Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Faint Signs of Caution Appear in Stocks

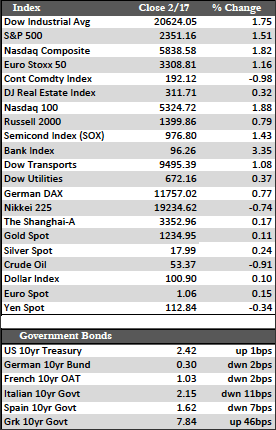

Earlier this week, stocks accelerated their upward momentum and broke through Dow 20,600 with relative ease. They had a tailwind provided by Trump’s “massive” tax cut news and Janet Yellen’s dovish remarks in her recent testimony before the Senate Banking Committee. I say “dovish” because traders simply do not fear the Fed, as everything is interpreted as bullish, specifically the Fed’s consistent inability to follow through on the promise of rate hikes (two in ten years). By the end of the week, stocks looked exhausted as they gave up a small portion of their gains. By the close on Friday, the major indices were all up in excess of a percent, with the NASDAQ (+1.5%) leading the charge as investors continued to chase semiconductor stocks. Aside from the merger speculation in that sector, I still believe that the latest increase in chip demand (mostly in Asia) was more a function of the recall of the exploding Galaxy Note 7 phone than anything else.

Away from stocks, bond markets looked a little better, relatively speaking, both here and abroad. That could be attributable to any number of reasons, not least of which is that the data (whether economic or corporate) still doesn’t support hawkish policies from any central bank. The growing anti-establishment wave that has hit Europe ahead of upcoming elections could also be a factor. Treasuries and most high quality European government bonds fared the best, with the 30-year Treasury yield breaking just below its 50-day moving average of 3.06%. But the lower yields in bonds over the past two weeks still pale in comparison to the damage they’ve sustained since June of last year. Both the PPI and CPI inflation gauges here in the US were up 0.6% (7.2% annualized) in January. US Mortgage delinquencies rose to 9.02% from 8.3% (also in January), and US real average hourly earnings declined 0.6% in January. US retail sales looked better, up 0.4% in January, but those figures were augmented by a whopping 7.8% increase in gas prices. Overseas, industrial production fell in Europe at one of the fastest paces I’ve seen in 25 years (as far as my chart goes back) – by 1.6% (or 19% annualized) in December. UK retail sales were affected by inflationary pressures, down for the third month in a row by 0.3%.

Away from stocks, bond markets looked a little better, relatively speaking, both here and abroad. That could be attributable to any number of reasons, not least of which is that the data (whether economic or corporate) still doesn’t support hawkish policies from any central bank. The growing anti-establishment wave that has hit Europe ahead of upcoming elections could also be a factor. Treasuries and most high quality European government bonds fared the best, with the 30-year Treasury yield breaking just below its 50-day moving average of 3.06%. But the lower yields in bonds over the past two weeks still pale in comparison to the damage they’ve sustained since June of last year. Both the PPI and CPI inflation gauges here in the US were up 0.6% (7.2% annualized) in January. US Mortgage delinquencies rose to 9.02% from 8.3% (also in January), and US real average hourly earnings declined 0.6% in January. US retail sales looked better, up 0.4% in January, but those figures were augmented by a whopping 7.8% increase in gas prices. Overseas, industrial production fell in Europe at one of the fastest paces I’ve seen in 25 years (as far as my chart goes back) – by 1.6% (or 19% annualized) in December. UK retail sales were affected by inflationary pressures, down for the third month in a row by 0.3%.

All that supports my contention that the stock market has erred here in a big, parabolic way. Rising rates are doing things to world financial markets that will be extremely difficult, if not impossible, for Trump policy makers to cure. In any case, we all know that parabolic moves end horribly, but it’s still a question of where and/or when this one stops. What was interesting in this week’s news was that Blackrock has used and recommended gold as a hedge. That follows a similar recommendation made by Goldman Sachs last year. Next week, another round of FOMC minutes will be released along with reports on new and existing home sales. I anxiously await all this information to see what impact, if any, the interest rate environment will have in each area.

Best Regards,

David Burgess

VP Investment Management

MWM LLC