Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Fed is Tough – for Now

Markets were subdued leading into the FOMC committee meeting on Wednesday, at which time the Fed did something I didn’t expect (because it would be detrimental to markets). They raised rates a quarter point to 1.75% and declared that their outlook for economic growth had improved over the last few months. This led to very optimistic pontifications about employment, economic growth, and a steeper path for the Fed target rate (three more hikes in 2018). This is absurd, in my opinion, since all but one economic data point (that being the US jobs report) would have suggested that the economy hasn’t improved. What’s more, most in this business understand that the US jobs report became even more manipulated for political reasons after it was folded into the purview of the White House during the Obama Administration.

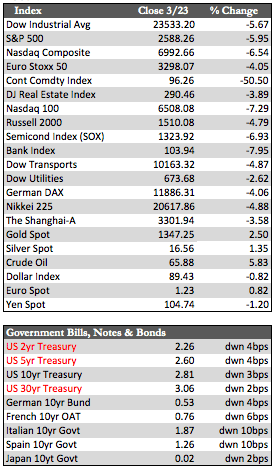

In any case, whatever the Fed’s motive for raising rates was, whether Powell’s willingness to blindly follow in Yellen’s footsteps or his succumbing to Trump’s campaign optimism, it was not a decision made with the best interests of stocks in mind. The Dow, S&P, and NASDAQ all proceeded to collapse. I realize there are extenuating circumstances at hand (i.e., trade war, with China, etc.) but I believe rates possess the ultimate trump card. That said, the indices lost about 5% in addition to creating to some rather severe technical damage through to the close on Friday.

In any case, whatever the Fed’s motive for raising rates was, whether Powell’s willingness to blindly follow in Yellen’s footsteps or his succumbing to Trump’s campaign optimism, it was not a decision made with the best interests of stocks in mind. The Dow, S&P, and NASDAQ all proceeded to collapse. I realize there are extenuating circumstances at hand (i.e., trade war, with China, etc.) but I believe rates possess the ultimate trump card. That said, the indices lost about 5% in addition to creating to some rather severe technical damage through to the close on Friday.

Away from the Fed and stocks, the economic data released this week didn’t suggest much, which made it even more irrelevant in light of the Fed’s decision. For the month of February, there was a small downtick in new home sales (-0.6%) and a small uptick in existing home sales (3.0%). Treasuries, along with bonds overseas, caught a decent bid as money rotated away from stocks. Commodities in general continued to be range-bound – except for oil, as some favorable OPEC import/export and inventory stats helped push crude to a 5.45% gain for the week. The dollar also appeared not to appreciate the Fed’s decision, seeing it as an impairment to future growth. It shed about 0.83% by week’s end.

Though gold finished the week in the upper bound of its trading range, in response to trade-war concerns I believe, others in the metals group (i.e., silver, platinum, and palladium) have camped out around their interim lows. As I have said here before, until the consensus adopts the view that rates are moving higher because of excessive borrowing (not economic growth) relative to demand – the metals may be limited to small achievements. However, I expect this condition to change soon given that rate increases have not gone down well, especially at the short end of the curve, regardless of movements in the economy or stocks.

Best Regards,

David Burgess

VP Investment Management

MWM LLC