August.

Economic releases were, for the most part, ignored – again. Still, I believe that any negative information may have fueled the bullish flames in stocks, prompting expectations of a more dovish Fed somewhere down the pike. The jobs numbers were perhaps the most important factor in that regard, as non-farm payrolls registered a rather unimpressive 156,000 for the month of August. The unemployment rate also saw an uptick of 0.1 to 4.4, while the labor participation rate remained steady at 62.9. Among the other top-tier economic data, pending home sales and construction spending slipped 0.8% and 0.6%, respectively, for the month of July. Aside from this, we saw a healthy but expected uptick in PMI/ISM manufacturing opinion polls (think Harvey), and second-quarter GDP growth of 0.3% to 3.0%. Inflation data (PCE and ISM Prices Paid) once again showed benign results for July and August.

In other markets, Treasuries and EGBs were flat or slightly down against the rally in stocks, crude oil was off about 1.0%, and gasoline held onto a gain of 4.6% after a volatile week. As for the dollar, it managed a slight gain by week’s end, but this didn’t seem to impact the metals in a negative way. Gold added 2.6% and silver 3.87%. Short-term, I would not be surprised to see a pullback in the metals given the recent advance, but from a fundamental and relative strength perspective, the metals have yet to reach an overbought condition. Therefore, gold at $1,350 should be a reasonable goal by the time the Fed meets Sept 20th. Next week we have durable goods orders, the Fed Beige book, and several Fed speakers that may provide some insights on the topic of balance sheet normalization.

Best Regards,

David Burgess

VP Investment Management

MWM LLC