Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Fed Double-Speak Takes Unexpected Turn

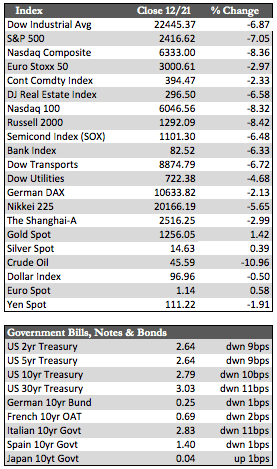

Stocks fell to a 17-month low to close out their worst week since August 2011. Just about every sector (ex the gold shares) lost ground, and intense selling in technology drove the NASDAQ index officially into a bear market. The possibility of a government shutdown and issues surrounding personnel at the White House were tossed around as plausible explanations for the instability. However, the selling really began shortly after the Fed’s policy meeting on Wednesday. That meeting produced a rate hike of 0.25% to 2.5%. On one hand, the Fed lowered its growth and inflation outlook for the economy, citing a global slowdown and increased restrictions stemming from the financial sector (think higher rates). On the other, it kept alive the option of further rate increases as we head into next year (reduced to two from three). The latter was, I believe, THE surprise to traders. Up to that point, they were half expecting the Fed to quit rate hikes altogether, having achieved what Powell referred to as a “neutral” rate stance against inflation just a few weeks ago. With that news, and with only five more trading days left on the calendar, stocks appear poised to finish the year with losses across the board.

Treasuries continued to benefit from the “flight to safety” bid, sending rates fractionally lower across the curve. It’s a month-long trend that has breathed new life, albeit temporarily, into the housing market. Housing starts, permits, and existing home sales all saw an uptick within the month of November. This activity won’t last long, I suspect, since in this environment any progress in one sector is likely to come at the expense of another – in this case the stock market.

Treasuries continued to benefit from the “flight to safety” bid, sending rates fractionally lower across the curve. It’s a month-long trend that has breathed new life, albeit temporarily, into the housing market. Housing starts, permits, and existing home sales all saw an uptick within the month of November. This activity won’t last long, I suspect, since in this environment any progress in one sector is likely to come at the expense of another – in this case the stock market.

Oil resumed its 2½ month decline to 45.59/bbl in sympathy with stocks. The dollar weakened a bit to 96.96 on the Fed’s lower growth outlook, which helped the metals attain new interim highs. I suspect that’s a trend that will extend into the New Year as the nascent cost-push inflation (i.e., interest rate) paradigm proliferates.

Their will be no recap next week, but I’ll send out a brief summary on January 4th.

In the meantime, please accept my very best wishes for a merry Christmas and happy New Year.

Best Regards,

David Burgess

VP Investment Management

MWM LLC