Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Greece: Third Time’s a Charm

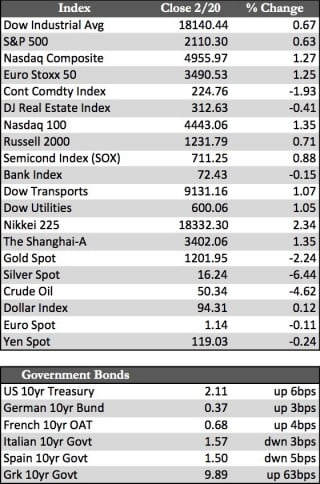

At 175.0% debt-to-GDP, Greece has passed the point of no return, fiscally speaking. And while lowering the cost of its debt, borrowing more, and/or submitting to eurozone demands for austerity might keep the lights on a bit longer, the long run will require more. Nothing less than a complete financial overhaul denominated in a currency other than the euro will do. But it appears that as I write, midday Friday, eurozone finance ministers have reached an accord (details to be released later) to keep bailout funds flowing into Greece – for now. Despite the apparent risks, speculators were at peace (all week) with the negotiations, as stocks both here and abroad were firm. U.S. indexes in particular ran up to new highs. Treasuries and eurozone debt yields inched up, as did the euro against the dollar, while gold explored the bounds of technical support. All was deemed safe in financial markets – again.

No doubt the Greek deal will be laced more with “debt workout” fixes than austerity. After all it would be hypocritical to ask Greece to balance its books when virtually all those in the southern eurozone should be required to do the same. Greece was simply the first (certainly not the last) to cross the threshold of insolvency. Ultimately the eurozone will hang its hat on the ECB and its QE program (currently €1.2 trillion over 18 months) to solve the region’s financial issues. I think that this, combined with the worlds’ recent central bank fetish with QE, is behind the current rally in stocks. But the phrase “this time it’s different” comes to mind in noting that this is the first time four or more of the major “developed” central banks have concurrently engaged in alternating asset monetization with debt accumulation. It gives rise to the question: If everyone’s pitching, who’s hitting? It’s simply not possible to debase all currencies against each other, but it is possible to debase them against a relatively fixed asset such as the precious metals.

No doubt the Greek deal will be laced more with “debt workout” fixes than austerity. After all it would be hypocritical to ask Greece to balance its books when virtually all those in the southern eurozone should be required to do the same. Greece was simply the first (certainly not the last) to cross the threshold of insolvency. Ultimately the eurozone will hang its hat on the ECB and its QE program (currently €1.2 trillion over 18 months) to solve the region’s financial issues. I think that this, combined with the worlds’ recent central bank fetish with QE, is behind the current rally in stocks. But the phrase “this time it’s different” comes to mind in noting that this is the first time four or more of the major “developed” central banks have concurrently engaged in alternating asset monetization with debt accumulation. It gives rise to the question: If everyone’s pitching, who’s hitting? It’s simply not possible to debase all currencies against each other, but it is possible to debase them against a relatively fixed asset such as the precious metals.

Let’s not forget that, internally, these policies have already run relatively detached from their respective economies. Low rates and/or lending initiatives have done very little to stimulate in China, Europe, and North America (e.g., recent Canadian and U.S. real estate woes). That said, I couldn’t find much of a reason for gold to have sold off to technical lows – other than knee-jerk reactions to the “everything will be solved” fantasy ongoing in Europe. Some say the five-day market hiatus (that started Wednesday) brought on by the Chinese New Year had something to do with it, but I find that a bit of a stretch. Gold needs to remain above the $1,196 level to stay out of technical trouble, though if it were to breach that level there would be very little reason for it not to rebuild quickly. “Valued” currency alternatives are fast becoming scarce.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP