Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Interest Rates: The Elephant in the Room

Early in the week, it appeared that fixed income was a bit stronger at the behest of stocks both here and abroad. Traders continued to adopt a more defensive posture ahead of the Fed meeting next Wednesday. As I’ve postulated here before, it’s getting to the point where inflation might stay strong relative to economic activity. If so, the Fed may need to be “tighter” than the market is trained to expect.

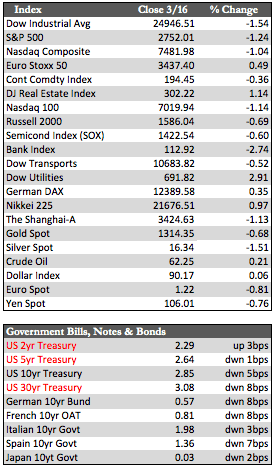

Given that the economic data this week supported that thesis, at least to a degree, stocks slid lower through mid-week. At that time it was announced that Lawrence Kudlow (former CNBC commentator) was to be appointed as Trump’s new economic advisor. From that point on, markets staged a rally as Kudlow began to espouse the virtues of a strong dollar and spoke against tariffs and in support of a slower pace to rate hikes (if at all) by the Fed. The rally didn’t make up for earlier week losses as the Dow, S&P, and NASDAQ all finished lower, with returns of -1.27%, -1.09%, and -0.90% respectively.

Given that the economic data this week supported that thesis, at least to a degree, stocks slid lower through mid-week. At that time it was announced that Lawrence Kudlow (former CNBC commentator) was to be appointed as Trump’s new economic advisor. From that point on, markets staged a rally as Kudlow began to espouse the virtues of a strong dollar and spoke against tariffs and in support of a slower pace to rate hikes (if at all) by the Fed. The rally didn’t make up for earlier week losses as the Dow, S&P, and NASDAQ all finished lower, with returns of -1.27%, -1.09%, and -0.90% respectively.

Turning back to inflation, the CPI (+0.2%), PPI (+0.2%) and Import Price Index (+0.4%) released this week were all relatively strong. This was in contrast to the downshift in autos, housing, and possibly technology that we’ve seen over the last few months. My analysis includes stats released this week on housing starts (-7.0%) and permits (-5.7%) for February. This can’t be regarded as a trend quite yet, and it’s certainly not something the media wants to recognize, but it’s worth mentioning. I’m sure that many in the ivory towers of hedge fund land will follow this nascent development closely – it’s an extremely bearish proposition for both stocks and bonds (and wildly bullish for the metals).

Along those lines, the yield curve looks more and more as if it wants to invert, which has always led to a recession. What this means is that the gap between short rates and long rates has been getting smaller. The 2-year Treasury added about 4 bps to yield 2.30% (that’s 1,050% higher than the low set in 2013) relative to a loss of 9 bps in the 30-year yield. As I have said before, I believe this is happening (for the most part) as a result of natural market forces. That being the case, I really don’t think there’s any chance the Fed will raise rates next week. They won’t want to be seen as the cause of an inversion (and/or a funding crisis) – though crazier things have happened.

Best Regards,

David Burgess

VP Investment Management

MWM LLC