Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Euro Takes It on the Chin – Again

For some time now, we’ve stood on the assumption that the Fed would not be able to taper its QE program without some severe consequences. This week (and last), we’ve started to see inklings of some of these consequences. News of credit risk (bankruptcies), slower corporate earnings, and/or a de-leveraging stock market have appeared too often in the headlines. By our count, about 15 entities that range from mall-type retail stores (Wet Seal, Deb Stores, Loehmann’s, Coldwater Creek, and RadioShack) to hotel chains such as Caesar’s Palace and Harrah’s have thrown in the fiscal towel, so to speak, in the last handful of days.

Within the energy sector, the debt-laden oil shale players have managed to refinance and/or borrow their way to keeping the lights on – if only for a little while longer. As for corporate earnings, banks, homebuilders, and a few tech names (in the data storage field) have seen their shares punished for falling short of expectations on revenue and/or profits. As we know now, consumers have not come to the rescue. According to the official retail sales data from December, overall sales were off by 0.9% even as gas prices fell. It’s likely that 4th quarter earnings in combination with the aforementioned credit risk issues will continue to weigh on stock prices in the near term.

I say near term because the Fed still has some power left to influence the market in the medium to longer term. There’s little doubt that the Fed will eventually reinstate QE for the sole purpose of preventing a systemic meltdown, even though that option’s efficacy is vanishing. QE will still be likely to produce a not-so-small bounce in equity prices. The problem is determining the exact moment a currently hawkish Fed will crank up the presses again. All we can do is keep a watchful eye on critical events and the way they unfold. As credit risk and sell-side volatility increase, so does the pressure on the Fed to act.

I say near term because the Fed still has some power left to influence the market in the medium to longer term. There’s little doubt that the Fed will eventually reinstate QE for the sole purpose of preventing a systemic meltdown, even though that option’s efficacy is vanishing. QE will still be likely to produce a not-so-small bounce in equity prices. The problem is determining the exact moment a currently hawkish Fed will crank up the presses again. All we can do is keep a watchful eye on critical events and the way they unfold. As credit risk and sell-side volatility increase, so does the pressure on the Fed to act.

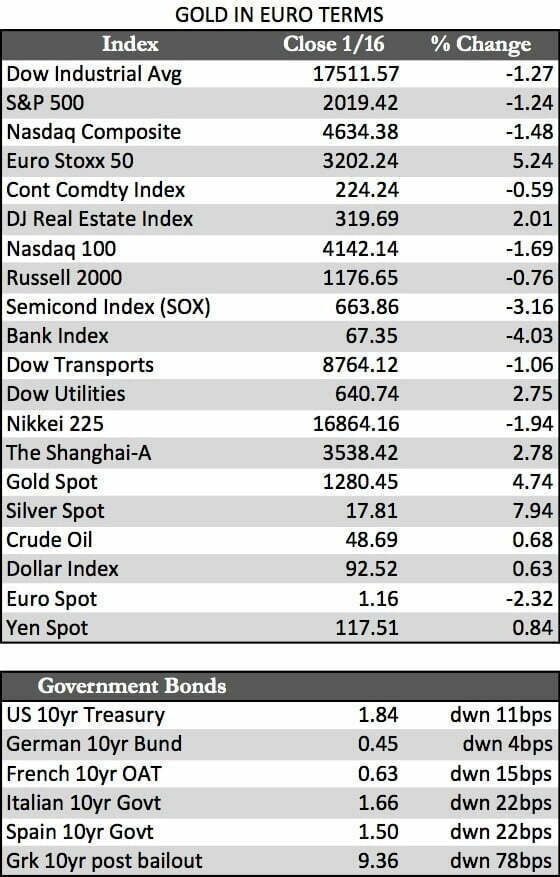

Away from stocks, Treasuries rallied, with the 30-year yield marking a new low. Precious metals managed another week of solid gains against the backdrop of a stronger dollar. The Swiss National Bank’s surprise move to take its key rate negative and to discontinue its euro peg sent Switzerland’s currency soaring (as much as 39.0% Wednesday night) and its stocks plummeting (near 9.0%). But it may have been the Swiss no-confidence vote with respect to the euro that made all the difference for the precious metals.

The ECB is expected to launch its bond buying program next Thursday, while the Greeks are set to vote on exclusion from the eurozone by week’s end – none of which spells glad tidings for the euro. However, let’s not forget that gold has been spiking against most major currencies of late (excepting the Swiss Franc this week), which may be an early indication that confidence in central banks’ abilities to effectively control markets via QE has, in an intrinsic sense, begun to diminish.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP