Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Gold Rallies Despite the Usual Setbacks

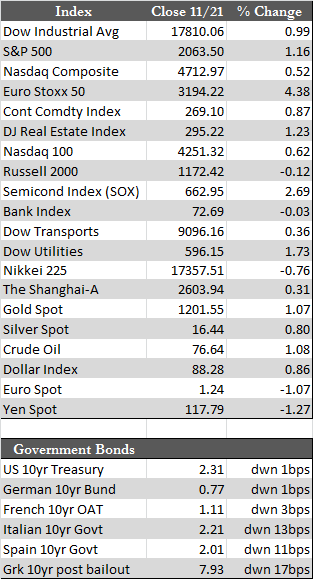

It was a rather dull week leading into overnight markets Thursday, at which time we heard once again from a few central banks on the topic of easing. China unexpectedly made some interest rate cuts (the loan rate and the deposit rate) for the first time in two years, while in Europe Mario Drahgi said that the ECB needed to increase inflation by whatever means necessary (i.e., monetizing government debt). Now, I’m not sure why anyone would listen to these guys anymore, considering that just a year ago they were all telling everyone that everything was “recovering” nicely. Nonetheless, markets took the news as bullish, like everything else lately, and rallied. Overseas equity markets faired the best, including emerging markets. However, most of these reversals have yet to produce meaningful technical breakouts to the upside. Regardless, that bullish tone spilled over into US markets Friday morning, sending the Dow up nearly 200 points in the early going, presumably on short covering. As the day wore on, more than half of those gains disappeared. It may be nothing, but the loss of momentum on what otherwise would be an opportunity for bulls to party could mean that an interim top for US stocks is in progress.

Supporting that thesis would be the failure of the broader market (the total NYSE index), small caps, and high-yield debt (once known as junk) to confirm the highs set in the major indexes (Dow, S&P, and NASDAQ). Once again, it may be nothing, but a real bull market should involve the entire field with increasing (not stagnant or decreasing) volumes.

Supporting that thesis would be the failure of the broader market (the total NYSE index), small caps, and high-yield debt (once known as junk) to confirm the highs set in the major indexes (Dow, S&P, and NASDAQ). Once again, it may be nothing, but a real bull market should involve the entire field with increasing (not stagnant or decreasing) volumes.

Both gold and the miners have been behaving much better as of late, not having reacted characteristically to things typically provoking bearish behavior in the group. A possible “no” vote on the Swiss Gold referendum, a bullish FOMC minutes release (citing low inflation outlook), and a collapsing yen (strengthening the dollar) had little or no effect on the metals this week. Dips seem to be attracting buyers and/or causing short sellers to cover their positions. With the exception of some fund companies that have increased their shorts to near record highs, gold short positions overall have been greatly diminished, most notably among the much larger commercials – whose short positions are near record lows. As far as bullish indicators go, the commercials have a tendency to be more accurate than other participants.

Another interpretation might be that as markets near their leveraged extremes, traders are acquiring protection via the metals against possible reversals in equity and dollar/currency markets. In the following week, however, all should be on hold for Thanksgiving. Participation during the week historically tends to be fairly low for obvious reasons (though anything can happen leading up to Black Friday). In any event, the next recap will be posted December 5th. Until then, we wish you the very best of times with family and friends. Happy Thanksgiving!

Best Regards,

David Burgess

VP Investment Management

MWM LLLP