Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Election, Gridlock, and Rates

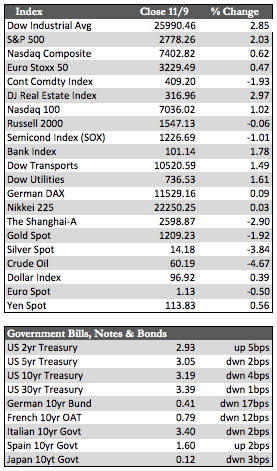

Stocks moved higher in front of Tuesday’s elections, in which a more “conservative” group of Dems successfully took control of the House. I say conservative because a good handful of Democratic winners were deemed to be non-socialistic and pro-Trump trade. Naturally, the bulls found a way to spin that prospect into a 545-point Dow rally on Wednesday. However,that rally faded when the focus turned back to interest rates after a rather hawkish FOMC policy statement on Thursday. By the close Friday, stocks had given back a small portion of their political gains as the indices added between 1% and 3%. Tech came in at the lower end of that range due to the release of somebad news from Apple (and related suppliers). Net, net, it was another week where the rising tide of borrowing costs trumped all other considerations. That may mean that Mr. Market ispreparing for an influx of data, whether economic or corporate, that reflects polarized negatives – i.e., light on storm spending and heavy on the effects of rates.

Away from all that, US producer prices in October rose by an astounding 0.6% (versus expectations for 0.2%), while US mortgage applications fell to near an 18-year low – both of which developments were ignored. Treasury prices fell at the short end and rose at the long end, compressing the term premium (2–year vs. 10–year yield) back below 30 to 26bps. Oil fell again, for the tenth consecutive time, as OPEC over-production continued to flood the market. Fed-induced dollar strength sent the metals lower: Gold lost 1.9% and silver about 4.0%. I am not pleased with the price action in the metals, but until we see some economic results that begin to match our overseas counterparts and/or a change in the Fed’s perceived control over the curve – the dollar may continue to hold the metals in check through year-end. While granting the possibility,however, I nonetheless consider it doubtful.

Away from all that, US producer prices in October rose by an astounding 0.6% (versus expectations for 0.2%), while US mortgage applications fell to near an 18-year low – both of which developments were ignored. Treasury prices fell at the short end and rose at the long end, compressing the term premium (2–year vs. 10–year yield) back below 30 to 26bps. Oil fell again, for the tenth consecutive time, as OPEC over-production continued to flood the market. Fed-induced dollar strength sent the metals lower: Gold lost 1.9% and silver about 4.0%. I am not pleased with the price action in the metals, but until we see some economic results that begin to match our overseas counterparts and/or a change in the Fed’s perceived control over the curve – the dollar may continue to hold the metals in check through year-end. While granting the possibility,however, I nonetheless consider it doubtful.

Best Regards,

David Burgess

VP Investment Management

MWM LLC