Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Central Bank Woes Become More Prevalent

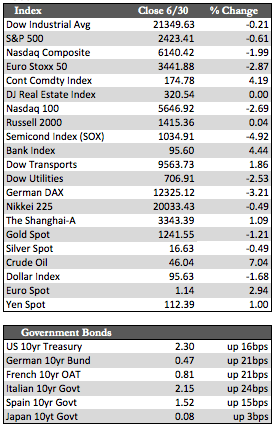

For the week, US investors continued to rotate away from “overvalued” tech into more defensive names. The NASDAQ 100 shed around 2.0% compared to the Dow and S&P, which closed out the week relatively unchanged. Overseas stocks fared worse across the board, ex markets in Shanghai (+1.0%), with most indices finishing anywhere between 1.0 and 2.0% lower. Yields on Treasuries, EGBs, and the majority of Asian debt gapped significantly higher, while the US dollar continued to slide (for the sixth straight month) against the euro. Bottom fishers pushed the price of crude oil to just over $46/bbl from roughly $42/bbl, while those frustrated with gold’s performance over the last few months were seen selling and testing the limits of the $1,237/oz technical support level.

Central Bank officials seemed responsible for the volatility due to remarks made Monday night. ECB President Mario Draghi made it clear that deflationary forces were now being “replaced” by inflationary ones. In other words, the ECB can’t print money recklessly the way they used to (my take). After seeing the damage that comment did to markets, especially government bonds, Draghi attempted to soften the blow by assuring speculators that the ECB’s current QE program would not end any time soon. The effort had little effect, as both stocks and bonds across Europe resumed their decline just a few days later.

Central Bank officials seemed responsible for the volatility due to remarks made Monday night. ECB President Mario Draghi made it clear that deflationary forces were now being “replaced” by inflationary ones. In other words, the ECB can’t print money recklessly the way they used to (my take). After seeing the damage that comment did to markets, especially government bonds, Draghi attempted to soften the blow by assuring speculators that the ECB’s current QE program would not end any time soon. The effort had little effect, as both stocks and bonds across Europe resumed their decline just a few days later.

Regular readers of this recap know that we’ve discussed at length the ongoing efficacy of QE both here and abroad. Large amounts of liquidity, totaling near $1.8 trillion globally, has had trouble being absorbed by the financial markets. Said a different way, the inflationary impact of incremental QE on the economy now exceeds the resultant “growth.” China, I believe, has already come to that realization. Markets there have undergone a sizeable bout of deleveraging. All we can say about Europe at this point is that they seem to be headed in the same direction. We’ll just have to wait and see how their markets react in coming days and weeks.

I won’t spend much time here rehashing the economic data released this week, as it was virtually ignored by the markets. I will say that first quarter GDP growth of 1.4% was rather anemic, as were the associated inflation gauges (PCE was -0.1%). Also, pending home sales fell for an uncharacteristic third straight month – off 0.8% in May, 1.7% in April, and 0.89% in March. Over the last couple of recaps, I’ve made mention of the more meaningful economic data, only to demonstrate the fact that the economy is not growing “organically” – despite the usual hype. Ergo, it’s all up to the Fed and/or Trump reforms to hold things together. There’s little reason for faith in the Fed given the above analysis, so one can only hope that President Trump finds a way to postpone the inevitable.

Best Regards,

David Burgess

VP Investment Management

MWM LLC