Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Dow Record, but Not All is Up and Up

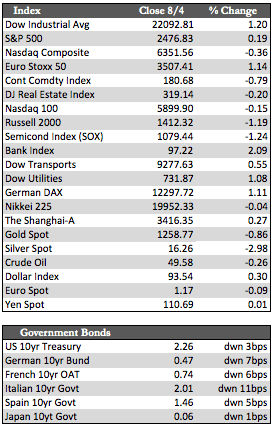

The Dow Industrials were able, with the help of a few key stocks (e.g., Apple) to breach the 22,000 level and set a new high. I believe this now marks the 32rd time the Dow has set a new record within the calendar year, which is something that happens only once every two decades or so. That said, however, the trading action away from the Dow may be telling us a different story as the S&P 500, NASDAQ, Transports, and several indices overseas are off their highs and struggling to regain some semblance of upside momentum. Further, several defensive areas of the market have been perking up as of late, which could imply that the post-election bull phase may be coming to a close. That’s near-term speculation on my part, but it is based on real observations. At any rate, it will be interesting to see if the action in stocks adopts a more conservative tone in the next handful of weeks or if Wall Street figures out a way to extend and pretend. Readers here know that beside what’s left of Trump’s well-intentioned policies, there really isn’t much the bulls can hang their hats on. Second quarter earnings thus far have shown greater buildup and emphasis for accounting purposes than economic profits – and I would include Apple’s numbers in that category even though the company’s shares were bid up after “beating expectations.”

On the economic front, most everything was ignored except for Friday’s near-perfect non-farm payroll report – I say this a bit tongue in cheek because these numbers rarely reflect reality. Non-farm payrolls registered 209,000 in July, which is a little better than the 180,000 jobs expected. The unemployment rate dropped a tenth to 4.3% as the participation rate ticked up a notch to 62.9 from 62.8. Hiring in lower wage industries like restaurants and home health services were responsible for much of the increase. The reaction to this news was mixed on Friday, as traders were cautious that the good news would bring about the possibility of another Fed rate hike later this year.

On the economic front, most everything was ignored except for Friday’s near-perfect non-farm payroll report – I say this a bit tongue in cheek because these numbers rarely reflect reality. Non-farm payrolls registered 209,000 in July, which is a little better than the 180,000 jobs expected. The unemployment rate dropped a tenth to 4.3% as the participation rate ticked up a notch to 62.9 from 62.8. Hiring in lower wage industries like restaurants and home health services were responsible for much of the increase. The reaction to this news was mixed on Friday, as traders were cautious that the good news would bring about the possibility of another Fed rate hike later this year.

On the week, Treasuries were a little stronger and the dollar was little weaker despite the jobs number. Crude oil backed off of last week’s rally a smidge, as did the metals – gold shed 0.85% to silver’s 2.95%. Aside from this, there were two other stories of interest. One, that Andy Hall, the oil tycoon, just announced he will be shutting down his oil-related hedge fund – which could suggest that oil has reached its nadir (as to that, I still have my doubts over the short run). Also, I thought it interesting that CNBC ran an article in which Alan Greenspan voiced concern over the US (and perhaps global) bond market(s). First, because he admitted that bonds are currently in a bubble, and second, that he deems that bubble ready to burst.

Best Regards,

David Burgess

VP Investment Management

MWM LLC