Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Draghi Throws Everything – Including the Kitchen Sink

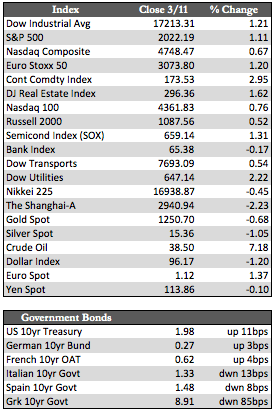

Global markets had much to digest this week. Mario Draghi unveiled another surprise boost to the ECB’s current stimulus program and China intervened with a record setting “fix” to its onshore currency (the Renminbi). The former development saw stocks and bonds sell off initially, perhaps on a “sell the news” proposition. However, after China responded to the ripple effect Draghi’s announcement had on currency markets, the losses in all markets quickly reversed. Stock markets closed out the week at or near interim highs, while bonds on average finished lower despite a bounce last night. The German Bund, Europe’s largest bond market, tacked another three basis points onto its 10-year yield. Now at 0.27%, it’s up from its low of 0.14% two weeks ago. I mention this because if easing were working as the ECB intended it would have the effect of “floating all boats.” That doesn’t appear to be happening, which strengthens the suggestion that rallies in stocks will be short-lived without the aid of cheaper credit.

Oddly enough, as the ECB added €20 billion to its now €80 billion bond buying efforts and lowered its deposit rate deeper into negative territory (to -0.4 from -0.3), the euro actually rose against the basket of currencies – including the US dollar, which underwent a fairly hefty decline (see the box scores). Draghi may have caused this to happen – he apparently gave the media the impression that no further QE would be in the pipeline – or it could have been another case of “sell the news.” Either way it shows that, at the very least, ECB news is close to being fully discounted.

Oddly enough, as the ECB added €20 billion to its now €80 billion bond buying efforts and lowered its deposit rate deeper into negative territory (to -0.4 from -0.3), the euro actually rose against the basket of currencies – including the US dollar, which underwent a fairly hefty decline (see the box scores). Draghi may have caused this to happen – he apparently gave the media the impression that no further QE would be in the pipeline – or it could have been another case of “sell the news.” Either way it shows that, at the very least, ECB news is close to being fully discounted.

Crude oil rose about 7% this week as the International Energy Agency said that prices may have bottomed for the “Texas tea.” The agency based this statement on the fact that non-OPEC high-cost producers have cut their production to what is assumed to be a more reasonable level. To put that into proper perspective, producers here have cut only 500,000 barrels from an increase in high-cost production that has totaled 4.5 million barrels a day since 2009. The reduced level still covers nearly two thirds of our daily usage – usage that OPEC can easily provide at less than half the cost. With that kind of production ongoing it’s doubtful that we’ve witnessed the final chapter in oil’s correction. Still, it may take some time before these imbalances are recognized. Investors are currently giving in to a frenzied buying spree based on oil’s perceived “value” relative to other assets.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP