Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Clouding the Issue

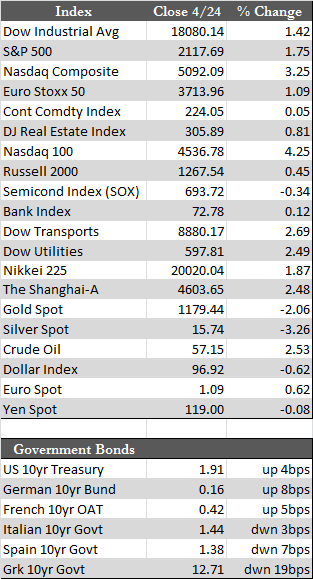

Just over 40% of the firms in the S&P 500 have now reported earnings for the first quarter of this year. The tally thus far has about 72% of those companies beating estimates on earnings and 47% on revenues. That puts results for earnings in line with the five-year average, which would suggest that all is well. But when it comes to exceeding revenue estimates, results so far have clearly fallen short of the five-year average of 58%. The estimates bar was already set low for companies in the energy and technology sectors, along with some industrials, by a wave of negative preannouncements that set a record (since ’09) just before results were released. It’s therefore fair to say that the overall picture is actually worse than it appears. In this market, though, spin and perception rule the roost (for the moment). Both create the belief in a second-half recovery and the extrapolation of cloud computing growth into infinity – which is unlikely since it’s a consolidative and not an expansive move for the sector. Familiar names such as Microsoft, IBM, Google, Facebook, AT&T, and Amazon have been leading the tape higher (we’re certain that short covering and low-volume trade helped), though profits and/or revenues for each are trending in the wrong direction. These latter developments are attributable to the undisclosed increase in competition and the lethargic U.S. consumer.

On that subject, the economic data both here and abroad continues to disappoint as we head into warmer weather, and may be worsening despite the massive worldwide QE efforts now ongoing. Here in the U.S., Bloomberg’s economic surprise index has fallen to levels not seen since the ’08 crisis, while retail stocks with the exception of Amazon have been declining against the market, possibly forecasting rough sailing ahead. This possibility was further suggested by the release this week of lower than expected PMI (manufacturing) data for Europe, Asia, and the U.S. for April.

On that subject, the economic data both here and abroad continues to disappoint as we head into warmer weather, and may be worsening despite the massive worldwide QE efforts now ongoing. Here in the U.S., Bloomberg’s economic surprise index has fallen to levels not seen since the ’08 crisis, while retail stocks with the exception of Amazon have been declining against the market, possibly forecasting rough sailing ahead. This possibility was further suggested by the release this week of lower than expected PMI (manufacturing) data for Europe, Asia, and the U.S. for April.

Away from stocks, Treasuries rallied and the dollar fell in response to higher than expected jobless claims (295,000) for the week ending Thursday. Gold broke below $1,185 once again as stock indexes moved nearer to breakout territory on the charts – though gold began rallying into the close on Friday, perhaps in anticipation of more uncertainty beyond the IMF’s May 6th payment deadline for Greece. Month-end gaming and an FOMC meeting are on the docket for next week. In that setting we’re likely to see stocks extend their gains and the metals range-bound. I don’t expect the Fed decision makers to do anything different in this next meeting, but in case they do back-peddle on rates, which is their next most probable move, it will be interesting to see if stocks are able to gain further momentum to the upside in response. Without actual QE, I am increasingly skeptical that they can do so.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP