Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

China Contagion Spreads Among Those Susceptible

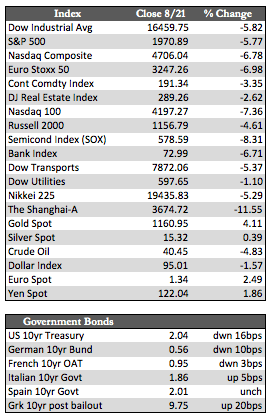

Equity markets worldwide were sharply lower this week because of China’s financial market troubles and/or related economic ills. Most stock indexes in Asia, Europe, the U.S., and emerging markets are now trading at or well below their 200-day moving averages. In the U.S. the most important index in this category is the S&P 500. Its 200-day has been defended repeatedly over the last few months, but finally succumbed on Wednesday when the Fed minutes failed to strike a sufficiently dovish tone. I suspect that equity markets are now going to face the question that has bedeviled China for the past few months: What do you do when your markets begin to unwind trillions’ worth of levered trades? So far China has not been able to control this aspect of its financial markets. I suspect that the Fed will fare no better when its time comes, presumably after US stocks take a 10% or more nosedive.

Aside from stocks, Treasuries received the usual “flight to quality” bid this week as the 30-year Treasury yield fell 9 basis points to 2.75% (down from its high of 3.25% in early July). Similar maturities in mortgages (bankrate @ 3.87%) failed to catch the wave in Treasuries, and have essentially moved sideways for nearly three weeks now. Much worse could be said of high-yield markets, where credit spreads have jumped from 252.0 at the beginning of this year to 312.0 today (led by energy). I would expect this divergence between riskier fixed income instruments and Treasuries to continue, though at some point Treasuries will fall under greater scrutiny given our government’s $18.5 trillion in debt (or 120% of GDP). For now, though, they appear to be attracting capital on the basis of presumed safety.

Aside from stocks, Treasuries received the usual “flight to quality” bid this week as the 30-year Treasury yield fell 9 basis points to 2.75% (down from its high of 3.25% in early July). Similar maturities in mortgages (bankrate @ 3.87%) failed to catch the wave in Treasuries, and have essentially moved sideways for nearly three weeks now. Much worse could be said of high-yield markets, where credit spreads have jumped from 252.0 at the beginning of this year to 312.0 today (led by energy). I would expect this divergence between riskier fixed income instruments and Treasuries to continue, though at some point Treasuries will fall under greater scrutiny given our government’s $18.5 trillion in debt (or 120% of GDP). For now, though, they appear to be attracting capital on the basis of presumed safety.

Gold tacked on some impressive gains this week. Now at $1,157 and change, the price has rebounded nearly 85.0 points from the Asian-induced selling spree levels we saw in mid-July. Although I wouldn’t be surprised to see additional countries sell gold on the basis of dire financial need, as Venezuela announced only a few days ago, I’m confident that the benefit gold receives from a stock market unwind will overwhelm these selected sellers as we go. That said, $1,150 seemed an easy hurdle for gold this week, so I suppose gold bulls now have their sights set on $1,200 to $1,225 as the next milestone or resistance area before some meaningful momentum can be built. Next week, quite a bit of housing data will be released. The housing sector has been unusually strong of late because folks are concerned about mortgage rates gaining speed to the upside in the near future. At any rate, strong data is not what the bulls are looking for. After a relief rally or two, stocks may see more selling pressure in the week ahead.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP