Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Hype Trumps Reality – for Now

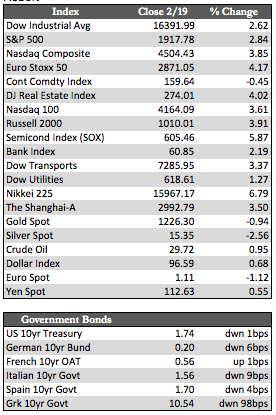

The hype-driven rally in stocks that began last Thursday raged on this week. By the close Friday European and Asian markets had tacked on more than 4.5%, while U.S. indexes had gained about 2.5%. Once again the rally was led by the companies that have been most heavily shorted and those discarded in the last handful of months, which included familiar names within the material, industrial, and commodity sectors. FANG (Facebook, Amazon, Netflix, Google) type stocks joined the uphill charge, driven by a series of feel-good announcements that in the grand scheme of things didn’t amount to much. Amazon said it would be bypassing direct delivery with the use of parcel lockers across Europe. Priceline touted its superiority in its travel related businesses. IBM announced plans to restructure, and Boeing’s CEO repeatedly defended its accounting practices, backlogs, and future orders. The list goes on, but I believe the common denominator was a desire to keep stock prices from slipping further and to gloss over a dismal fourth quarter earnings season and an equally dismal outlook.

That said, we are already beginning to see the effects of such gaming fade. Boeing shares were a primary example of this. After having stated all the obvious positives behind its business model, the aircraft maker saw its shares heading lower into the close on Friday. Similar price action plagued the shares of Apple, Facebook, Amazon, IBM, and Netflix (Priceline bucked the trend). With such declines in evidence, it’s possible that the rally in stocks is coming to a close – though it’s still too early to say conclusively. We have another roundup of Fed heads speaking every day next week. This usually means that stocks will hold firm as traders fear missing out on a rally caused by an off-the-cuff dovish remark. However, the all-talk-and-no-action routine must be wearing thin.

That said, we are already beginning to see the effects of such gaming fade. Boeing shares were a primary example of this. After having stated all the obvious positives behind its business model, the aircraft maker saw its shares heading lower into the close on Friday. Similar price action plagued the shares of Apple, Facebook, Amazon, IBM, and Netflix (Priceline bucked the trend). With such declines in evidence, it’s possible that the rally in stocks is coming to a close – though it’s still too early to say conclusively. We have another roundup of Fed heads speaking every day next week. This usually means that stocks will hold firm as traders fear missing out on a rally caused by an off-the-cuff dovish remark. However, the all-talk-and-no-action routine must be wearing thin.

Away from stocks, Treasuries and the dollar traded sideways, though the dollar saw a little upside movement against devaluing Asian currencies (e.g., the yuan and won), while gold, silver, and the miners rebounded nicely after what amounted to a few days of backfilling on the chart. Finally, it should be noted that both the Producer Price Index (PPI) and Core Consumer Prices (CPI) have been spiking higher for the last several months leading up to and through January. The increases are some of the largest we’ve seen over the course of the last nine years. This combined with the long stream of relatively benign job reports (a three-month low in jobless claims this week of 262,000) will most likely give the Fed the excuse it seeks to extend its hawkish stance in line with current mandates. I mention this because it’s another macro data point on the way to a dislocation in stocks that, at this point, very few seem to expect.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP