Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Draghi Delivers

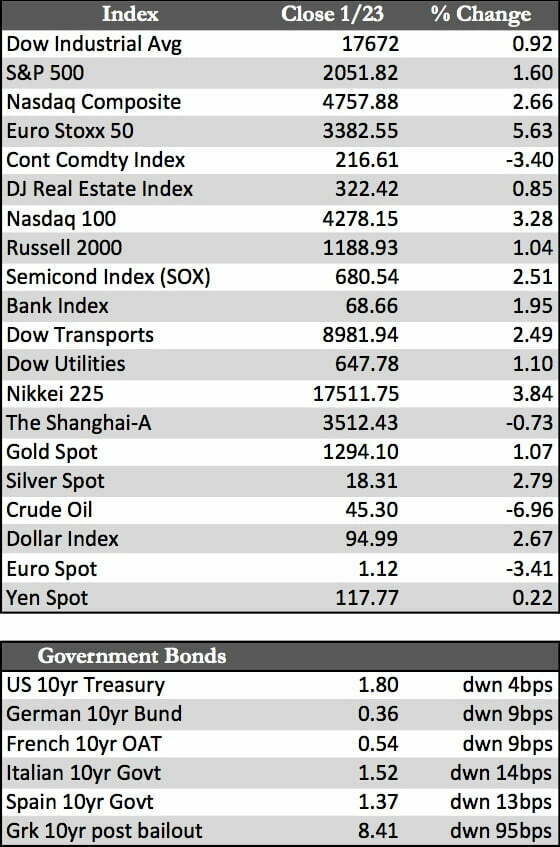

As the threat of “deflation” or credit risk increases globally, central banks are falling one by one to the temptations of easy money policy. This week, the ECB unveiled its plans to monetize €60 billion worth of eurozone debt a month through September 2016. The PBoC injected $8 billion into its bank money markets. Demark cut its key lending rate by 0.30% to -0.35%, while BoE members turned unanimous against future interest rate hikes. World markets took the news quite well as equities and bonds erupted higher – particularly in France and Germany where new highs were seen across the board. In other markets, the dollar jumped to a new high against the euro, Treasuries rose, with 30-year yields setting a new low of 2.37%, while the precious metals managed to break above critical resistance levels (200-day moving averages) for another week of solid gains.

Underneath that central bank malaise, U.S. 4th quarter corporate earnings releases are now in full swing and the results are a bit more mixed than usual. Most have won at “beat the number,” though that bar was set rather low to begin with. Weak sectors include the banks (JPM, BAC, and GS), deep cyclicals (CAT, UTX), tech, and energy. Strong sectors include consumer staples, utilities, transports and healthcare. This is not saying much, as the field can essentially be separated into the many that have leveraged their balance sheets to boost earnings and the few that have wisely chosen not to.

Underneath that central bank malaise, U.S. 4th quarter corporate earnings releases are now in full swing and the results are a bit more mixed than usual. Most have won at “beat the number,” though that bar was set rather low to begin with. Weak sectors include the banks (JPM, BAC, and GS), deep cyclicals (CAT, UTX), tech, and energy. Strong sectors include consumer staples, utilities, transports and healthcare. This is not saying much, as the field can essentially be separated into the many that have leveraged their balance sheets to boost earnings and the few that have wisely chosen not to.

That raises an important issue moving forward, as it will be interesting to see whether or not central banks are successful at manipulating rates to the benefit of their respective economies and subsequent corporate earnings. With short-term rates in several European countries having already turned negative, and longer-term rates, particularly in Germany and France, below 0.5% – how much more stimulation is possible? Easy money at this point may cause more inflation than growth, and at the same time derail badly needed structural reforms – as several European officials (mostly German) have aptly diagnosed. In any case, I do believe that these actions are indicators of things to come here in the States. Once the leveraged community runs out of ammo and credit risk extends beyond the energy sector, it will be difficult for the Fed to stand idle.

That said, I don’t think the precious metals require a reason to continue to move higher – whether the dollar is strong or not. Discounting future QE and/or volatility I believe is the motive at hand. Over the short run, a “sell the news” proposition may be in effect following what was a highly expected ECB announcement. A reversion back to the mid-1250s would therefore not be out of the question as investors have time to digest the effects of newly conceived ECB policies.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP