Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Damage Control

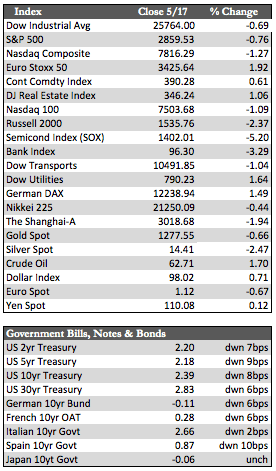

The Trump administration made little progress on tradewith the Chinese this week, but made up for it by removing aluminum and steel tariffs on Mexico and Canada, and by postponing auto tariffs on Europe for at least six months. Those acts of goodwill, in addition to an options expiry on Thursday, prevented an otherwise weak stock market from getting any worse. Stocks finished the week with minor losses, trade war nerves were calmed, and traders began to focus on more bullish prospects, e.g., Fed rate cuts expected in 2019 and 2020. Defensive undertones remained, however, as strength in Treasuries and consumer staples outshone shares of banks and autos. Changes in New York laws favoring tenants (renters) and further weakness in global economies may have contributed to the latter.

Away from stocks, Treasuries held to gains amid a more consistent flight to safety, or “risk-off” global theme. The dollar rose after perceived progress on trade, while the metals fell (most likely on the prospect of weaker China demand) and oil added a few percentage points on an escalation of tensions with Iran. The economic data was mixed, though the underlying details suggest the U.S. has joined the global slowdown. In April, retail sales fell 0.2% (from +1.7% in March) and industrial production dipped 0.5% (from +0.2% in March). Housing starts rose 5.7%, while building permits added a meager 0.6%. Both housing stats remained within a technical downtrend on the charts. It may also be worth noting that industry discounts have helped move unwanted inventories lately.

Away from stocks, Treasuries held to gains amid a more consistent flight to safety, or “risk-off” global theme. The dollar rose after perceived progress on trade, while the metals fell (most likely on the prospect of weaker China demand) and oil added a few percentage points on an escalation of tensions with Iran. The economic data was mixed, though the underlying details suggest the U.S. has joined the global slowdown. In April, retail sales fell 0.2% (from +1.7% in March) and industrial production dipped 0.5% (from +0.2% in March). Housing starts rose 5.7%, while building permits added a meager 0.6%. Both housing stats remained within a technical downtrend on the charts. It may also be worth noting that industry discounts have helped move unwanted inventories lately.

Where we head from here may be tricky to gauge, as a trade deal of any kind with China could ignite stocks from what are regarded as relatively depressed levels – at least from the ultra-bull perspective. The press has not widely covered the possibility of Fed rate cuts this year, so any expectation of exhaustion in stock market speculation is probably not warranted. We could see stocks retesting resistance around Dow 26,800 before any real downside can manifest. That said, accelerating financial and economic woes overseas (i.e., Italy) have already proven to be a drag, both in terms of U.S. corporate earnings and investment flows. In any case, my theories about the metals were incorrect, as tariffs have had a greater impact than previously assumed, but I remain optimistic. A progressively more dovish Fed should begin to offset any setbacks caused by tariff woes with China.

Best Regards,

David Burgess

VP Investment Management

MWM LLC