Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Jobs Are Strong … You Can Sell Your Stocks Now

Mario Draghi kicked things into higher gear for the markets Thursday with a self-congratulatory speech about how well the ECB’s policies have “worked” – so much so that he just has to wear shades. Keep in mind that the only ECB policy so far has been in the manufacture of promises, not actual QE. Next week Draghi will begin pumping €60.0 billion into bonds, which will include the rather nonsensical act of purchasing securities with negative yields. European stocks rallied on the already twice-baked news, but more interesting was the fact that European bond markets struggled to get off the ground, remaining relatively flat for the week. I don’t know if that gives us a clue as to what’s to come, but if the ECB’s QE can’t lower long-term rates, among other negative side effects of printing, economic traction will be difficult to gain. For now, however, much of that has been masked by shorter-term benefits arising from cheaper oil and a weaker euro that made the region’s current production attractive for purchase and export. In any case, I am skeptical regarding the longer-term prospects of ECB QE plans, simply on the premise that speculators have already levered up in trillions anticipating reimbursement with free money.

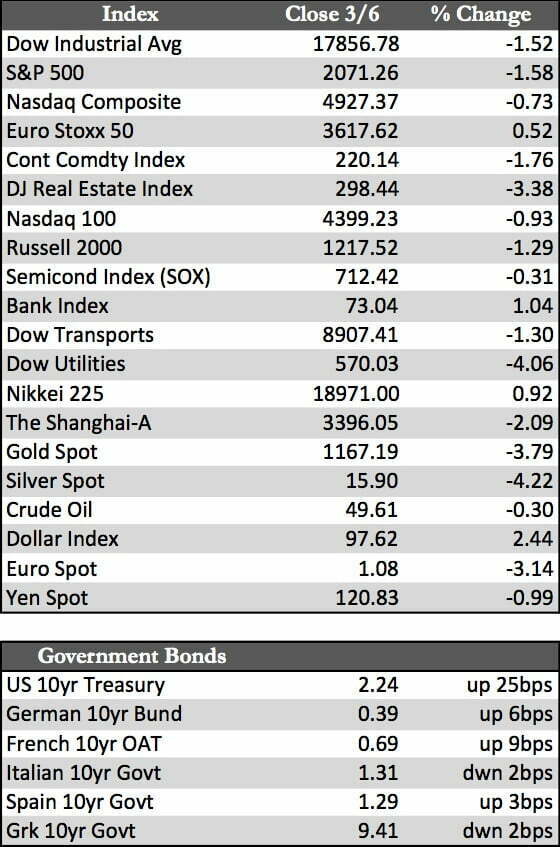

Of course the idea of front-running chronically dovish policy makers is not a foreign concept to US speculators. Evidence of that fact is this terrible fright they have over the smallest possibility of a rate hike by the Fed. This Friday’s jobs report exacerbated that fear when it told us that 295,000 non-farm jobs were created and the unemployment rate fell 0.2% to 5.5%. I couldn’t find much to poke a stick at in the details – except the participation rate, which fell to a 1970 low of 62.8%. Away from that, the oil sector lost 9,500 jobs, but this was offset by healthy gains across the board in both part-time and full-time jobs (i.e., waiters and bartenders scored nicely). Of course, with the leeway the BLS provides itself in calculating unemployment, who knows if the numbers have any veracity. Both US stocks and Treasuries took the news rather poorly regardless, and shaved points rather steadily all the way into the close on Friday. Again, it’s difficult to make much sense of it all just yet, but “good news” used to be treated as good news (even if it was fake). Therefore it just may be that markets, stocks in particular, have reached an exhaustion point and are ready to roll over. Before that happens, I’m fairly certain we’re going to see some volatility in and around the moving averages.

Of course the idea of front-running chronically dovish policy makers is not a foreign concept to US speculators. Evidence of that fact is this terrible fright they have over the smallest possibility of a rate hike by the Fed. This Friday’s jobs report exacerbated that fear when it told us that 295,000 non-farm jobs were created and the unemployment rate fell 0.2% to 5.5%. I couldn’t find much to poke a stick at in the details – except the participation rate, which fell to a 1970 low of 62.8%. Away from that, the oil sector lost 9,500 jobs, but this was offset by healthy gains across the board in both part-time and full-time jobs (i.e., waiters and bartenders scored nicely). Of course, with the leeway the BLS provides itself in calculating unemployment, who knows if the numbers have any veracity. Both US stocks and Treasuries took the news rather poorly regardless, and shaved points rather steadily all the way into the close on Friday. Again, it’s difficult to make much sense of it all just yet, but “good news” used to be treated as good news (even if it was fake). Therefore it just may be that markets, stocks in particular, have reached an exhaustion point and are ready to roll over. Before that happens, I’m fairly certain we’re going to see some volatility in and around the moving averages.

There’s no doubt that Draghi’s enthusiasm for QE and the subsequent fall in the euro this week put gold (in dollar terms) in a questionable position to withstand shocks such as the jobs report. That said, I do not believe that what we witnessed Friday in the gold price is trendsetting. We probably caught some short-sighted bulls off guard playing for the expectation of worse news in the non-farm payrolls. Instead, I would expect gold to get back to building (on the year) in anticipation of an eventual topping out and reversal of an extremely overbought dollar index – among other things. Keep in mind, however, that, at the extremes we now see in asset prices, anything can still happen in the short run.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP