Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

ECB Retreats on QE

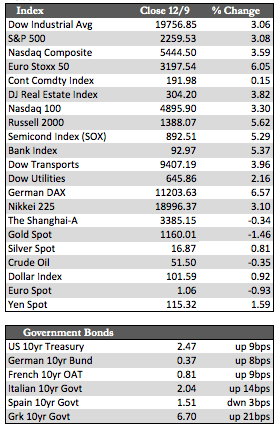

Stocks certainly didn’t take a break from the post-election rally as I had previously surmised. Instead the indices motored on to new highs as the Dow pushed through 19,700 in blow-off style near the close on Friday. The origins of that insanity take us back to midweek, just before the ECB policy meeting on Thursday. At that time speculators got it into their heads (courtesy of the media) that both the ECB and the Fed (meeting next Wednesday) just might turn more dovish than they are at present – for what reason I simply do not know.

In any case, the ECB dashed those expectations when they kept rates unchanged and actually reduced their QE program by €20 billion to €60 billion/month for all bond purchases slated to occur after March 2017. Draghi was duplicitous in his explanation for the decision, stating that the reduction was not a taper – though for all intents and purposes it certainly is. European stocks were consequently held to small gains for the remainder of the week. Needless to say, the ECB’s taper did nothing to slow the advancement in equities back here in the States. They were seemingly running on the assumption that the Fed can and will trump just about anything if it so desires – pun intended.

In any case, the ECB dashed those expectations when they kept rates unchanged and actually reduced their QE program by €20 billion to €60 billion/month for all bond purchases slated to occur after March 2017. Draghi was duplicitous in his explanation for the decision, stating that the reduction was not a taper – though for all intents and purposes it certainly is. European stocks were consequently held to small gains for the remainder of the week. Needless to say, the ECB’s taper did nothing to slow the advancement in equities back here in the States. They were seemingly running on the assumption that the Fed can and will trump just about anything if it so desires – pun intended.

Away from stocks, fixed income markets continued to lose ground both here and abroad, with the 30-year Treasury now sporting a yield of 3.15% (100 bps higher than 2016 lows) and the German Bund at 0.362% (up from 0.279% last week). The dollar remained strong as it revisited its highs of the year, due largely to the bet on the ECB continuing QE. This put pressure on gold as it fell back to a support area at 1,160, while silver trended with the action in stocks, rising to 16.87. Crude oil lost a bit of ground to 51.50 in the wake of more bickering between OPEC and non-OPEC actors over commitments (or lack thereof) to production cuts.

As did the ECB, the Fed will likely disappoint the speculative crowd next week – with a 0.25% rate hike accompanied by hawkish statements about the future. This seems highly probable to me given the extremely overbought condition in stocks at this juncture – but of course it’s not certain. I do find it interesting, for those investing defensively and looking beyond this year, that the ECB found it necessary to cut back on its QE program when none of its markets trade at all-time highs in either stocks or bonds and while its economies continue to founder. As I have said before, and as you will never hear from anyone at the ECB or any other central bank, QE is in fact the underlying cause for the erosion in value across its markets.

Best Regards,

David Burgess

VP Investment Management

MWM LLC