Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Grasping at Straws

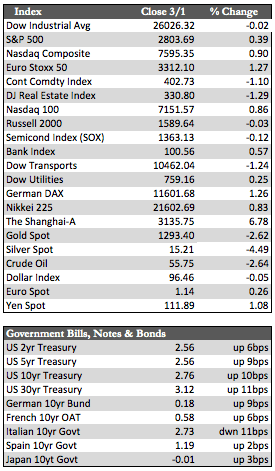

Noting the way markets finished this week, one would think all our problems are now behind us. It seems to be the case, with the two-month rally in stocks, a better-than-expected 2.6% fourth-quarter US GDP, Powell’s belief in a second-half recovery, “fantastic” (thank you Kudlow) China trade negotiations combined with an uptick in China’s Markit manufacturing PMI on Friday (from 48.3 to 49.9 in February). But just as the stimulatory 2017 Trump tax cut turned out to be a US budget buster, the benefits of the above have more to do with perceptions than reality. In particular, it was just the day before that China’s Federation PMI (also for February) showed the exact opposite, a decline to a 2-year low. But it is what it is, well-hyped disinformation. The markets generally reacted true to form as the major stock indices erased much of their early losses to finish the week nearly unchanged. Interim highs were not breached, which I believe calls into question the issue of momentum.

Away from stocks, Treasuries couldn’t stand the perceived prosperity, and fell across the curve (rates rose sharply). The same could be said of the metals, which quickly retreated to technical interim support levels, as gold lost about 2.7% and silver 4.6%. Platinum and palladium, thanks to trade talks, held to respective gains of 1.8% and 2.8%. Oil lost about 2.7% as Trump’s tweets about OPEC production more than offset a somewhat bullish slump in US inventory levels of about 8.65 million barrels.

Away from stocks, Treasuries couldn’t stand the perceived prosperity, and fell across the curve (rates rose sharply). The same could be said of the metals, which quickly retreated to technical interim support levels, as gold lost about 2.7% and silver 4.6%. Platinum and palladium, thanks to trade talks, held to respective gains of 1.8% and 2.8%. Oil lost about 2.7% as Trump’s tweets about OPEC production more than offset a somewhat bullish slump in US inventory levels of about 8.65 million barrels.

US economic data was once again ignored, but it’s still worth mentioning. I don’t really know how anyone can relate it directly related to the government shutdown because the negative progression in some of the data has been going on for years, not months. For December, US Housing Starts collapsed by 11.2% to a 2-year low. Incomes rose by about 1.0%, but oddly enough spending fell 0.5% as the core PCE (Fed) inflation gauge rose by 0.2% (or 2.4% annualized). In January, Pending Home Sales rose by about 4.6% – but those numbers are still at a 5-year low. And in February, every component of the ISM Manufacturing Index gave way to a rather large 4.2% decline in the composite – or 54.2 from 56.6. Total vehicle sales fell once again, this time by 0.24% – or 11% below the 2017 high.

That said, I still believe the onus is on the bulls to prove, fundamentally speaking, that they belong in the driver’s seat. They have much to overcome in the data. Fed QE may not help, as I believe it could lead to even higher interest rates from an already restrictive level. Next week we hope to get some resolution of or details on the trade deal. And again, I suspect that, once assessments can be made, stocks could begin to selloff. If the deal is postponed, we just may see this trade hype repeat itself through the end of March.

Best Regards,

David Burgess

VP Investment Management

MWM LLC