Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bulls Sanguine Despite Disconnect in Fundamentals

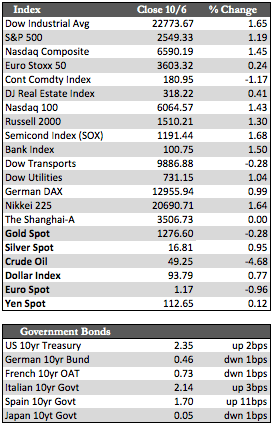

Following the end/start-of-month ramp job, stocks both here and abroad set a few new records on some post-storm economic data and a US House-approved tax package. Auto sales jumped to the highest on record (or at least since the ’80s) as insurance companies started cutting checks to cover hurricane damages. Auto sales increased a cool 15.2% to an 18.47 million annualized rate, which helped GM shares increase 20.5% since the beginning of September. As for taxes, the US House passed a bill that will supposedly cut $5 trillion from the budget over the next 10 years and impose a greater share of the tax-burden on the rich. Of course, it’s not logical to cut $5 trillion from a budget that is currently $4 trillion in size, so these are budget cuts that assume growth in the economy. In any case, stocks finished the week on a high note, led oddly enough by more defensive/value areas like consumer staples, which have gained over 4.0% to the broader market’s 1.07%.

That situation didn’t help Treasuries or sovereign debt overseas. Instead, the auto sales and the US manufacturing PMI (60.8 in September from 58.8 in August) had traders worrying about a Fed rate hike in one of the upcoming FOMC meetings scheduled for November 1st and December 13th. The 30-year Treasury finished the week at a yield of 2.90%, and has clearly broken out and away from a downward trend that began in mid-March of this year. EGBs were relatively unchanged for the week, though the Catalonian revolt had Spanish debt and shares of its banks trading lower amid some heavy volume. Aside from this, I thought the lackluster jobs data (-33,000 non-farm payrolls) was a total nonevent for the market. Jobs are expected to rebound next month as Texas, Florida, and others rebuild.

That situation didn’t help Treasuries or sovereign debt overseas. Instead, the auto sales and the US manufacturing PMI (60.8 in September from 58.8 in August) had traders worrying about a Fed rate hike in one of the upcoming FOMC meetings scheduled for November 1st and December 13th. The 30-year Treasury finished the week at a yield of 2.90%, and has clearly broken out and away from a downward trend that began in mid-March of this year. EGBs were relatively unchanged for the week, though the Catalonian revolt had Spanish debt and shares of its banks trading lower amid some heavy volume. Aside from this, I thought the lackluster jobs data (-33,000 non-farm payrolls) was a total nonevent for the market. Jobs are expected to rebound next month as Texas, Florida, and others rebuild.

The bigger question is whether or not stock bulls can keep up the “everything is bullish” charade. Valuations are stretched, with the Case Shiller cyclically adjusted P/E at a record 30.97. Volatility as measured by the VIX hit an all-time closing low of 9.19 on Thursday, while short interest remains subdued – at least against the major indexes. In sum, the market seems to be overly complacent at a time when fundamentals haven’t kept pace with stock prices. Parenthetically, I am still skeptical about the contention that a tax cut won’t increase the deficit, the debt ceiling, and subsequently interest rates. Anyway, the metals did not enter a freefall, even as both gold and silver dipped below their moving averages. Once again, threats from North Korea helped to buoy prices. Further, given the aforementioned, I would expect gold to thrive as a hedge. $1,250 and $1,271 may be retested before moving higher on that basis.

Best Regards,

David Burgess

VP Investment Management

MWM LLC