Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Eternal Bliss?

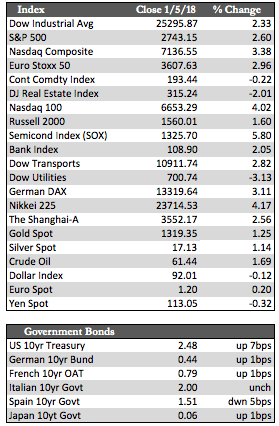

The New Year’s rally in stocks maintained itself at breakneck speed for the entire week, and pushed the major indices to fresh new highs. The Dow broke 25,000, the NASDAQ Composite, 7,000, and the S&P and Transports set records with less round figures. The leadership behind the rally still favored stocks that led the way higher last year (i.e., tax cut benefactors), while the breadth of the market, including small caps, continued to lag. I really don’t have much to say about the action other than the fact that there was a lot of money earmarked for investment at the start of this year, and it’s flowing in when there are very few sellers and below-average volumes. Trump also began to tackle the idea of a fiscal spending package (as expected), among other plans, now that the tax cut is behind him. All of this I believe helped to underpin/justify the wild and euphoric movements seen in stocks here and abroad. At the close Friday, just about every index worldwide had added between 1.0% and 4.0% over the week. The lone exception was Utilities, which shed just over 3.0%.

Away from stocks, fixed income was weaker but not crushed in the wake of super-charged equity markets. Economic optimism helped oil advance 1.6%. The dollar fell against the euro, as Europe’s manufacturing data remains firm ahead of ECB QE taper plans. This, along with the growing desire for an equity hedge, extended a now three-week and still going strong rally in the metals. Gold gained 1.37% to silver’s 1.79%. Also, there was quite a bit of U.S. economic data released this week, but none of it would suggest growth is accelerating to a level commensurate with the optimism in stocks. For the month of December, vehicle sales were in line with the three-year average, ISM gauges were mixed (though prices paid jumped to 69.0 in December from 65.5 in November), as was the jobs data. The ADP employment report came in at 250,000 and the non-farm payroll a somewhat disappointing 148,000.

Away from stocks, fixed income was weaker but not crushed in the wake of super-charged equity markets. Economic optimism helped oil advance 1.6%. The dollar fell against the euro, as Europe’s manufacturing data remains firm ahead of ECB QE taper plans. This, along with the growing desire for an equity hedge, extended a now three-week and still going strong rally in the metals. Gold gained 1.37% to silver’s 1.79%. Also, there was quite a bit of U.S. economic data released this week, but none of it would suggest growth is accelerating to a level commensurate with the optimism in stocks. For the month of December, vehicle sales were in line with the three-year average, ISM gauges were mixed (though prices paid jumped to 69.0 in December from 65.5 in November), as was the jobs data. The ADP employment report came in at 250,000 and the non-farm payroll a somewhat disappointing 148,000.

Next week, we’ll get a look at US retail sales and earnings for the world’s biggest banks (all of which should be okay – for now). We’ll also see if the rally in stocks, now dramatically overextended, can continue amid signs of negative breadth divergence and narrow leadership.

Best Regards,

David Burgess

VP Investment Management

MWM LLC